Emerging Trends in Smart Contract Adoption Across Industries

Introduction

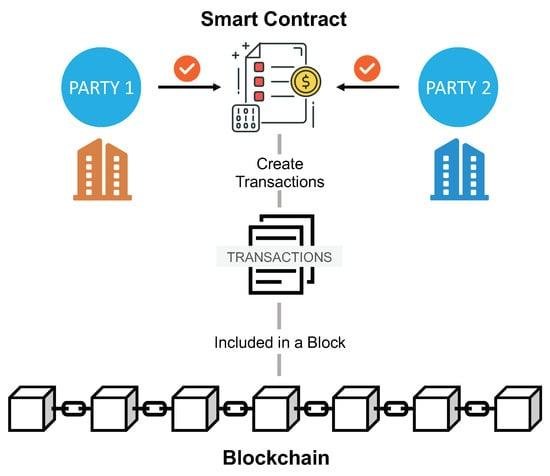

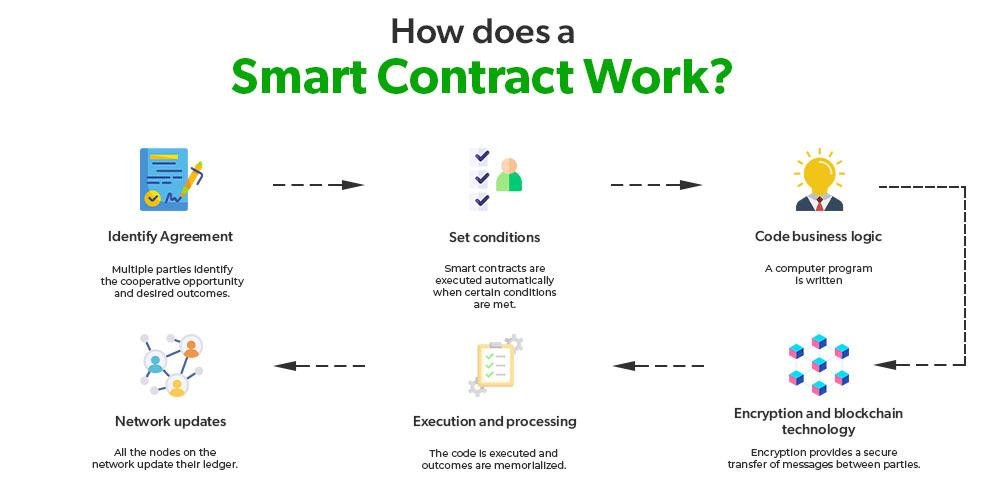

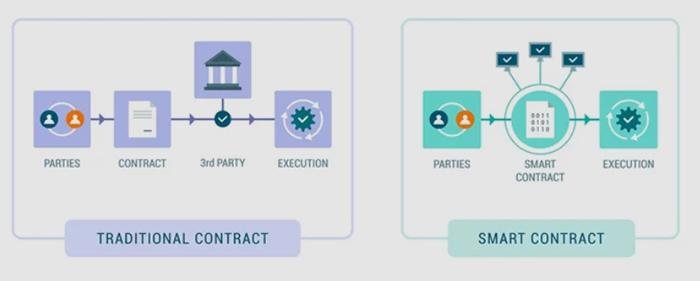

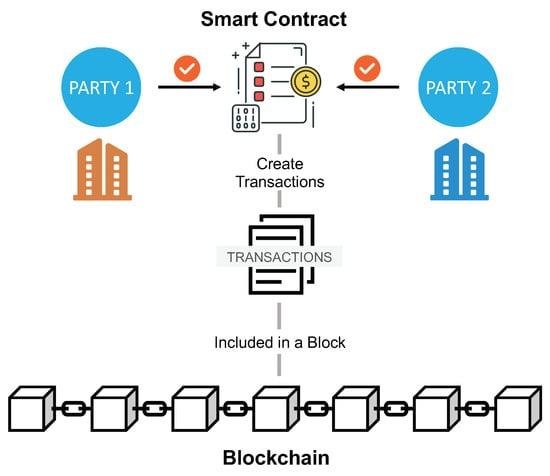

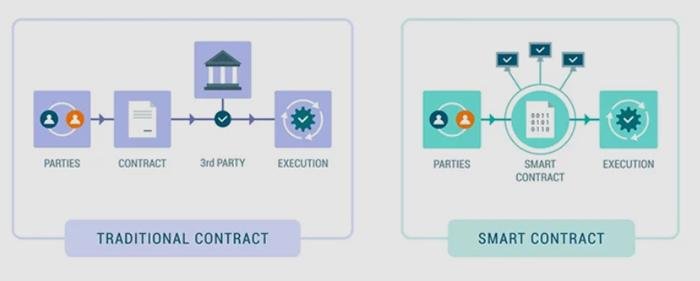

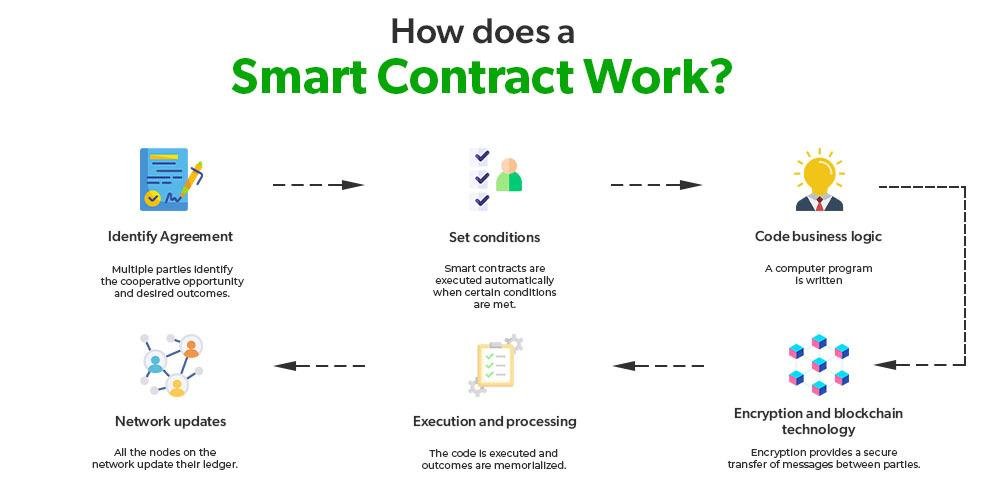

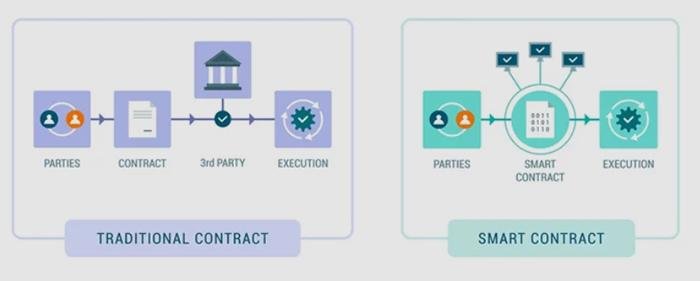

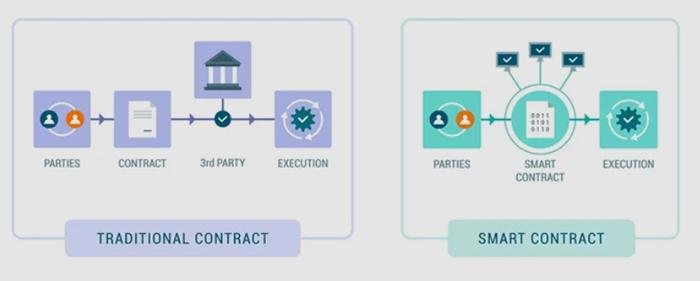

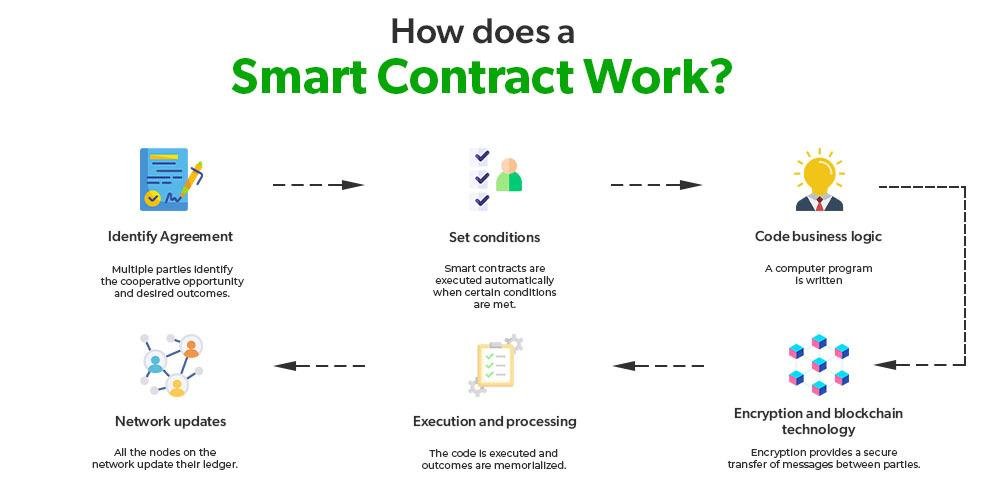

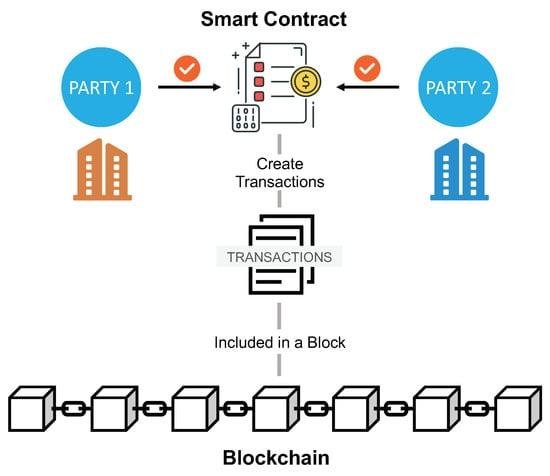

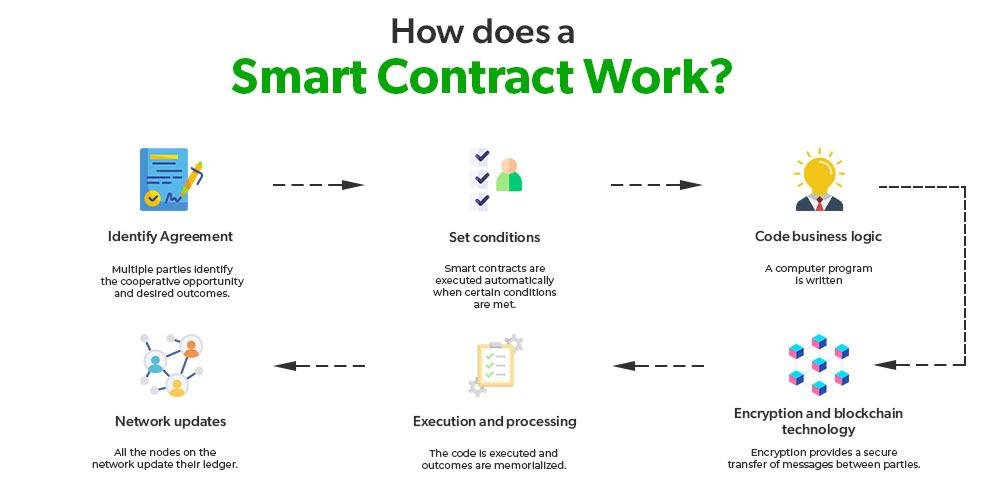

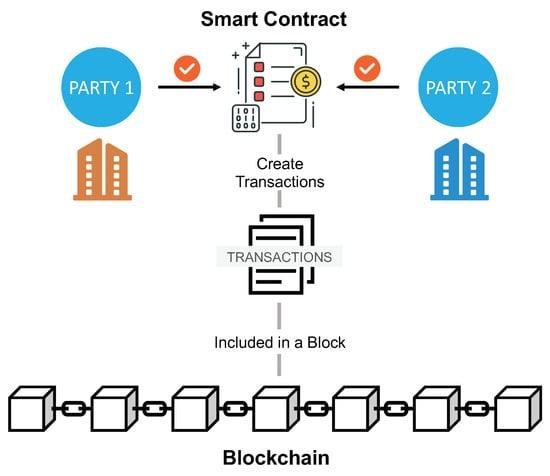

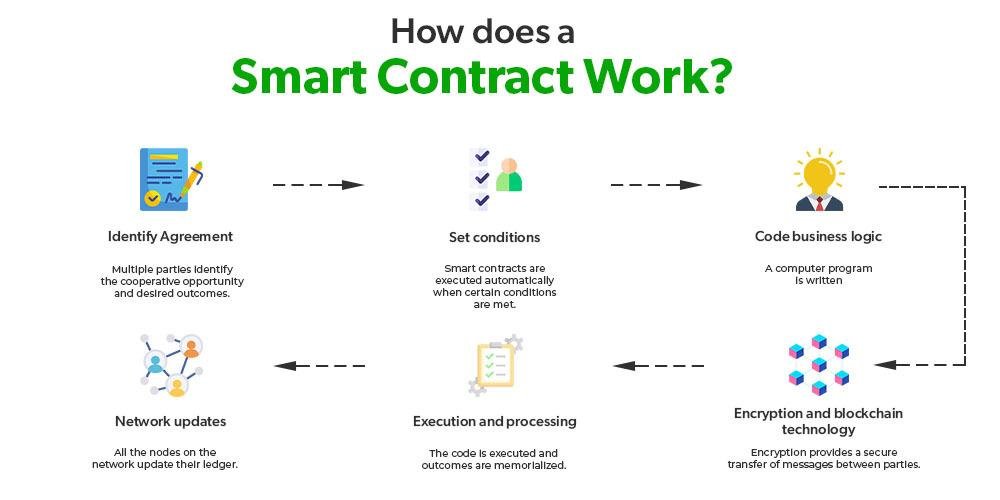

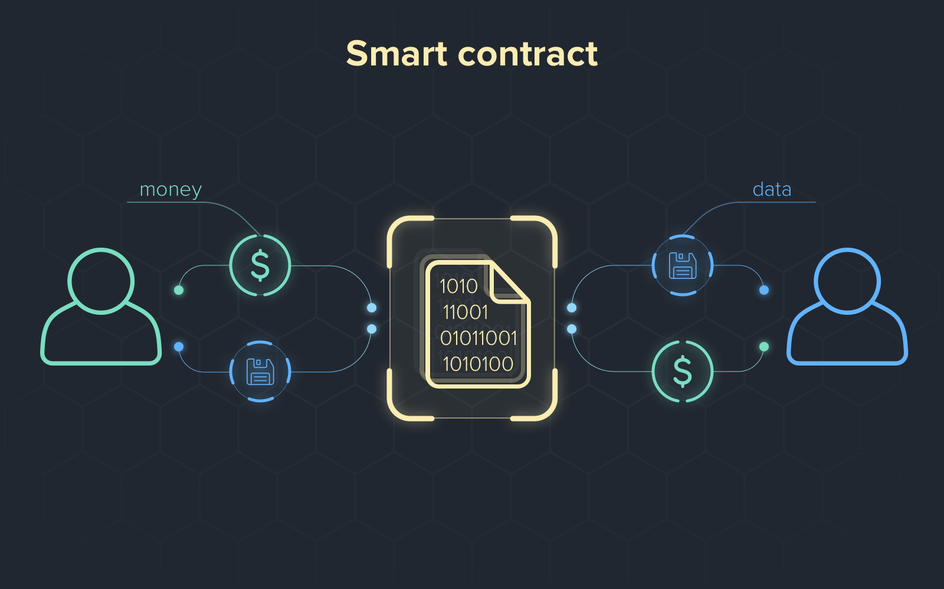

