Compliance Automation: Transforming Law Firms with Technology

Table of Contents

Introduction

Compliance automation is revolutionizing the legal industry by streamlining processes, enhancing accuracy, and reducing the burden of regulatory adherence for law firms. As the landscape of legal compliance becomes increasingly complex, technology-driven solutions are emerging to help firms efficiently manage their compliance obligations. By integrating automated systems, law firms can minimize human error, improve data management, and ensure timely reporting, all while freeing up valuable resources to focus on client service and strategic initiatives. This transformation not only enhances operational efficiency but also positions law firms to better navigate the evolving regulatory environment, ultimately leading to improved client trust and competitive advantage.

Streamlining Compliance Processes with Automation Tools

In the ever-evolving landscape of legal practice, compliance has emerged as a critical area where law firms must excel to maintain their competitive edge. As regulatory requirements become increasingly complex and the consequences of non-compliance more severe, law firms are turning to automation tools to streamline their compliance processes. By leveraging technology, these firms can enhance efficiency, reduce human error, and ensure adherence to legal standards, ultimately transforming their operational frameworks.

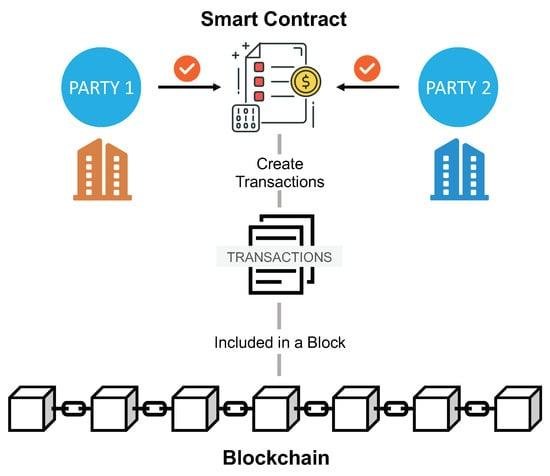

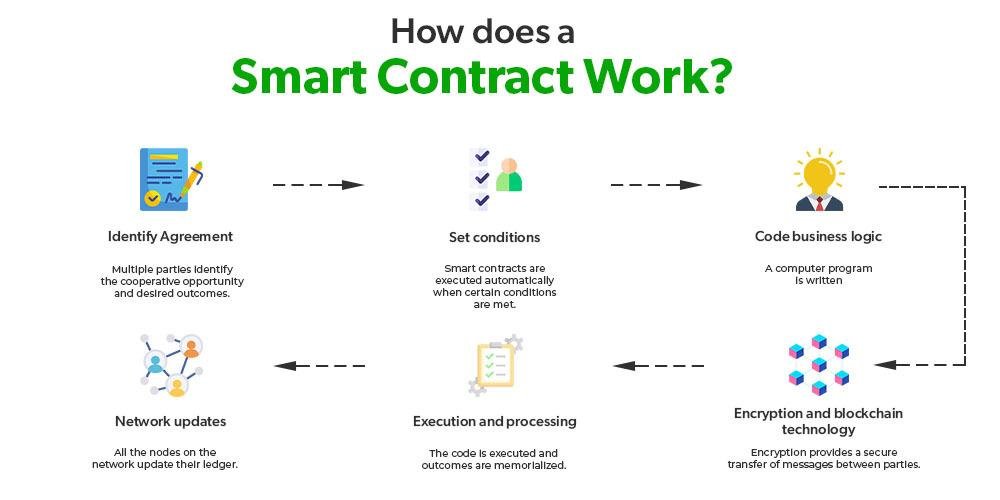

The integration of automation tools into compliance processes begins with the digitization of documentation. Traditional methods of managing compliance often involve extensive paperwork, which can be cumbersome and prone to errors. By utilizing document management systems, law firms can automate the creation, storage, and retrieval of compliance-related documents. This not only saves time but also ensures that all necessary documentation is readily accessible and up-to-date. Furthermore, automated systems can track changes in regulations and alert legal teams to necessary updates, thereby minimizing the risk of oversight.

