Leveraging Technology to Mitigate Contractual Risks Effectively

Introduction

Contractual risks are an unavoidable part of conducting business in today’s complex environment. With various stakeholders involved, clear communication and adherence to stipulated terms are paramount for preventing misunderstandings and disputes. These risks can encompass a range of issues, from compliance and operational challenges to financial uncertainties and reputational damage. As organizations strive to navigate these potential pitfalls, leveraging technology to mitigate contractual risks has emerged as an essential strategy for safeguarding business interests. In this article, we explore how technology can enhance the management of contractual risks effectively, presenting practical solutions and advancements that businesses can adopt.

Introduction to Contractual Risks in Business

Contractual risks arise from the inherent nature of agreements between parties, often leading to unforeseen complications and liabilities. These risks can stem from vague contract language, unforeseen circumstances that alter obligations, and failure to meet regulatory requirements. As industries evolve, organizations must remain vigilant in identifying and addressing these risks to mitigate potential losses. Furthermore, understanding the legal landscape surrounding contractual engagements is crucial, as deviations can lead to lengthy and costly litigation.

The consequences of inadequate risk management can be severe. Financial losses may arise, not only due to direct penalties from breaches but also through lost business opportunities and diminished stakeholder trust. Reputational damage can linger, with negative consequences for customer relationships and market standing. Therefore, businesses must prioritize effective risk management strategies, focusing on preventative measures that minimize vulnerabilities before they escalate into costly disputes.

Proactive engagement in managing contractual risks can provide organizations with a competitive advantage. By instilling a culture of risk awareness and implementing comprehensive strategies to address these challenges, companies can enhance their credibility and strengthen relationships with employees, clients, and suppliers. This lays the foundation for sustainable operational practices and long-term success.

Types of Contractual Risks

Understanding and categorizing the various types of contractual risks are critical in developing targeted mitigation strategies. Compliance risks pose significant threats when organizations fail to adhere to legal, regulatory, or industry-specific standards. Non-compliance can result in harsh penalties, such as fines or legal actions which can disrupt business operations. In 2020, for instance, the World Health Organization identified numerous compliance breaches during its pandemic response, highlighting the necessity of stringent adherence to policies.

Operational risks arise from errors committed during contract execution or misunderstandings regarding the interpretations of contractual terms. Such challenges may lead to breaches or subpar performance, crippling collaborative efforts between parties. A notable example occurred during the construction of Berlin airport, where ambiguous responsibilities led to extensive delays and budget overruns, showcasing the importance of clear operational terms in contracts.

Financial risks involve disputes related to payments, pricing, and other monetary obligations that can jeopardize organizational cash flow. Financial uncertainty is especially dangerous during economic downturns, where managing cash reserves becomes crucial for survival. The 2008 financial crisis illustrated how failure to adhere to contractual financial obligations could lead to widespread bankruptcies and loss of market confidence, driving the need for meticulous financial risk management strategies within contracts.

You May Also Like: The Risks of Cloud Computing in Legal Tech and How to Mitigate Them

Importance of Mitigation Strategies

To effectively confront and alleviate contractual risks, organizations must embrace robust mitigation strategies. By implementing systematic approaches to contract management, they are better equipped to identify and address potential issues proactively. This not only protects the organization’s interests but also fosters stronger ties with stakeholders, enhancing overall business stability.

Effective mitigation strategies also support compliance with evolving regulations and market conditions. Organizations must continuously monitor and adapt to changes within their operational environments, ensuring that contracts reflect current laws and practices. This adaptability minimizes risks stemming from outdated contractual terms, ensuring ongoing alignment with market and legal obligations.

Moreover, effective risk mitigation improves overall organizational resilience. Companies that prioritize risk management can anticipate challenges and develop contingency plans, leading to smoother operations and strategic flexibility. This capability can significantly differentiate them in competitive landscapes, positioning them for sustainable growth and success in the long term.

