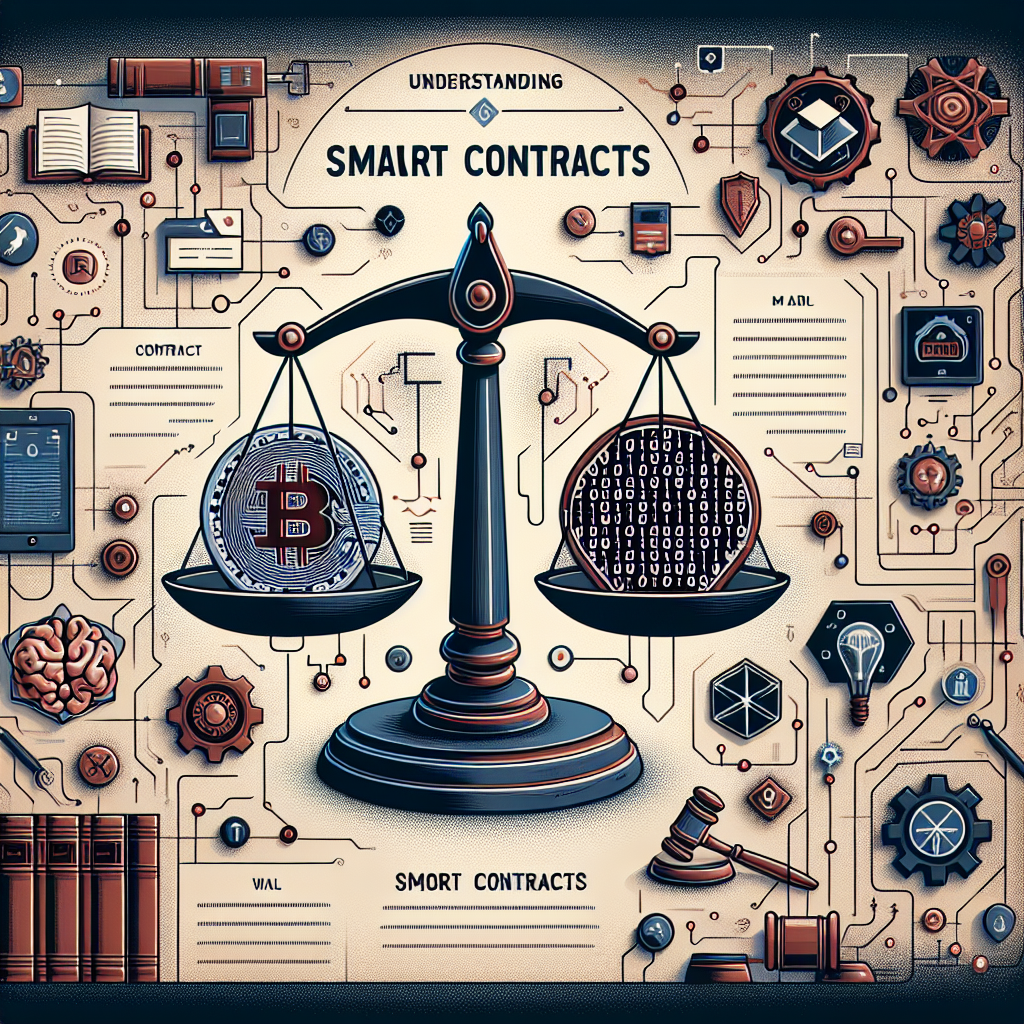

Understanding the Legal Framework Surrounding Smart Contracts

Introduction

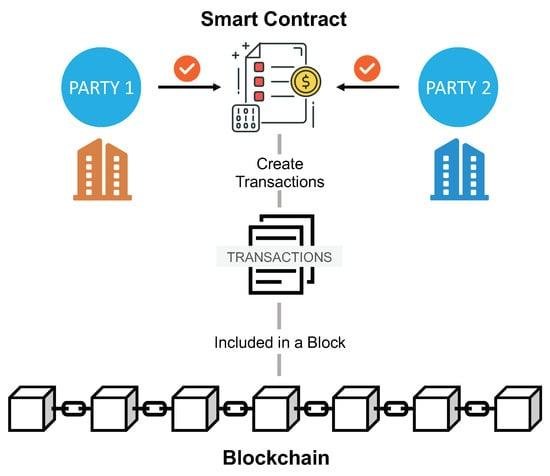

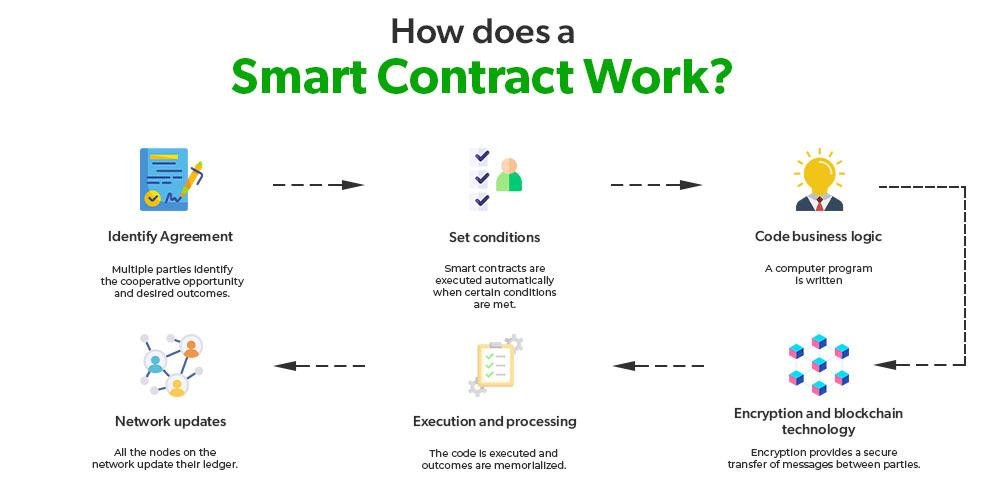

