Introduction to Financial Compliance and Legal Tech

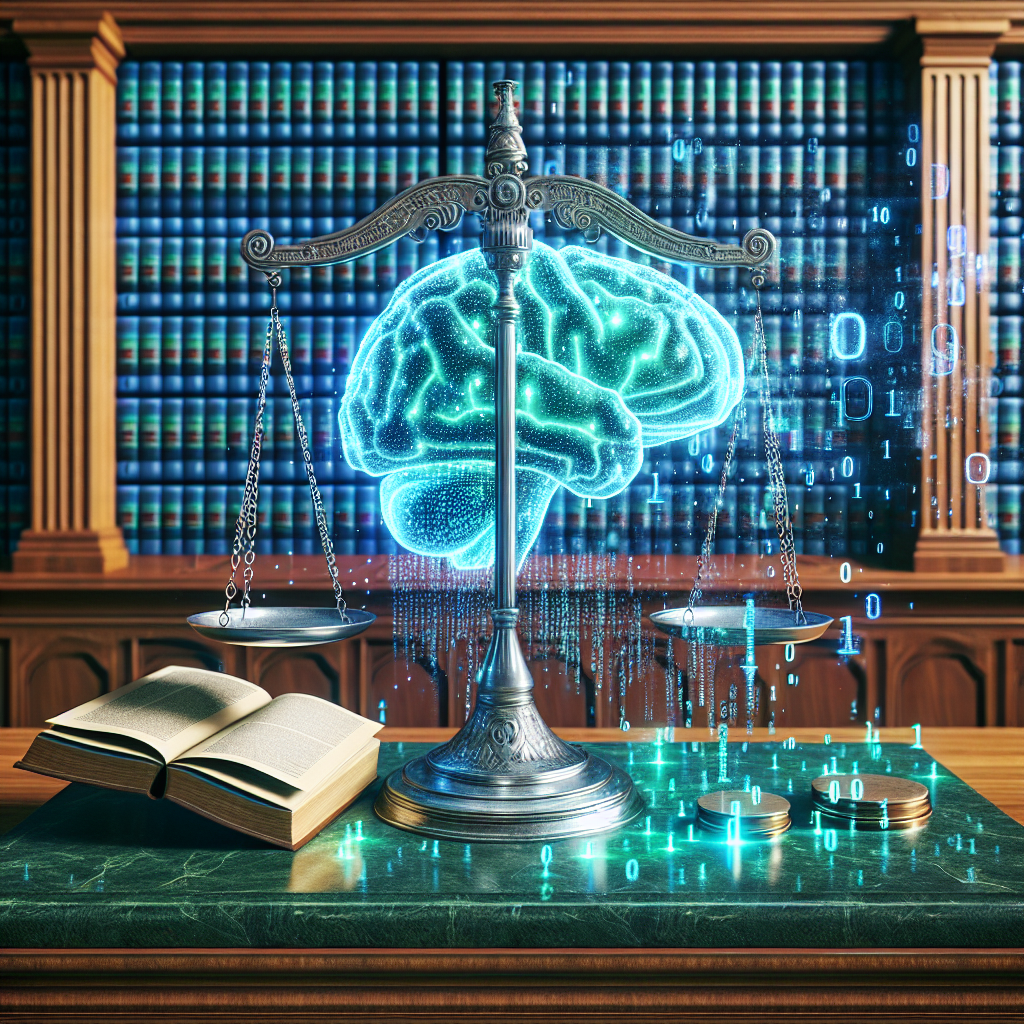

Introduction: In today's rapidly evolving financial landscape, strict adherence to compliance standards has never been more important. Financial institutions operate within a labyrinth of regulations aimed at protecting investors and maintaining market integrity. The penalties for non-compliance can be severe, encompassing both financial repercussions and reputational harm. As such, organizations are turning to legal technology (legal tech) to streamline compliance processes and elevate their operational efficiency.

The regulatory environment is characterized by a plethora of regulations, including the Dodd-Frank Act, the Markets in Financial Instruments Directive (MiFID II), and the General Data Protection Regulation (GDPR), each imposing stringent stipulations on financial entities. Risk management is another critical component, as financial institutions must identify potential threats while navigating complex transaction landscapes. Meeting these compliance obligations often demands robust reporting standards and unwavering commitment to consumer protection, thus underscoring the importance of a formidable compliance framework.