Smart contracts are self-executing contracts with the terms of the agreement directly written into lines of code. This technology operates on decentralized blockchain networks, ensuring that the contracts are immutable, transparent, and verifiable. The essence of smart contracts lies in their ability to facilitate, verify, and enforce the negotiation or performance of a contract, eliminating the need for intermediaries. As industries seek more efficient means to manage agreements and transactions, smart contracts are gaining popularity.

Key Characteristics of Smart Contracts:

- Automation: Smart contracts leverage automation to minimize human intervention, thus reducing the chances of errors and enhancing reliability. By coding the contractual obligations directly into the digital framework, tasks can be executed quickly and accurately without the need for oversight.

- Transparency: Smart contracts enhance accountability by providing public access to the terms and conditions of agreements. Stakeholders can view and validate contract conditions, which fosters an environment of trust among parties.

- Security: Utilizing advanced cryptographic techniques, smart contracts ensure data integrity and protect against unauthorized access or alterations. The decentralized nature of blockchain further bolsters security, as data is not stored in a single location, making it less susceptible to attacks.

The adoption of smart contracts is quickly gaining momentum across various sectors, driven by advancements in blockchain technology and the demand for enhanced operational efficiency. As organizations actively explore the integration of smart contracts in their processes, a variety of trends begin to emerge that showcase the transformative impact of this technology.

Read More: From Courtrooms to Smart Contracts: Blockchain’s Legal Use Cases

Financial Services: A Revolution in Transactions

The financial services industry is at the forefront of smart contract adoption, as traditional processes often involve complex agreements and intermediaries. By leveraging smart contracts, institutions can streamline their operations significantly, enabling faster transactions and reducing costs. Financial institutions are increasingly experimenting with blockchain technology, leading to a sea change in how they approach contract execution.