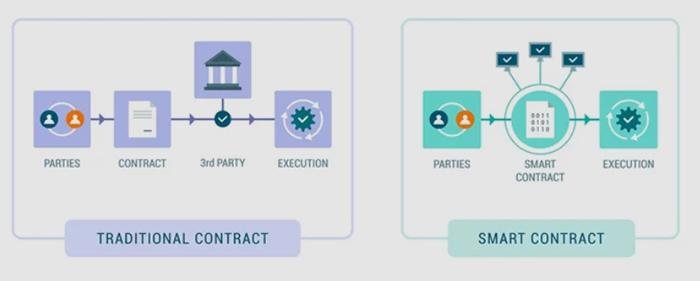

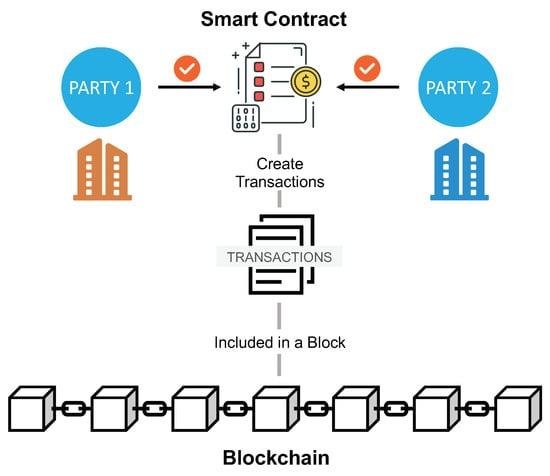

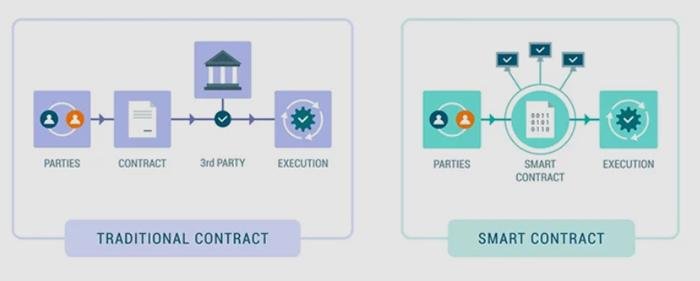

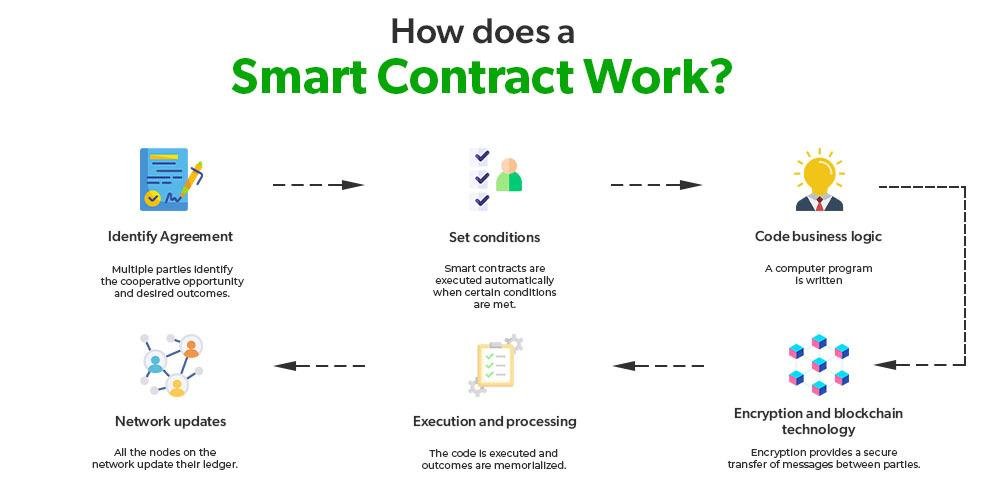

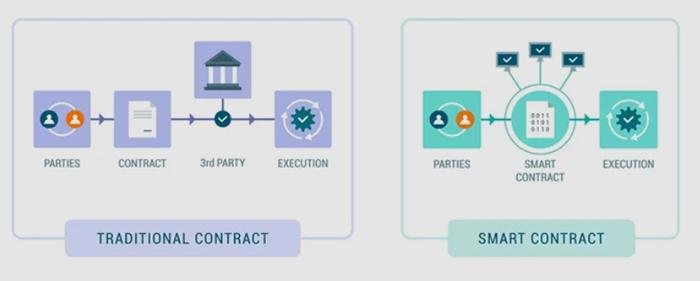

