How Smart Contracts Are Revolutionizing Real Estate Law

In the age of digital transformation, the realm of real estate is undergoing a seismic shift, propelled by the innovative force of smart contracts. These self-executing agreements, which are coded to automatically enforce and execute terms upon the fulfillment of predefined conditions, are not merely a technological novelty; they are poised to redefine the very framework of real estate law. As traditional processes give way to automated solutions, the intersection of real estate and blockchain technology heralds a new era of transparency, efficiency, and security in transactions. This article explores how smart contracts are dismantling longstanding barriers in real estate dealings, reshaping the legal landscape, and presenting both opportunities and challenges for stakeholders in this dynamic sector. Whether you’re a seasoned investor, a prospective homeowner, or a legal professional, understanding this transformation is essential to navigating the future of property transactions.

The Rise of Smart Contracts in Real Estate Transactions

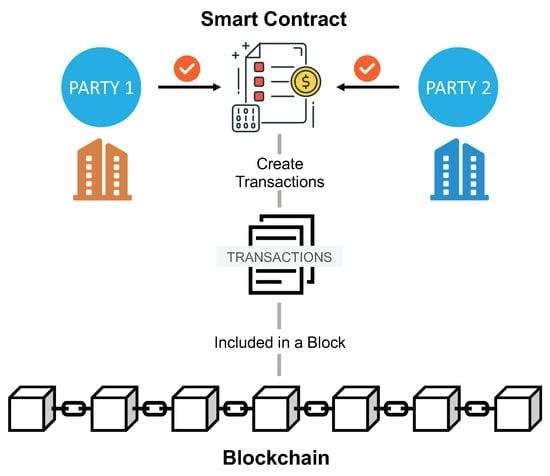

The advent of smart contracts is reshaping the landscape of real estate transactions, offering a paradigm shift in how agreements are executed and enforced. These self-executing contracts, powered by blockchain technology, enable buyers and sellers to exchange value without the need for intermediaries. By automatically executing terms and conditions once agreed upon, smart contracts enhance transparency and trust while mitigating the risk of fraud. Key benefits include:

- Efficiency: Transactions can be completed faster as documents and funds are processed automatically.

- Cost Savings: Reduced reliance on lawyers and agents lowers transaction costs significantly.

- Security: The immutable nature of blockchain ensures that data breaches and tampering are virtually impossible.

As more stakeholders in the real estate sector embrace this innovative approach, the synergy between smart contracts and traditional practices is becoming more evident. Real estate firms are utilizing these contracts to streamline various processes, from property listings to closings. Smart contracts can automate tasks such as:

- Escrow Management: Automatically managing deposits and releases based on fulfilled conditions.

- Title Transfers: Simplifying the transfer of ownership by securing and verifying title records.

- Rental Agreements: Facilitating automatic rent payments when pre-defined conditions are met.

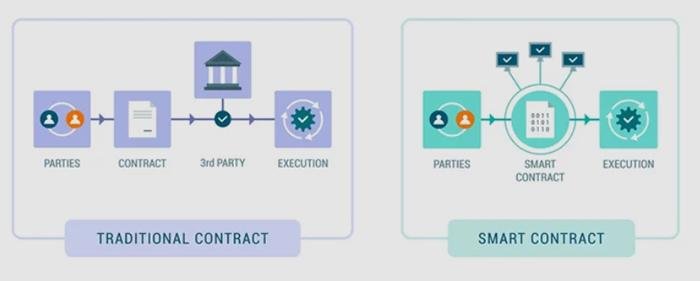

To illustrate the potential impact, consider the following comparison of traditional versus smart contract approaches:

| Aspect | Traditional Approach | Smart Contract Approach |

|---|---|---|

| Time to Close | Weeks to Months | Days |

| Intermediary Fees | High | Minimal |

| Risk of Fraud | High | Low |

Streamlining Property Transfers Through Automated Agreements

In the realm of real estate, the traditional hurdles of tedious paperwork and lengthy negotiations are being transformed, thanks to the advent of automated agreements. Smart contracts leverage blockchain technology to create self-executing contracts that are not only transparent but also immutable. This means that once the terms are agreed upon, the terms will automatically be executed when conditions are met, significantly reducing the potential for disputes or misunderstandings. Properties can change hands with the click of a button, streamlining the entire process while increasing trust between parties.

The benefits of automated agreements are profound and impact multiple aspects of property transfers:

- Transparency: All parties have access to the same information in real-time.