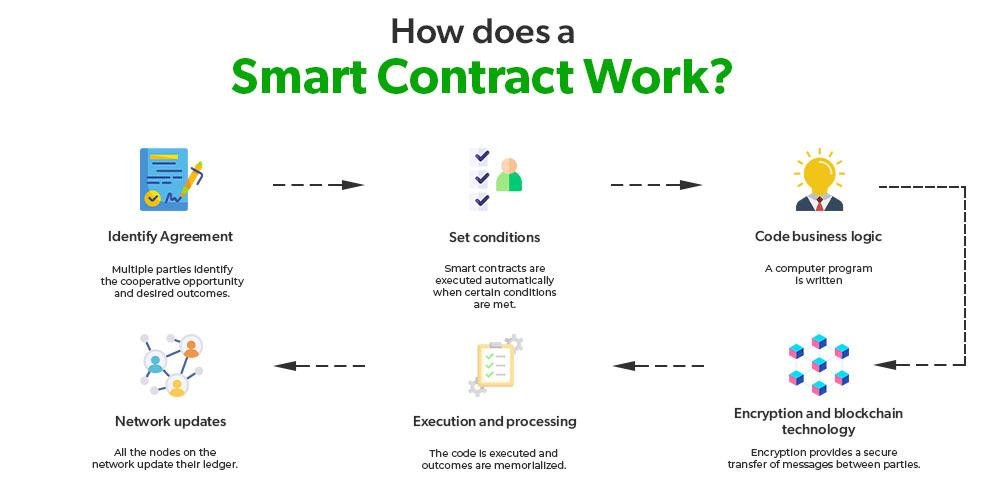

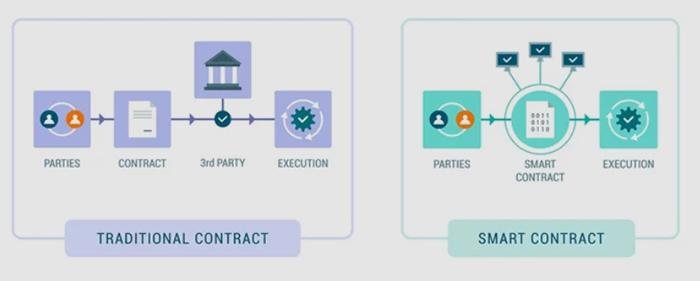

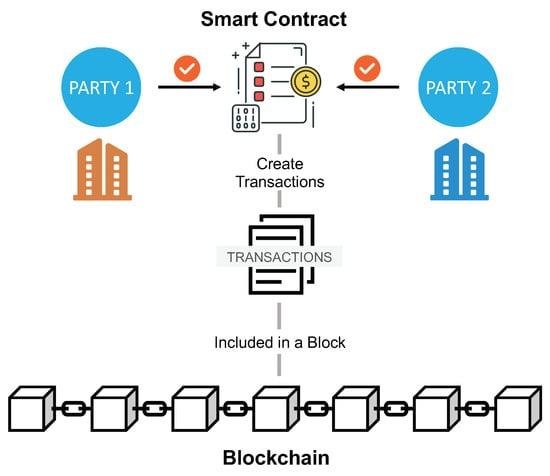

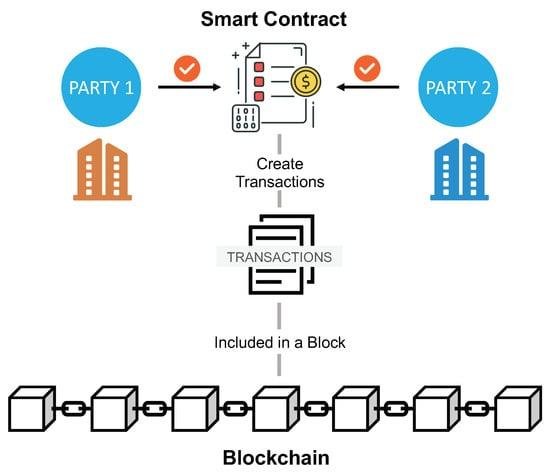

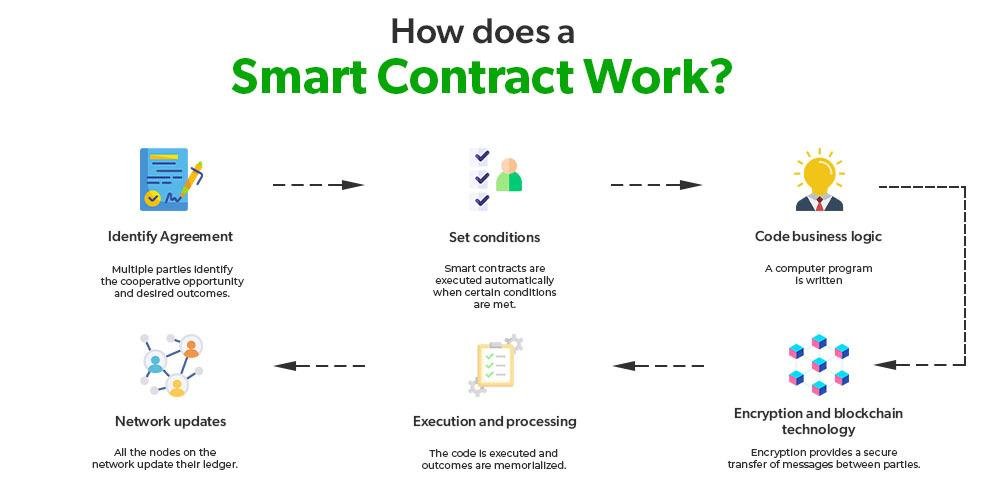

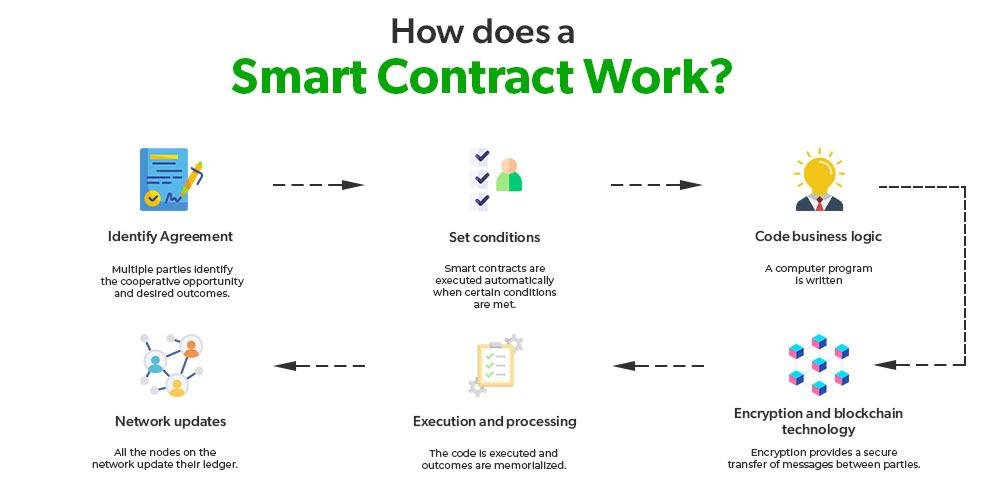

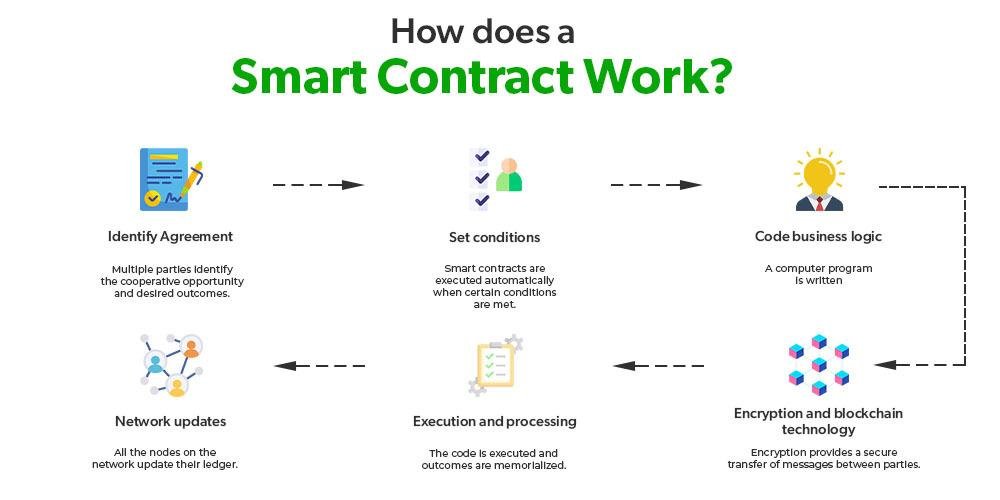

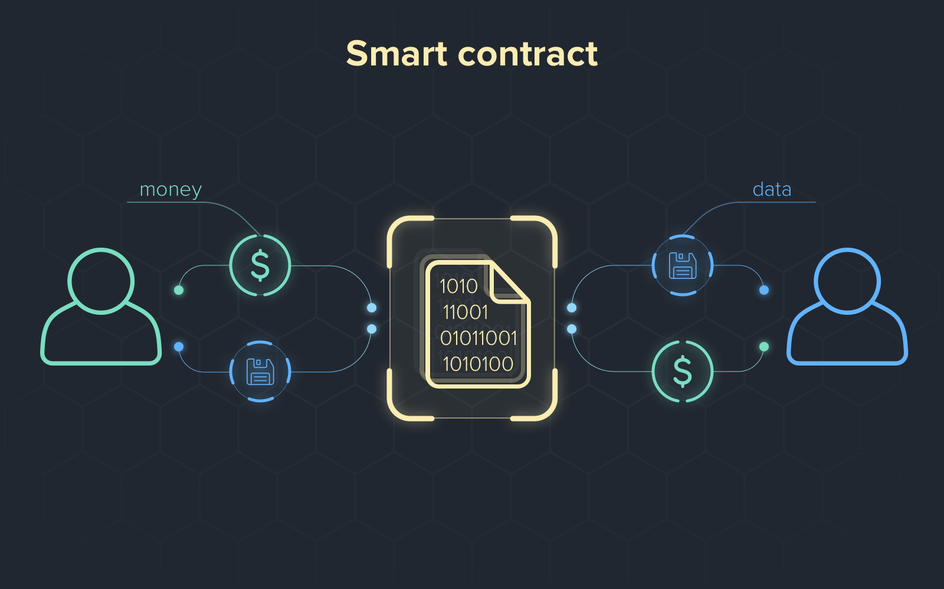

Legal tech plays a dual role by incorporating innovative solutions that not only help legal professionals better understand these regulations but also automate various compliance tasks. This technology includes an array of software tools designed to facilitate real-time monitoring, regulatory updates, and automated reporting, thus ensuring that compliance processes are not only effective but also efficient.