The Role of Technology in Risk Mitigation

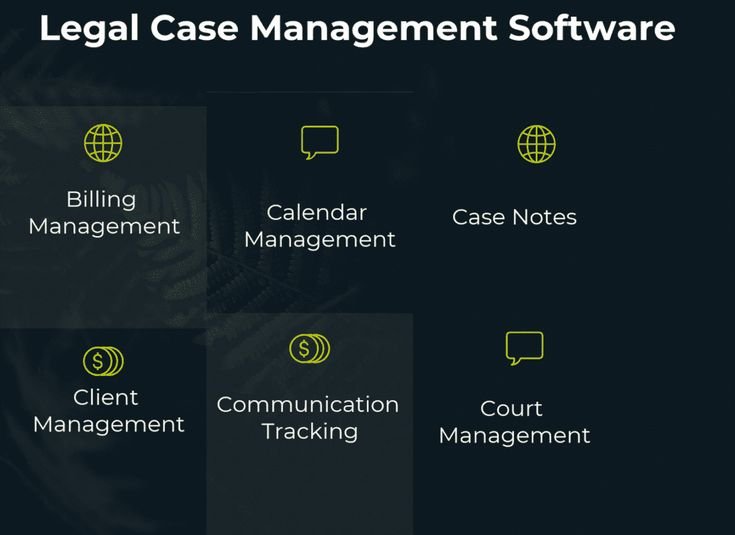

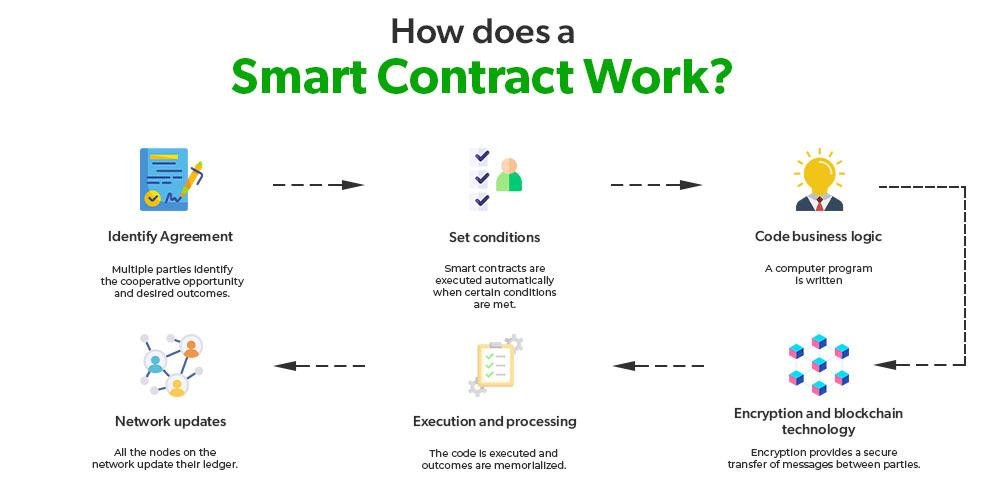

Technology’s impact on risk mitigation has been profound, fundamentally changing how organizations manage contracts. For instance, contract management software provides a centralized repository for drafting, negotiating, and storing contracts, enhancing visibility and control. By utilizing these platforms, teams can easily access essential documents, track changes in real-time, and maintain version control, thereby reducing errors and conflicts arising from miscommunication.