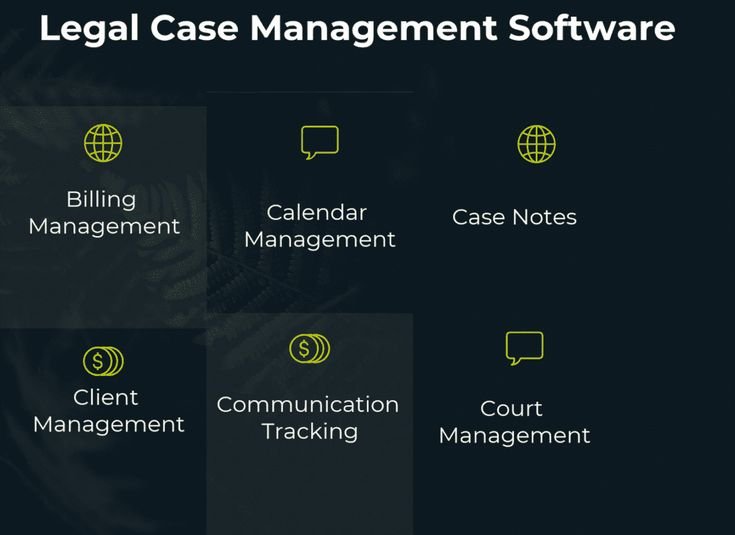

In addition to document management, automation tools can significantly enhance the monitoring of compliance activities. For instance, compliance management software can provide real-time tracking of compliance tasks, deadlines, and responsibilities. This level of oversight allows law firms to maintain a proactive approach to compliance, rather than a reactive one. By automating reminders and notifications, firms can ensure that critical deadlines are met, reducing the likelihood of penalties or legal repercussions. Moreover, these tools can generate comprehensive reports that provide insights into compliance performance, enabling firms to identify areas for improvement and make informed decisions.

Another critical aspect of compliance automation is the facilitation of communication and collaboration among team members. Many automation tools come equipped with features that allow for seamless communication, ensuring that all stakeholders are informed and aligned on compliance matters. This is particularly important in larger firms where multiple departments may be involved in compliance efforts. By centralizing communication through automated platforms, law firms can eliminate silos and foster a culture of collaboration, which is essential for effective compliance management.

Furthermore, automation tools can enhance the training and onboarding processes related to compliance. With the introduction of e-learning platforms and automated training modules, law firms can ensure that all employees are well-versed in compliance requirements and best practices. This not only streamlines the training process but also allows for consistent messaging across the firm. By providing ongoing training and resources, firms can cultivate a culture of compliance that permeates every level of the organization.

As law firms continue to embrace automation, it is essential to consider the integration of artificial intelligence (AI) and machine learning into compliance processes. These advanced technologies can analyze vast amounts of data to identify patterns and potential compliance risks. By harnessing AI, firms can proactively address issues before they escalate, thereby safeguarding their reputation and financial standing. Additionally, AI-driven tools can assist in conducting due diligence and risk assessments, further enhancing the firm’s ability to navigate complex regulatory landscapes.

In conclusion, the adoption of automation tools in compliance processes is not merely a trend but a necessary evolution for law firms aiming to thrive in a competitive environment. By streamlining documentation, enhancing monitoring, facilitating communication, and leveraging advanced technologies, firms can transform their compliance efforts into a strategic advantage. As the legal industry continues to adapt to technological advancements, those who embrace compliance automation will undoubtedly position themselves for success in the future.