Notable Applications:

- Decentralized Finance (DeFi): This rapidly evolving segment utilizes smart contracts to facilitate lending, borrowing, and trading without intermediaries. DeFi platforms like Aave or Compound allow users to transact directly with one another, offering greater control over their assets while maintaining lower fees.

- Insurance: Automating claims processing through predefined conditions can drastically reduce the time and hassle involved in traditional settlements. For example, Insurtech companies like Etherisc are using smart contracts to automate flight delay insurance payouts, thus addressing customer pain points and ensuring quick compensation.

- Payments: The need for swift cross-border transactions has led to the use of smart contracts in payment processing. Solutions like Stellar utilize smart contracts to facilitate low-cost international payments, significantly shortening transaction times and enhancing transparency for all stakeholders involved.

Challenges and Solutions:

While the benefits of smart contract adoption in the financial sector are substantial, hurdles such as regulatory compliance, security, and interoperability between different blockchain platforms must be addressed. Engaging in continuous discussions with industry regulators is imperative to navigate the existing legal landscape and ensure alignment with emerging standards. Additionally, the formation of consortiums focused on creating interoperable solutions will facilitate collaborative development across different financial systems.

Supply Chain Management: Enhancing Traceability and Efficiency

In supply chain management, smart contracts are proving invaluable for enhancing traceability, efficiency, and trust among stakeholders. Their capacity to automatically enforce contractual terms and conditions can revolutionize how goods and services are tracked and verified, paving the way for more efficient logistics operations.

Key Benefits:

- Enhanced Traceability: Every transaction is recorded on the blockchain, creating a permanent and auditable record. This attribute is crucial in industries such as agriculture, where companies like IBM Food Trust enable consumers and retailers to track the path of products from farm to table, thereby ensuring quality and compliance.

- Reduced Fraud: Smart contracts significantly minimize the risk of fraud through transparent and immutable record-keeping. For instance, in diamonds and luxury goods, smart contracts are being employed to validate the authenticity and provenance of products, thereby fostering consumer confidence.

- Improved Efficiency: The automation provided by smart contracts leads to quicker transactions, with processes that previously required human intervention now being efficiently managed by the smart contract itself. Automation in inventory management systems can lead to optimized stock levels and reduced waste, resulting in higher operational efficiency.

Use Cases:

- Provenance Tracking: Companies in the food industry are utilizing smart contracts for provenance tracking to ensure ethical sourcing. A well-known application is Walmart, which has implemented blockchain technology to monitor the supply chain of food products, reducing contamination risks and improving response times in recall situations.

- Inventory Management: Automated restocking processes powered by smart contracts can provide real-time updates on stock levels. By integrating smart contracts into inventory management systems, companies like Unilever have begun to streamline their supply chains, decreasing operational costs while enhancing service fulfillment.

Conclusion

Emerging trends in smart contract adoption across industries reveal a promising future for enhanced operational efficiency, improved transparency, and cost reduction. From the financial sector to supply chain management, smart contracts are redefining how organizations engage in agreements and manage transactions. As technological advancements continue to accelerate and challenges are addressed, the widespread integration of smart contracts appears inevitable, marking a significant evolution in various operational landscapes.

FAQs about Emerging Trends in Smart Contract Adoption

1. What are smart contracts?

Smart contracts are automated, self-executing contracts where the terms of the agreement are directly written into code on a blockchain. They enable transactions to be conducted without intermediaries, thereby enhancing efficiency and security.

2. How are smart contracts used in finance?

In finance, smart contracts are used in decentralized finance (DeFi) applications for lending, borrowing, and trading without traditional intermediaries. They also automate insurance claims processing and streamline cross-border payments, reducing transaction costs and increasing speed.

3. What benefits do smart contracts provide for supply chain management?

Smart contracts enhance traceability and efficiency in supply chain management by automatically enforcing contractual conditions. They reduce fraud through immutable record-keeping and enable real-time updates and inventory management that minimize delays and losses.

4. What challenges are associated with smart contract adoption?

Challenges include regulatory compliance issues, security concerns, and the need for interoperability between various blockchain platforms. Continuous collaboration among industry stakeholders and regulators is essential to address these challenges effectively.

5. What industries are likely to see increased smart contract adoption in the future?

While finance and supply chain management are currently leading the adoption curve, industries such as healthcare, real estate, and legal services are also expected to increasingly leverage smart contracts, thanks to their potential for enhanced efficiency and reduced costs.