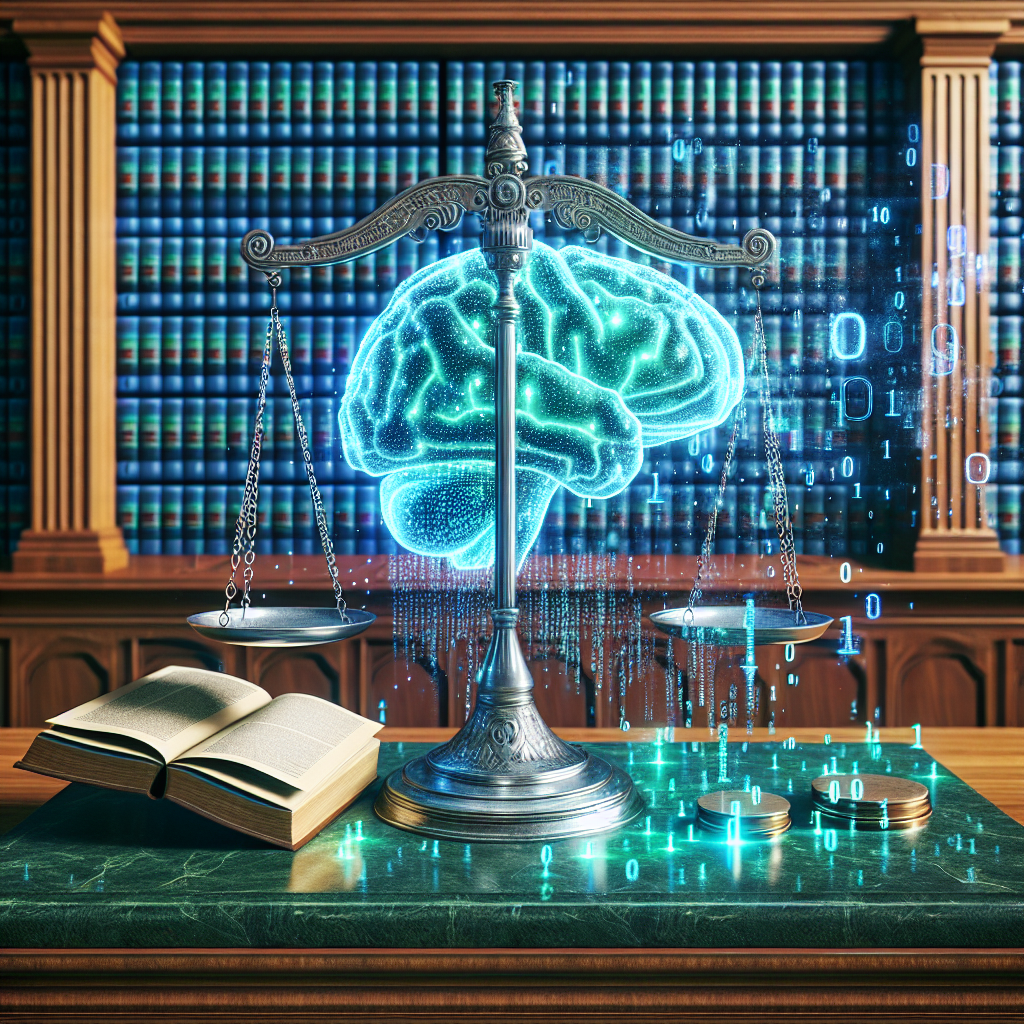

Artificial Intelligence (AI) plays a transformative role in contract risk assessment. Machine learning algorithms can analyze extensive contract datasets to identify potential risks and flag problematic clauses or terms. An example of this application is used by a legal tech startup, Luminance, which employs AI to help legal firms streamline their contract reviews, allowing firms to focus their expertise on high-value tasks rather than tedious document analysis.