## 2. Key Legal Tech Solutions for Financial Compliance

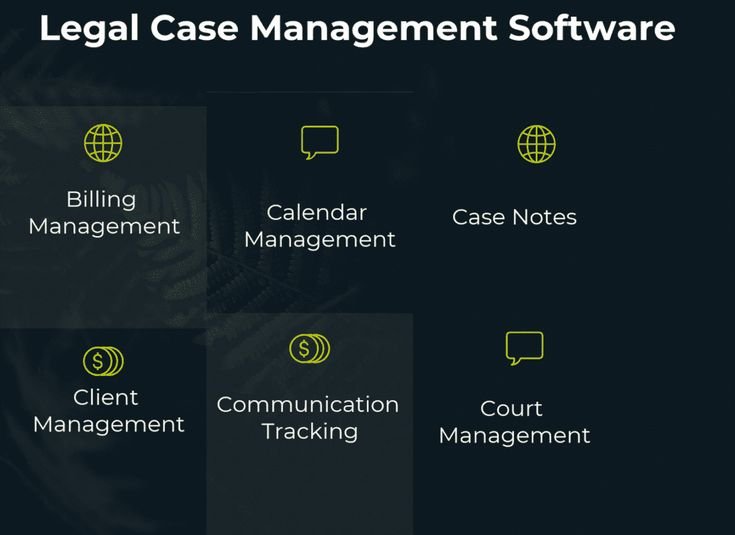

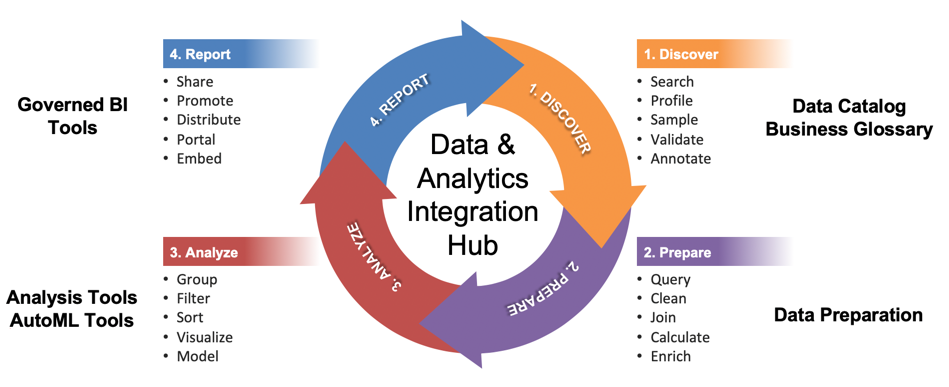

In the realm of financial compliance, a variety of legal tech solutions have emerged that effectively address the pain points faced by financial institutions. One of the primary tools is Document Management Systems (DMS), which centralize legal documentation, enhance version control, and simplify access to compliance records. By reducing time spent searching for documents, DMS can significantly expedite compliance efforts and empower legal teams to focus on more strategic activities.