- Efficiency: Reduces the paperwork and time normally associated with property transactions.

- Security: Information stored on blockchain is encrypted and virtually tamper-proof.

- Cost-effective: Minimizes the need for intermediaries, thereby reducing transaction fees.

To further illustrate the impact that smart contracts can have on property trading, consider the following example:

| Traditional Process | Smart Contract Process |

|---|---|

| Multiple documents to sign | Single digital contract executed |

| Manual verification procedures | Automatic verification via code |

| Possible delays in transactions | Instantaneous execution upon conditions met |

Enhancing Transparency and Reducing Fraud in Property Deals

In the ever-evolving landscape of real estate transactions, the integration of smart contracts plays a pivotal role in fostering transparency. Traditional methods heavily rely on intermediaries, which can lead to discrepancies and misunderstandings. By utilizing blockchain technology, every transaction is recorded on an immutable ledger, ensuring that all parties have access to the same information. This access mitigates the risk of misinformation and creates an environment where the details of each deal are clear and verifiable. Key benefits of this approach include:

- Real-time updates that reflect changes, creating immediate visibility for all stakeholders.

- Enhanced trust between parties, as the contract’s execution is guaranteed by code rather than subjective interpretation.

- Easier compliance with legal requirements, as the audit trail is embedded within the blockchain system.

Furthermore, the potential for fraud reduction through automated processes is remarkable. Smart contracts eliminate the necessity for manual handling, which is often a point of vulnerability in property deals. Since the execution of these contracts is predetermined and reliant on specific conditions being met, fraudulent practices such as document forgery or double-selling are significantly diminished. As a result, the real estate sector gains a renewed sense of security. A simple illustrative comparison of traditional vs. smart contract benefits is shown below:

| Traditional Process | Smart Contract Process |

|---|---|

| Multiple intermediaries increase complexity | Automated processes streamline transactions |

| Higher potential for disputes | Clear, codified agreements limit misunderstandings |

| Time-consuming verification | Instant validation through blockchain |

Navigating the Legal Landscape: Best Practices for Adoption

As smart contracts gain traction in the real estate industry, stakeholders must familiarize themselves with the best practices surrounding their adoption. Understanding the technology is essential for ensuring seamless integration into existing legal frameworks. Key considerations include establishing clear contractual terms, privacy protocols, and robust security measures to protect sensitive information. Engaging with tech-savvy legal professionals will help eliminate ambiguity and provide the necessary expertise to draft and implement these digital agreements accurately. To mitigate potential risks, consider the following strategies:

- Conduct thorough research on smart contracts and blockchain technology.

- Collaborate with legal experts specializing in technology and real estate law.

- Regularly update security measures to safeguard against cyber threats.

- Maintain compliance with local, state, and federal regulations.

Moreover, ensuring a smooth transition requires educational initiatives for all parties involved. Property buyers, sellers, and agents should all have a basic understanding of how smart contracts operate and their implications for the transaction process. Regular training sessions can facilitate this learning, thus fostering a culture of transparency and innovation. Consider implementing an information-sharing platform that details contract operations, best practices, and troubleshooting techniques. Here’s a simplified framework for these training sessions:

| Session Topic | Duration | Target Audience |

|---|---|---|

| Introduction to Smart Contracts | 1 Hour | All Stakeholders |

| Legal Implications and Compliance | 1.5 Hours | Real Estate Agents & Lawyers |

| Security Best Practices | 1 Hour | Technical Teams |

| Case Studies and Real-life Applications | 2 Hours | All Stakeholders |

Future Outlook

as the fog of traditional real estate transactions begins to lift, smart contracts emerge as a beacon of clarity and efficiency. These digital agreements, anchored in transparency and automation, are not merely a passing trend but a transformative force poised to reshape the landscape of real estate law. By reducing the potential for disputes, expediting processes, and ensuring security through blockchain technology, smart contracts hold the promise of a more equitable and streamlined industry.

As we stand on the cusp of this technological revolution, it is essential for legal professionals, investors, and property owners alike to embrace this evolution with open minds. The journey ahead may require adaptation and education, but the rewards are manifold. With smart contracts, the path toward ownership can become less fraught with complications, paving the way for a more accessible and trustworthy real estate market.

Ultimately, the integration of smart contracts into real estate law is not just about innovation; it’s about reimagining the very foundations of how we buy, sell, and manage property. As this transformation continues to unfold, one thing is certain: the future of real estate law is bright, and we are only just beginning to scratch the surface of its potential.