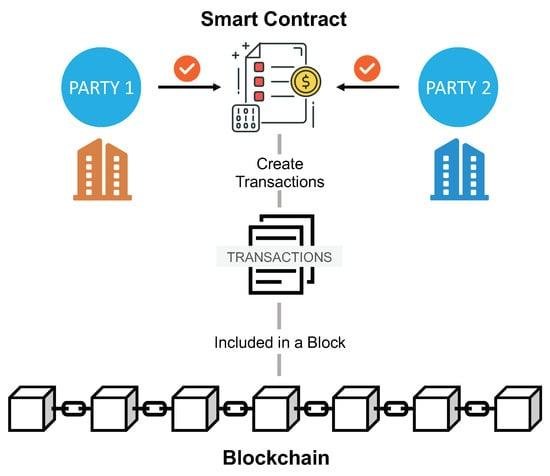

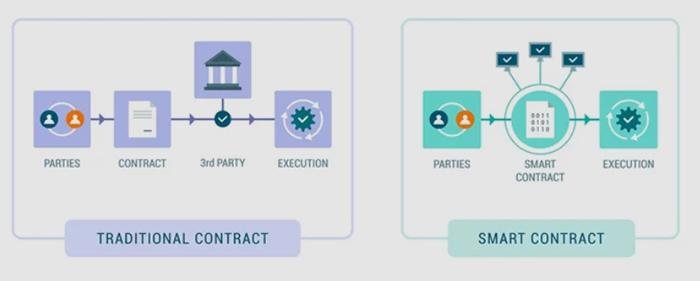

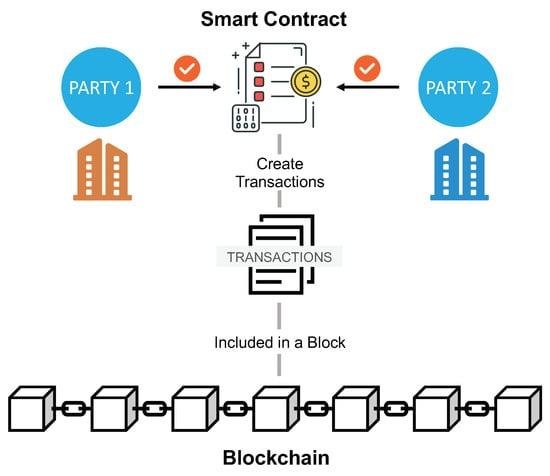

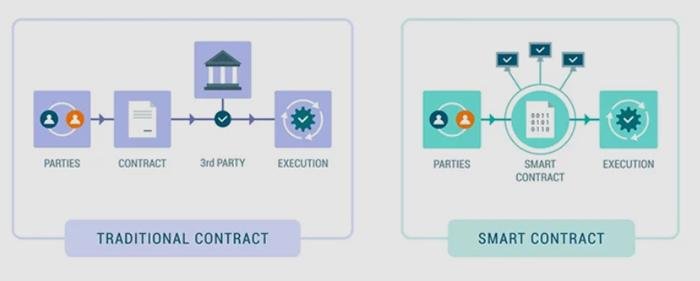

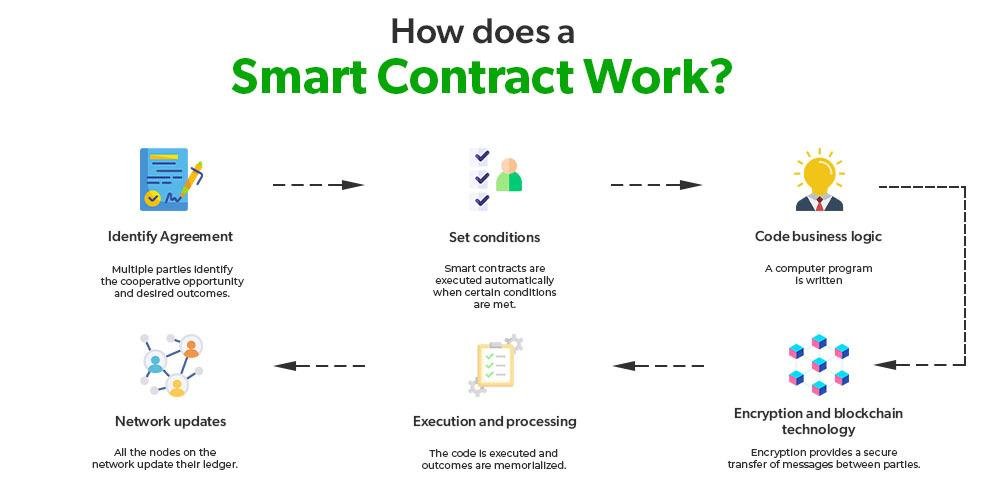

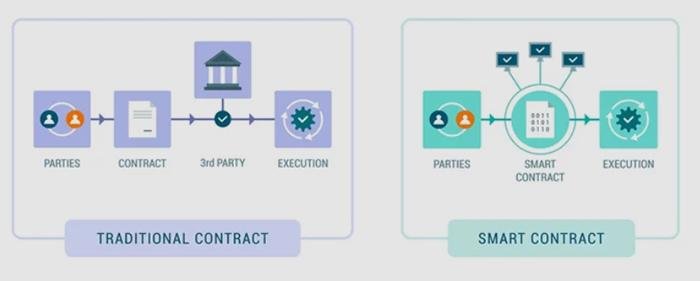

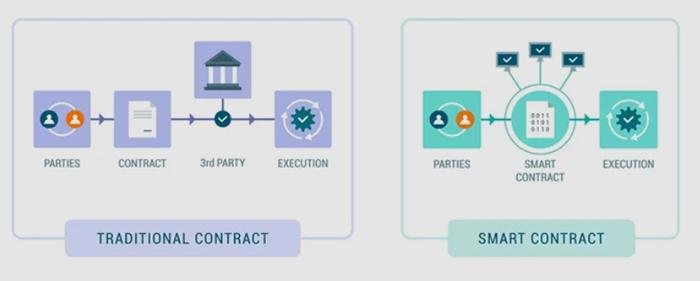

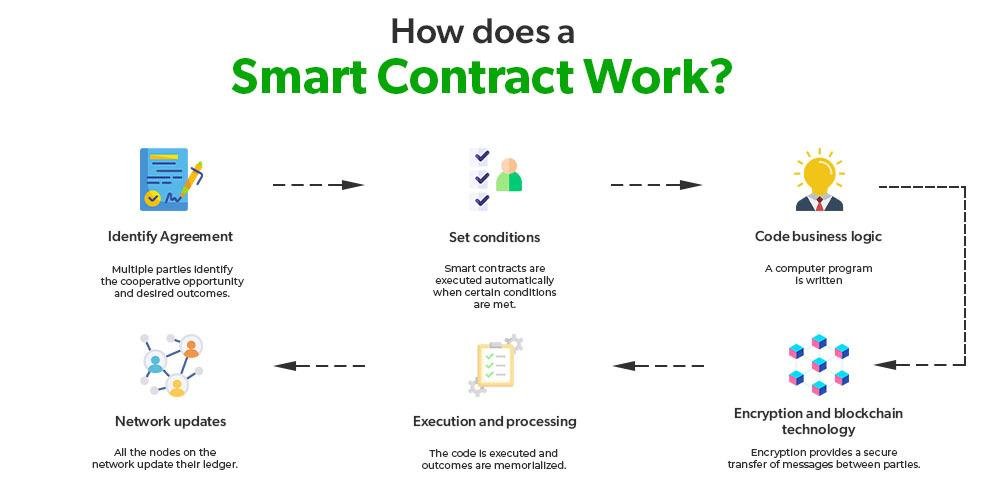

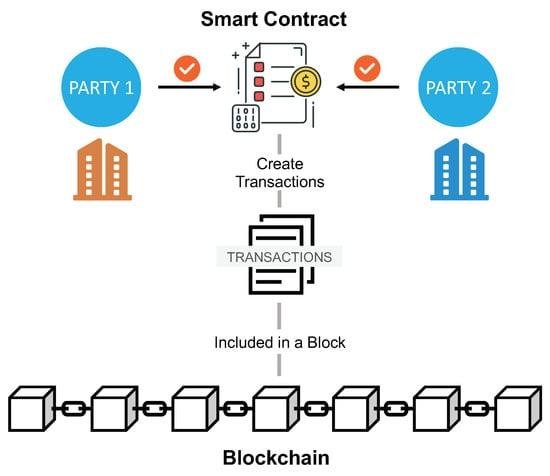

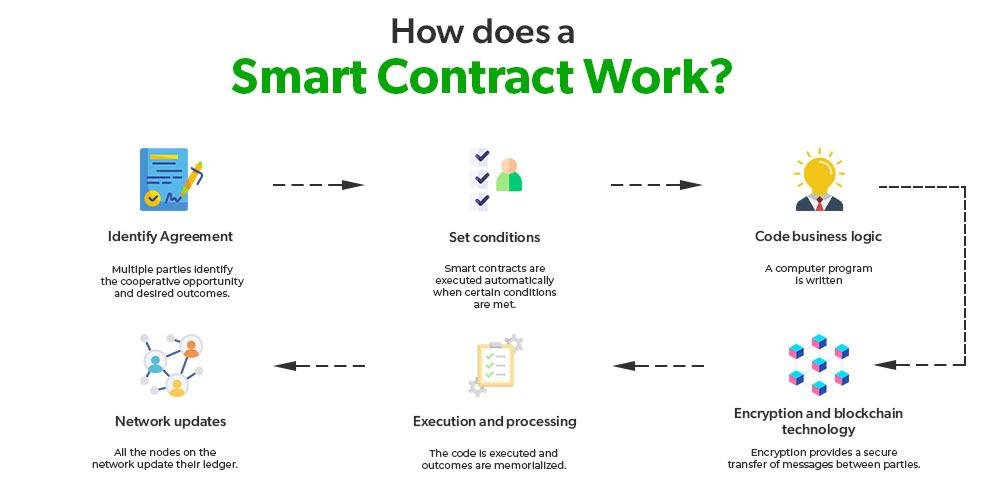

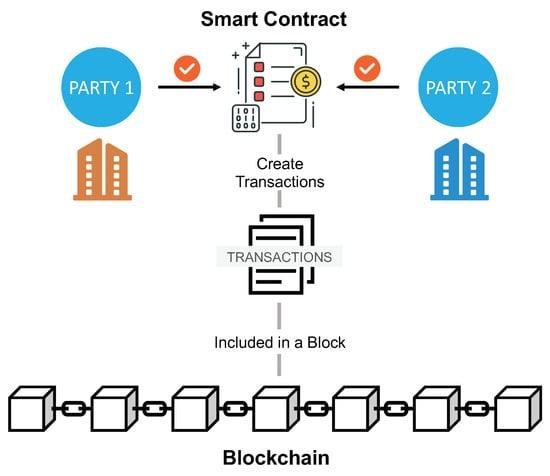

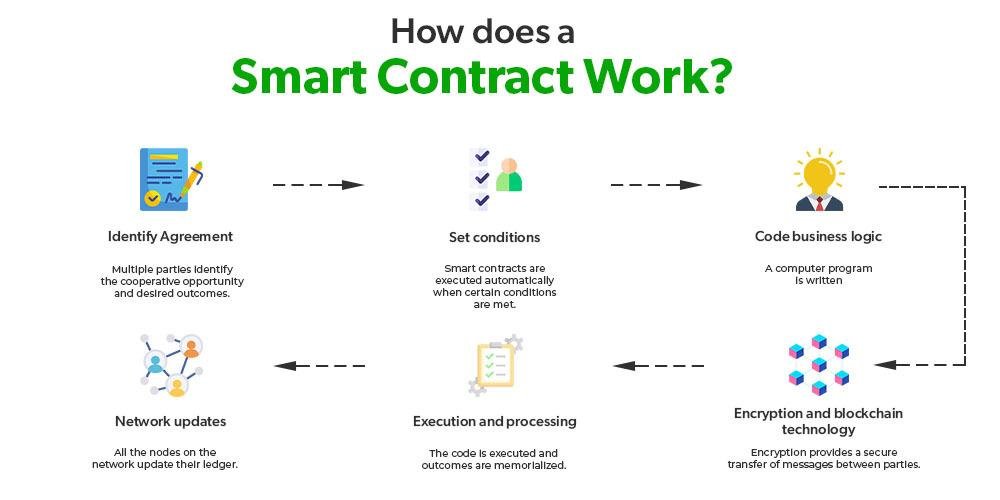