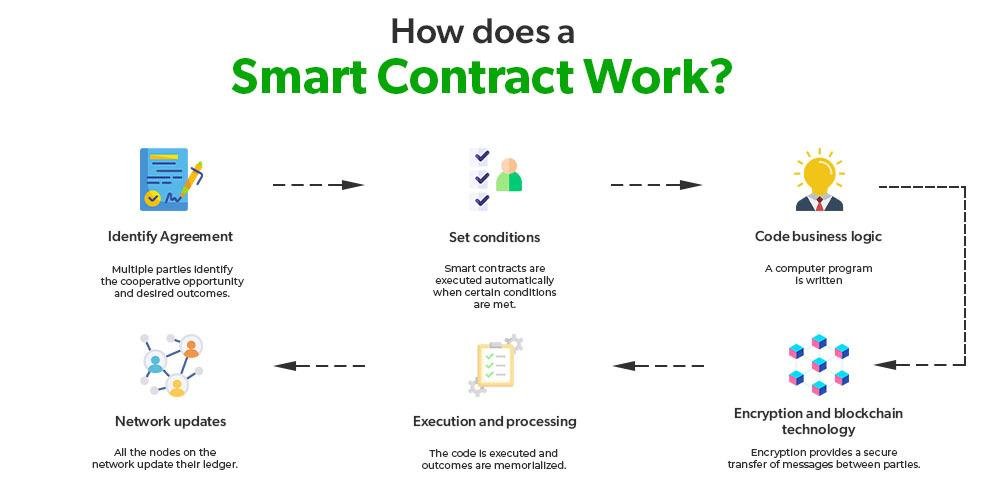

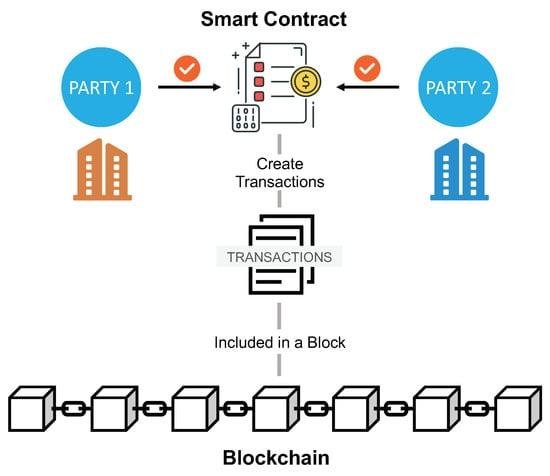

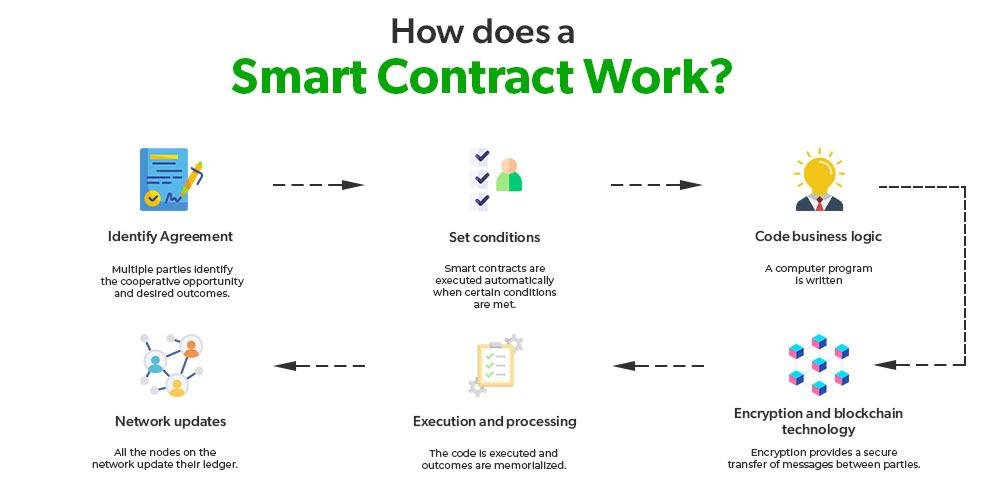

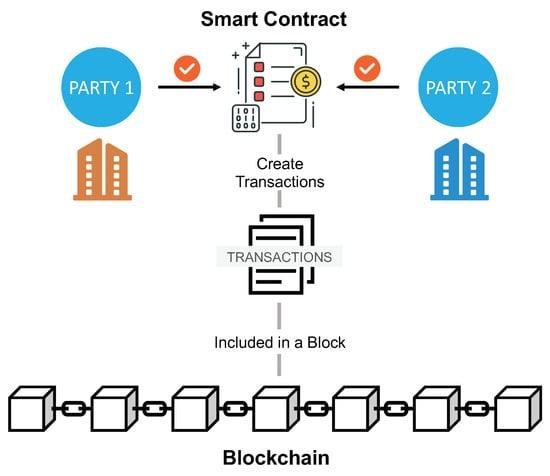

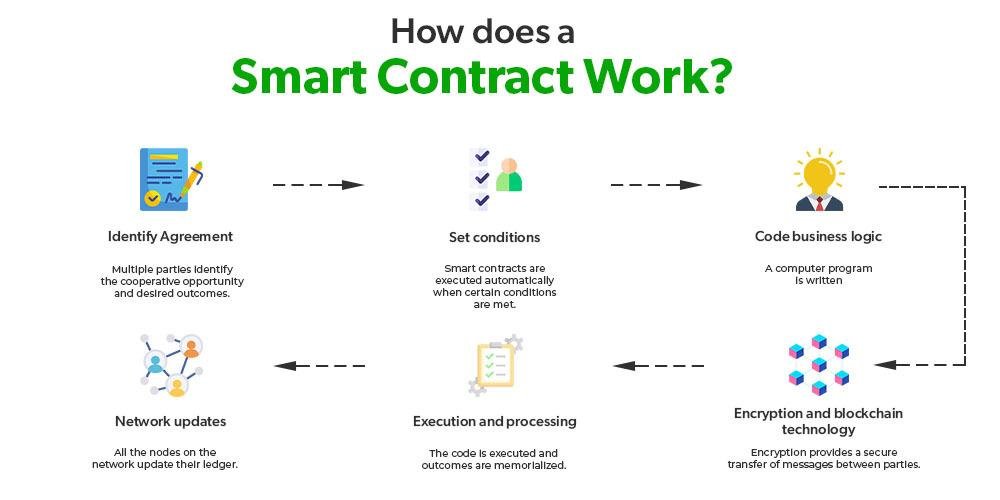

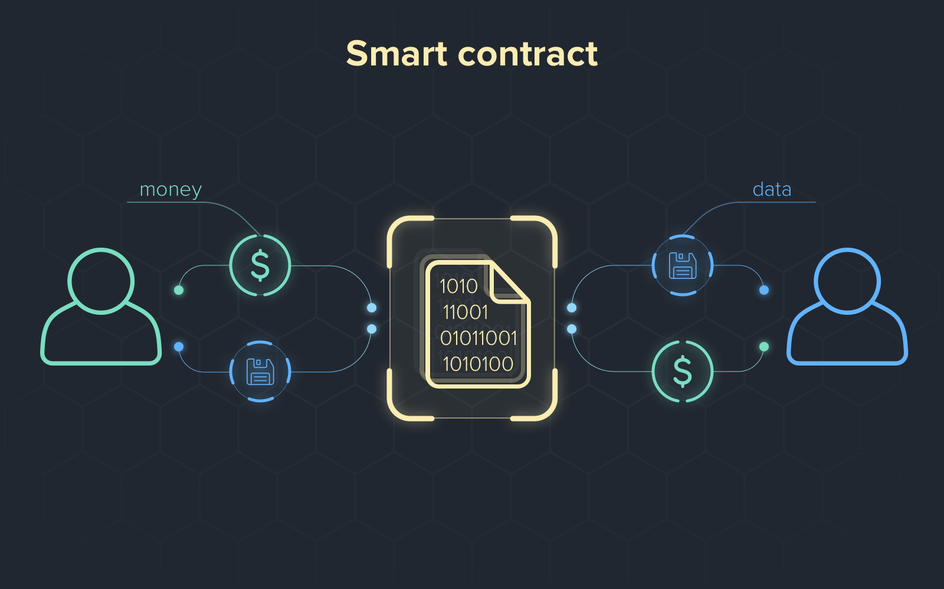

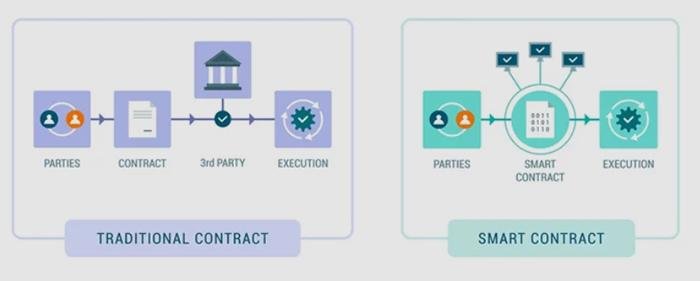

In today’s world, where technology is constantly changing how we live and do business, smart contracts are a game-changer. These digital agreements, powered by blockchain, automatically execute themselves when certain conditions are met, offering new levels of efficiency and security. But as exciting as this innovation is, it also raises important legal questions.