Enhancing Data Security in Law Firms through Compliance Automation

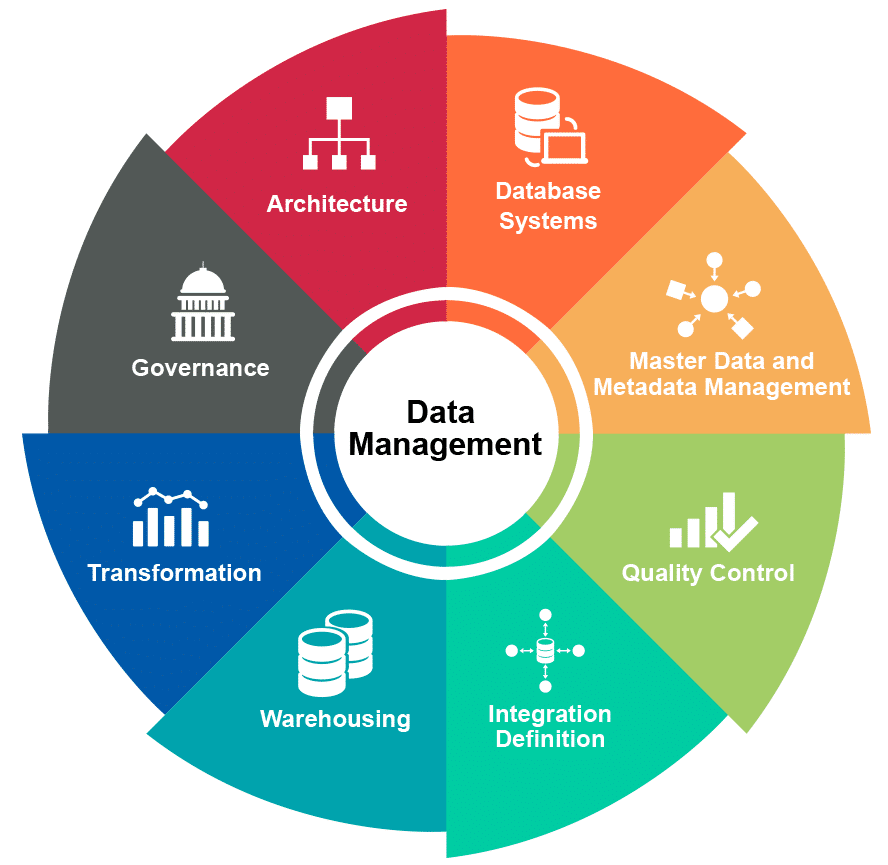

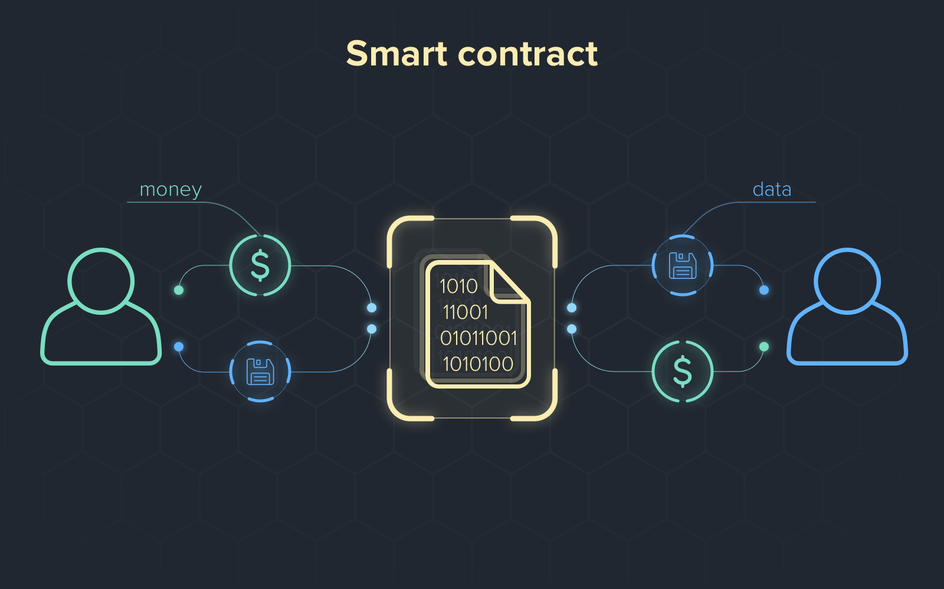

In an era where data breaches and cyber threats are increasingly prevalent, law firms are under immense pressure to safeguard sensitive client information. Compliance automation emerges as a pivotal solution, enabling these firms to enhance their data security protocols while streamlining their operations. By integrating automated compliance systems, law firms can not only adhere to regulatory requirements but also fortify their defenses against potential data vulnerabilities.

To begin with, compliance automation facilitates the systematic management of data security policies. Traditional methods often involve manual processes that are prone to human error, which can lead to significant lapses in security. In contrast, automated systems provide a consistent framework for monitoring compliance with data protection regulations such as the General Data Protection Regulation (GDPR) and the Health Insurance Portability and Accountability Act (HIPAA). By automating the tracking of compliance metrics, law firms can ensure that they are continuously aligned with legal standards, thereby reducing the risk of non-compliance penalties.

Moreover, the implementation of compliance automation tools allows for real-time monitoring of data access and usage. This capability is crucial in identifying unauthorized access or unusual activity that could indicate a security breach. For instance, automated alerts can be configured to notify compliance officers of any anomalies, enabling swift action to mitigate potential threats. Consequently, law firms can maintain a proactive stance on data security, rather than merely reacting to incidents after they occur.