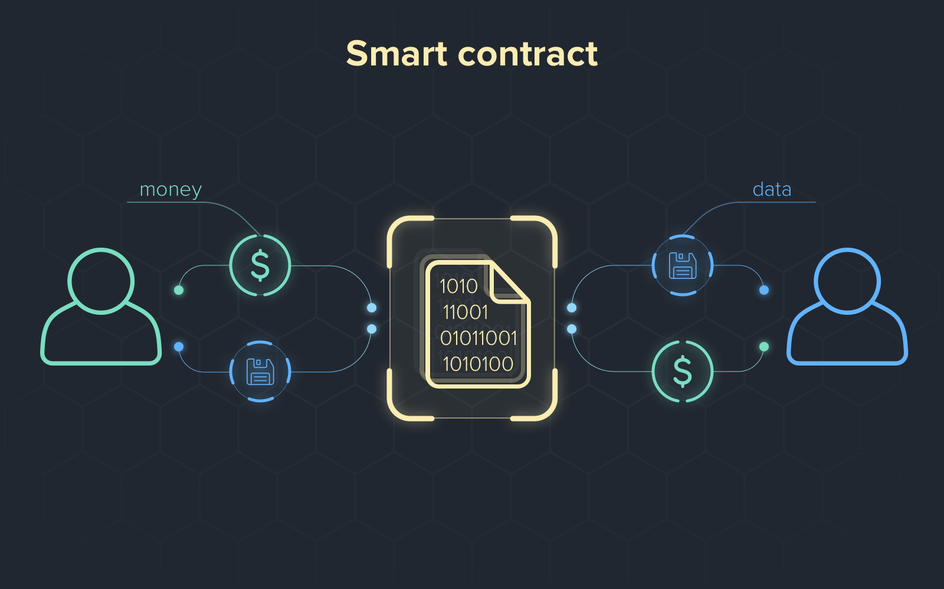

Another innovative technology, blockchain, offers solutions for establishing secure, transparent records of agreements. By ensuring that contracts are immutable and easily verifiable, blockchain reduces the likelihood of disputes arising from misinterpretations. A real-world application can be seen in the supply chain industry, where companies utilize blockchain technology to enforce compliance, manage contract terms, and ensure accountability among all parties involved.

Key Technologies for Risk Mitigation

The most effective technologies for mitigating contractual risks revolve around improving transparency, efficiency, and compliance. Contract management software serves as the backbone of contract management, providing centralized access and automation features that streamline workflows. Advanced platforms also include features for automated reminders, ensuring all parties meet their obligations on time and reducing the risk of breaches due to oversight.

Another critical technology is AI, which not only aids in analyzing contracts but also enhances predictive capabilities. By assessing historical data and trends, AI can proactively identify risks based on past contract performance, allowing organizations to refine their strategies continually. This functionality is particularly useful in industries with complex contractual relationships, as it empowers managers to make data-driven decisions.