Smart contracts present challenges for legal systems. Are these digital agreements legally binding? Which laws apply? How can traditional contract laws be adapted to fit this new technology? In this article, we will explore how smart contracts work within the legal world, discussing their enforceability, potential risks, and the evolving laws designed to keep up with this new tech. Let’s dive into how smart contracts are shaping the future of legal agreements.

Navigating the Legal Landscape of Smart Contracts

As more people and businesses start using smart contracts, it’s crucial to understand how these digital agreements fit into existing laws. Unlike traditional contracts, which require lawyers and other intermediaries, smart contracts are self-executing and rely on computer code. This introduces new challenges for the legal world. Several important legal issues include:

- Jurisdiction: Different regions may have different views on whether smart contracts are valid or enforceable.

- Consumer Protection: Even though these contracts are automated, they still need to protect consumers, just like traditional contracts.

- Intellectual Property: There are questions about who owns the code behind smart contracts and the technology used.

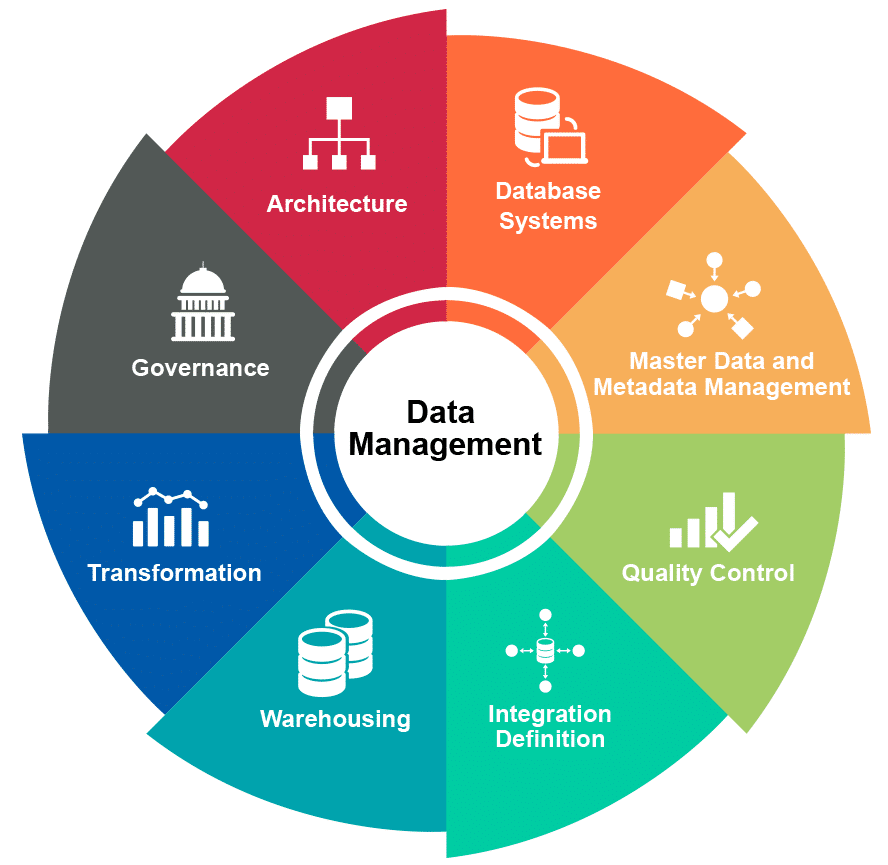

For regulated industries like finance, smart contracts must also meet strict compliance standards. The table below outlines some key areas of compliance for smart contracts:

| Compliance Area | Considerations |

|---|---|

| Data Privacy | Ensuring compliance with GDPR and similar regulations. |

| Anti-Money Laundering | Implementing measures to prevent illicit financial activities. |

| Tax Obligations | Understanding obligations arising from transactions executed via smart contracts. |