In addition to enhancing monitoring capabilities, compliance automation also streamlines the documentation process. Law firms are required to maintain extensive records of their compliance efforts, including data handling practices and security measures. Automated systems can generate and store these records efficiently, ensuring that they are readily accessible for audits or regulatory reviews. This not only saves time and resources but also enhances the firm’s ability to demonstrate compliance to stakeholders, thereby building trust with clients.

Furthermore, the integration of compliance automation fosters a culture of accountability within law firms. By clearly defining roles and responsibilities related to data security, automated systems help ensure that all employees understand their obligations. Training modules can be incorporated into the compliance framework, providing staff with the necessary knowledge to recognize and respond to data security threats. This comprehensive approach not only empowers employees but also cultivates a shared commitment to safeguarding client information.

As law firms increasingly adopt cloud-based solutions for data storage and management, the importance of compliance automation becomes even more pronounced. Cloud environments, while offering flexibility and scalability, also introduce unique security challenges. Automated compliance tools can help mitigate these risks by enforcing encryption protocols, access controls, and regular security assessments. By leveraging technology to manage these complexities, law firms can confidently embrace cloud solutions without compromising data security.

In conclusion, compliance automation represents a transformative approach for law firms seeking to enhance their data security measures. By automating compliance processes, firms can achieve greater accuracy in monitoring, streamline documentation, and foster a culture of accountability among employees. As the legal landscape continues to evolve, embracing compliance automation will not only help law firms meet regulatory requirements but also protect their most valuable asset: client trust. Ultimately, the integration of technology in compliance efforts is not merely a trend; it is an essential strategy for ensuring the long-term viability and security of law firms in a digital age.