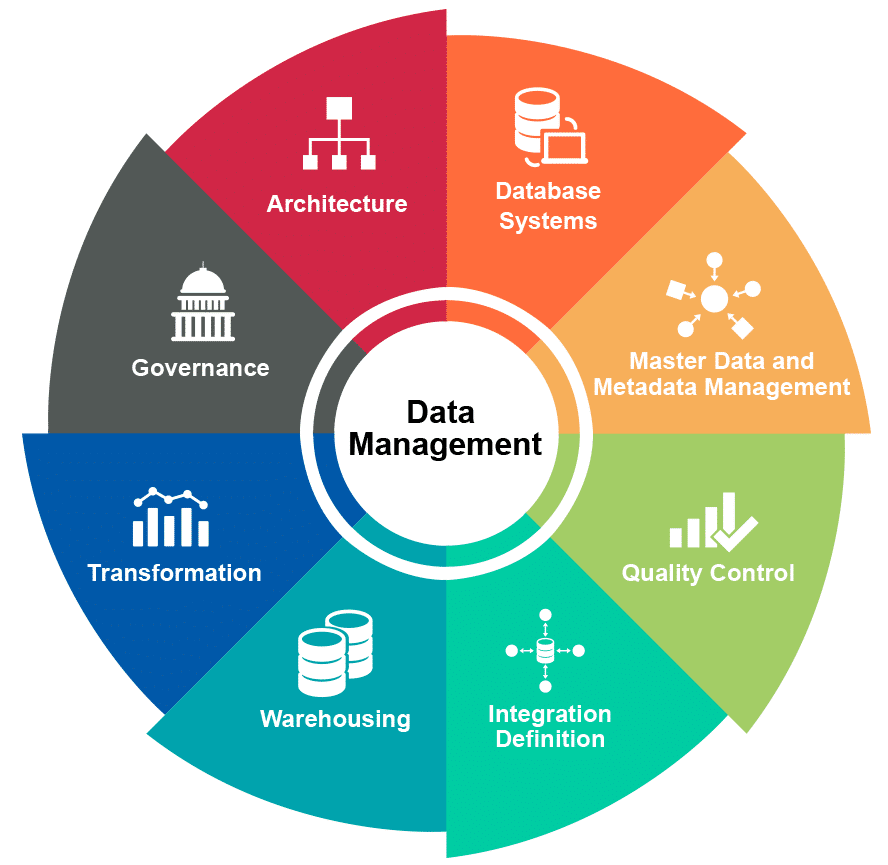

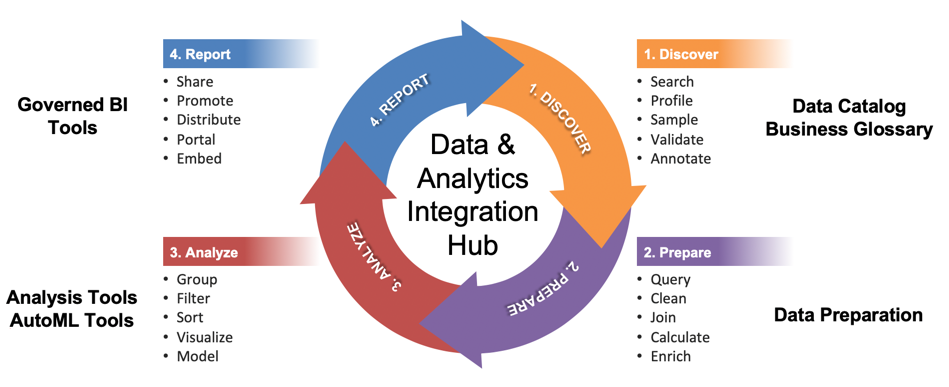

Data analytics tools also play a significant role in risk mitigation by enabling companies to assess their existing contracts comprehensively. By evaluating risk exposure across contract portfolios, organizations can allocate resources and attention to the most vulnerable areas, enhancing overall risk management protocols. These tools facilitate a deeper understanding of trends and compliance levels, enabling businesses to fortify their contractual engagements proactively.

Benefits of Using Technology

Integrating technology into contract risk management yields profound benefits for organizations. One of the primary advantages is increased efficiency. By automating repetitive tasks such as contract creation and approval processes, organizations can enhance productivity and ensure that valuable human resources are allocated to high-impact activities. This efficiency not only reduces the likelihood of errors but also accelerates the time-to-market for new initiatives.

Moreover, the use of technology in contract management fosters improved compliance. Enhanced visibility and tracking capabilities ensure that all parties meet their contractual obligations, significantly reducing instances of breaches that could lead to financial or legal repercussions. In sectors like finance or healthcare, where regulatory compliance is paramount, the ability to track compliance in real-time can prove invaluable.

Lastly, enhanced collaboration becomes possible through cloud-based contract management platforms. By facilitating real-time collaboration among various stakeholders—internal teams as well as external partners—technology ensures that everyone involved remains aligned and accountable. This level of collaboration reduces the likelihood of miscommunication or misunderstandings that could lead to contractual disputes. Organizations that prioritize collaboration can also foster stronger relationships with their partners, leading to improved outcomes and mutual success.

Conclusion

Leveraging technology to mitigate contractual risks is not just a trend; it is becoming a standard practice for organizations seeking to protect their interests in an increasingly connected and complex business landscape. By understanding the types of contractual risks and implementing robust mitigation strategies through technological advancements, businesses can position themselves for sustainable growth. The benefits of increased efficiency, improved compliance, and enhanced collaboration illustrate how technology can revolutionize contract risk management. As businesses continue to integrate these tools into their operations, the potential for reduced risks and enhanced stakeholder relationships becomes an achievable reality.

FAQs about Leveraging Technology to Mitigate Contractual Risks

- What are the main types of contractual risks in business?

- The main types of contractual risks include compliance risks, operational risks, financial risks, and reputational risks. Each type presents unique challenges that businesses must proactively manage to avoid potential disputes, penalties, or reputational damage.

- How can contract management software help in risk mitigation?

- Contract management software centralizes documents, automates workflows, and provides tracking features that enhance visibility. This reduces errors, ensures compliance with contractual obligations, and streamlines the contract lifecycle, thus minimizing operational risks.

- What role does AI play in mitigating contractual risks?

- AI analyzes contracts using machine learning algorithms to identify potential risks and suggest improvements. By processing large datasets, AI helps organizations anticipate issues and refine their contracts, leading to better risk management outcomes.

- Could you provide examples of how blockchain enhances risk mitigation?

- Blockchain offers secure, immutable records of agreements, ensuring transparent and enforceable contracts. For example, in supply chain management, companies use blockchain to monitor compliance and maintain accountability among suppliers, thereby minimizing disputes.

- What benefits can businesses expect when adopting technology for risk management?

- Organizations can expect increased efficiency, improved compliance, and enhanced collaboration. This not only reduces the likelihood of breaches or disputes but also strengthens stakeholder relationships and promotes sustainable operational practices.