Essential Elements of Enforceability and Compliance

For a smart contract to be enforceable in a court of law, it needs to meet certain legal criteria. These include:

- Intention to Create Legal Relations: Both parties need to show they intend to be legally bound by the contract.

- Consideration: There needs to be an exchange of value between the parties, such as money, goods, or services.

- Capacity: Both parties must be legally able to enter into a contract (e.g., not underage or mentally incapacitated).

- Compliance with Laws: Smart contracts must adhere to the laws in the jurisdiction where they are being enforced.

Legal compliance also means that the contract should be secure, with good coding practices and proper verification methods to ensure the terms are carried out as agreed.

| Element | Importance |

|---|---|

| Intention | Establishes mutual understanding and commitment. |

| Consideration | Validates the exchange of value, crucial for legality. |

| Capacity | Ensures both parties can legally engage in the agreement. |

| Compliance | Aligns the contract with local regulations and laws. |

Key Challenges and Risks in Smart Contract Implementation

While smart contracts offer many benefits, there are also risks and challenges that need to be addressed. A few of the major challenges are:

- Code Vulnerabilities: Even small errors in the code can lead to large financial losses.

- Immutability: After a smart contract is deployed on the blockchain, it becomes difficult to alter. If an issue arises, it’s challenging to resolve.

- Regulatory Uncertainty: Smart contracts often exist in a grey area where existing laws don’t provide clear answers on their legality or enforcement.

- Cross-Jurisdictional Issues: Smart contracts are used across borders, meaning different laws may apply in different places. A smart contract might be valid in one country but not in another, creating challenges for enforcement.

Here’s a summary of some key risks:

| Challenge/Risk | Description |

|---|---|

| Code Vulnerabilities | Potential for bugs leading to financial losses. |

| Immutability | Difficulty in modifying contracts post-deployment. |

| Regulatory Compliance | Unclear legal standing across jurisdictions. |

| Cross-jurisdictional Issues | Variability in enforcement and applicability of laws. |

Best Practices for Legal Clarity and Dispute Resolution

To ensure that smart contracts are legally sound and minimize disputes, it’s important to follow best practices when drafting them. Some key steps include:

- Clear Definitions: Use simple and unambiguous language to define all terms in the contract.

- Comprehensive Scope: Specify the rights and responsibilities of each party in detail.

- Execution Protocols: Clearly outline how the contract will be executed, including deadlines and conditions.

- Dispute Resolution: Include a method for resolving any conflicts that may arise.

Having a clear process for resolving disputes can help avoid lengthy legal battles. Some options for resolving conflicts include:

| Dispute Resolution Method | Key Advantages |

|---|---|

| Negotiation | Encourages collaboration; costs are generally low. |

| Mediation | Professional mediator aids communication; non-binding. |

| Arbitration | More formal than mediation; binding decision. |

Wrapping Up

Smart contracts are changing how agreements are made, offering new levels of speed, efficiency, and security. However, they also raise important legal questions that must be addressed. As more businesses and consumers turn to smart contracts, understanding the legal implications is essential.

The technology behind smart contracts is moving fast, but the legal world is catching up. By following best practices, understanding potential risks, and keeping informed about new laws, stakeholders can navigate the legal landscape of smart contracts successfully.

As we move into a future where digital agreements become the norm, we must balance innovation with the need for clear, fair legal frameworks that ensure justice and accountability. The potential of smart contracts is huge, and with the right legal safeguards in place, they can help create a more efficient, secure, and trustworthy world of digital transactions.