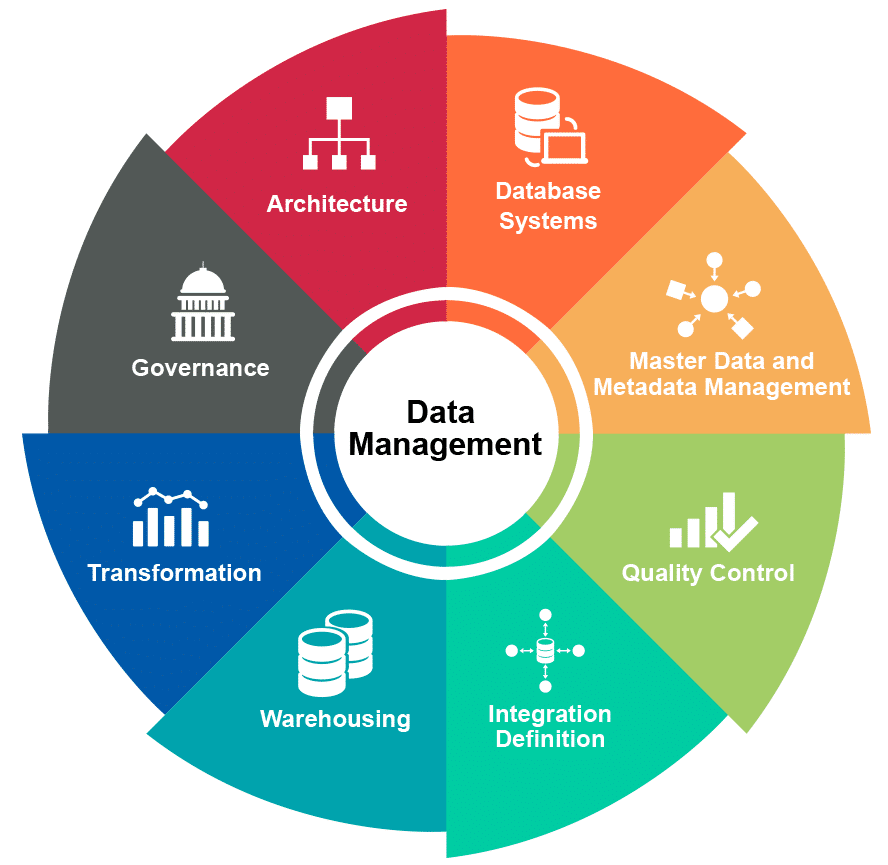

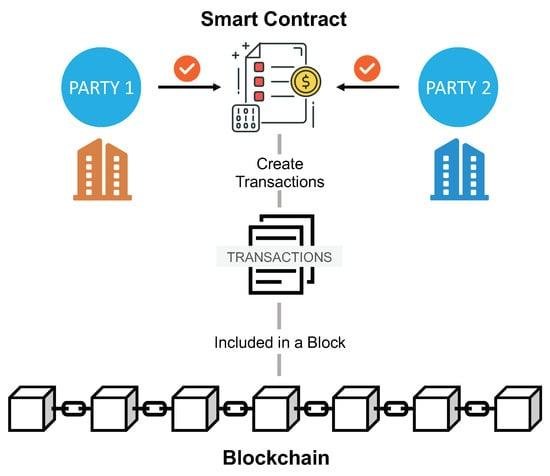

Another vital solution is Compliance Management Systems (CMS). These systems allow organizations to automate regulatory reporting and monitor their compliance status in real time. By maintaining an up-to-date database of regulatory requirements, a CMS ensures that financial institutions are immediate aware of any changes and can adapt accordingly. Organizations like [Compliance.ai](https://www.compliance.ai) offer solutions tailored to this purpose.

Furthermore, risk assessment tools utilize predictive analytics to analyze potential risks in financial transactions. These tools can create risk matrices that score and prioritize identified risks, enabling organizations to adopt proactive risk mitigation strategies. Notably, tools like [Riskalyze](https://www.riskalyze.com) provide financial advisers with insights that facilitate informed decision-making while deftly navigating regulatory landscapes.

You May Also Like: Key Cybersecurity Threats to Law Firms in 2024: A Detailed Analysis

## 3. Benefits of Integrating Legal Tech Solutions

The integration of legal tech solutions offers substantial benefits for financial institutions striving to enhance their compliance frameworks. One of the most significant advantages is cost reduction. By automating various compliance-related processes, organizations can decrease operational costs, effectively minimizing the labor-intensive nature of manual compliance checks. This automation not only streamlines workflows but also significantly reduces the risks associated with non-compliance penalties, including fines and litigation costs.

Additionally, legal tech solutions enhance accuracy and speed. By employing advanced technology, institutions can significantly reduce human errors often associated with document handling and reporting. The speed at which these systems process compliance-related tasks greatly surpasses traditional, manual methods, allowing firms to respond to regulatory changes promptly and accurately. For instance, platforms like [Everlaw](https://www.everlaw.com) leverage sophisticated algorithms to enhance document review processes, thereby reducing turnaround time without compromising on accuracy.