The Role of AI in Compliance Automation for Legal Practices

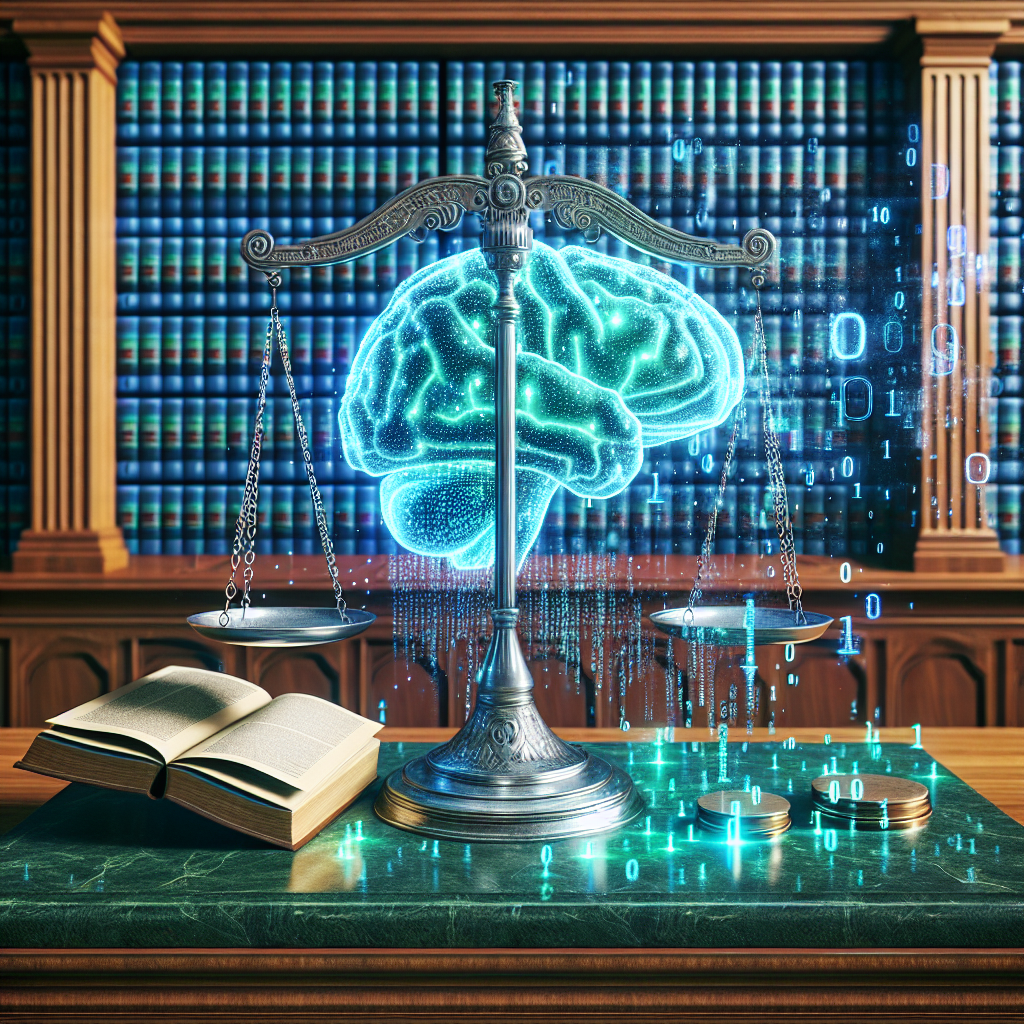

In the rapidly evolving landscape of legal practices, compliance automation has emerged as a pivotal element in enhancing operational efficiency and ensuring adherence to regulatory standards. At the forefront of this transformation is artificial intelligence (AI), which plays a crucial role in streamlining compliance processes within law firms. By leveraging AI technologies, legal practices can not only reduce the burden of manual compliance tasks but also enhance accuracy and responsiveness to regulatory changes.

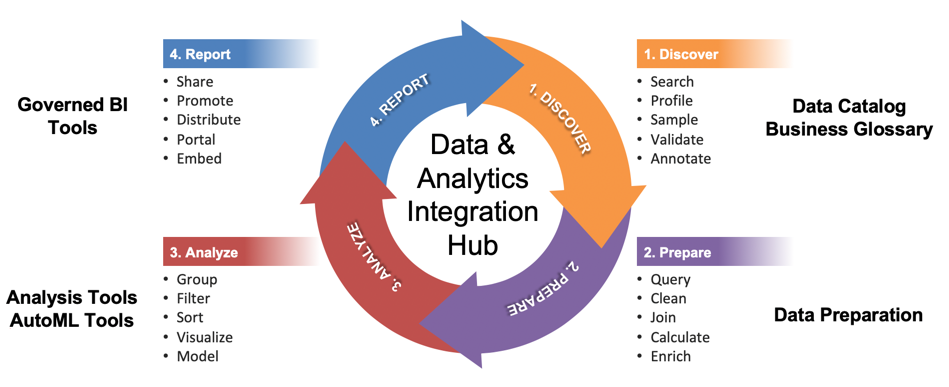

One of the primary advantages of AI in compliance automation is its ability to process vast amounts of data quickly and accurately. Traditional compliance methods often involve labor-intensive manual reviews of documents, contracts, and regulatory updates, which can be both time-consuming and prone to human error. In contrast, AI algorithms can analyze large datasets in real-time, identifying potential compliance risks and flagging discrepancies that may require further investigation. This capability not only accelerates the compliance review process but also allows legal professionals to focus their expertise on more complex legal issues rather than routine tasks.

Moreover, AI-driven compliance automation tools can continuously monitor changes in regulations and legal requirements, ensuring that law firms remain up-to-date with the latest compliance mandates. This proactive approach is particularly beneficial in an environment where regulatory frameworks are constantly evolving. By utilizing machine learning algorithms, these tools can learn from past compliance data and adapt to new regulations, thereby minimizing the risk of non-compliance and the associated penalties. As a result, law firms can maintain a competitive edge by demonstrating their commitment to compliance and risk management.

In addition to enhancing efficiency and accuracy, AI also facilitates improved collaboration within legal teams. Compliance automation tools often come equipped with features that allow for seamless communication and information sharing among team members. This collaborative environment fosters a culture of transparency and accountability, as all stakeholders can access real-time compliance data and insights. Consequently, legal practices can make informed decisions based on comprehensive information, ultimately leading to better client outcomes.

Furthermore, the integration of AI in compliance automation can significantly reduce operational costs for law firms. By automating routine compliance tasks, firms can allocate their resources more effectively, allowing them to invest in higher-value services and strategic initiatives. This shift not only enhances profitability but also positions law firms to better serve their clients in an increasingly competitive market. As clients demand more efficient and cost-effective legal services, the ability to leverage AI for compliance automation becomes a critical differentiator.