Finally, easier collaboration is one of the unassailable benefits of these technologies. Advanced legal tech solutions facilitate seamless communication across departments, thus improving the way stakeholders interact on compliance matters. By centralizing information and documentation, teams can work more cohesively, thereby fostering a culture of compliance within the organization. This aspect is vital for maintaining adherence to standards across diverse sectors of financial service.

## Conclusion

In summary, as financial institutions navigate the intricate web of regulatory requirements, legal tech solutions stand out as essential tools in enhancing compliance efforts. By automating workflows, improving accuracy, and promoting collaborative environments, these technologies empower organizations to proactively tackle compliance challenges and minimize risks. The integration of legal tech not only streamlines operational processes but also positions financial institutions to meet regulatory demands more effectively, ultimately contributing to their long-term success and sustainability.

---

### FAQs

**1. What is legal tech?**

Legal tech refers to technology and software solutions designed specifically to assist legal professionals in various aspects of their work, such as document management, compliance monitoring, and case handling.

**2. How does legal tech enhance compliance in financial law?**

Legal tech enhances compliance by automating documentation, improving risk assessment, and providing tools for real-time monitoring of regulatory changes, thereby reducing human error and expediting compliance processes.

**3. What types of legal tech solutions are used for financial compliance?**

Key legal tech solutions for financial compliance include Document Management Systems (DMS), Compliance Management Systems (CMS), Risk Assessment Tools, E-Discovery Tools, and Case Management Software.

**4. What are the benefits of adopting legal tech solutions?**

Benefits include cost reduction through automation, enhanced accuracy and speed in compliance checks, and improved collaboration among legal and compliance teams.

**5. Are there specific legal tech providers focused on financial compliance?**

Yes, notable providers include Compliance.ai, Riskalyze, and Everlaw, each offering tailored solutions to assist financial institutions in meeting their compliance obligations.