However, the implementation of AI in compliance automation is not without its challenges. Law firms must navigate issues related to data privacy, security, and ethical considerations when deploying AI technologies. Ensuring that AI systems are transparent and accountable is essential to maintaining client trust and upholding the integrity of legal practices. Therefore, it is imperative for law firms to establish robust governance frameworks that address these concerns while maximizing the benefits of AI.

In conclusion, the role of AI in compliance automation for legal practices is transformative, offering significant advantages in terms of efficiency, accuracy, collaboration, and cost-effectiveness. As law firms continue to embrace technological advancements, the integration of AI into compliance processes will undoubtedly reshape the future of legal practice. By harnessing the power of AI, legal professionals can not only enhance their compliance capabilities but also position themselves as leaders in an increasingly complex regulatory environment.

Cost Savings and Efficiency Gains from Implementing Compliance Automation

In the rapidly evolving landscape of legal services, compliance automation has emerged as a transformative force, particularly in terms of cost savings and efficiency gains for law firms. As regulatory requirements become increasingly complex and the demand for transparency intensifies, law firms are compelled to adopt innovative solutions that streamline their operations. By integrating compliance automation into their workflows, firms can significantly reduce operational costs while enhancing their overall productivity.

One of the most immediate benefits of compliance automation is the reduction in labor costs. Traditionally, compliance tasks have required substantial human resources, often leading to increased overhead expenses. However, by automating routine compliance processes, such as document management, reporting, and risk assessments, firms can reallocate their human capital to more strategic initiatives. This shift not only minimizes the need for extensive manpower but also allows legal professionals to focus on higher-value tasks that require critical thinking and expertise, thereby maximizing their potential contributions to the firm.

Moreover, compliance automation enhances accuracy and reduces the likelihood of human error, which can be costly in the legal field. Manual compliance processes are prone to mistakes, whether due to oversight or misinterpretation of regulations. By implementing automated systems, law firms can ensure that compliance tasks are executed consistently and accurately, thereby mitigating the risk of non-compliance penalties. This not only protects the firm’s financial interests but also bolsters its reputation in the marketplace, as clients increasingly seek assurance that their legal representatives adhere to the highest standards of compliance.

In addition to cost savings and error reduction, compliance automation significantly accelerates the pace of operations within law firms. Automated systems can process vast amounts of data in real-time, enabling firms to respond swiftly to regulatory changes and client inquiries. This agility is particularly crucial in an environment where regulatory landscapes are constantly shifting. By leveraging technology to stay ahead of compliance requirements, law firms can enhance their service delivery, ultimately leading to improved client satisfaction and retention.

Furthermore, the integration of compliance automation fosters better collaboration among team members. With centralized platforms that provide access to compliance-related information, legal professionals can work more cohesively, sharing insights and updates in real-time. This collaborative environment not only enhances communication but also promotes a culture of accountability, as team members can easily track compliance tasks and deadlines. As a result, firms can operate more efficiently, reducing bottlenecks and ensuring that compliance obligations are met in a timely manner.

As law firms continue to navigate the complexities of compliance, the strategic implementation of automation technologies will be paramount. The initial investment in compliance automation may seem daunting; however, the long-term benefits far outweigh the costs. By embracing these technologies, firms can achieve substantial savings, streamline their operations, and position themselves as leaders in the legal industry. In conclusion, compliance automation is not merely a trend but a necessary evolution for law firms seeking to thrive in a competitive market. The combination of cost savings, efficiency gains, and enhanced accuracy creates a compelling case for law firms to adopt compliance automation as a core component of their operational strategy. As the legal landscape continues to change, those who leverage technology effectively will undoubtedly emerge as the frontrunners in delivering exceptional legal services while maintaining rigorous compliance standards.

Conclusion

Compliance automation is revolutionizing law firms by streamlining processes, reducing human error, and enhancing efficiency. By integrating advanced technologies such as artificial intelligence and machine learning, law firms can automate routine compliance tasks, ensuring adherence to regulations while freeing up valuable time for legal professionals to focus on more complex matters. This transformation not only improves operational effectiveness but also enhances client trust and satisfaction through timely and accurate compliance management. Ultimately, compliance automation positions law firms to adapt to the evolving legal landscape, fostering innovation and competitive advantage in an increasingly digital world.