Navigating Legal Compliance: Key Challenges and Tech Solutions

Introduction to Legal Compliance in Business

Legal compliance refers to the method by which organizations ensure that they conform to all relevant laws, regulations, and standards applicable to their industry. This process is fundamentally crucial for businesses aiming to navigate the complex legal landscape effectively, as non-compliance can lead to severe consequences such as hefty fines, reputational damage, and operational disruptions. The dynamic nature of laws can vary across jurisdictions and can cover local, state, national, and international regulations, complicating compliance efforts further. Amidst this evolving environment, the advancement of technology has necessitated that businesses continually adapt to emerging legal requirements.

Legal compliance is essential not only for avoiding punitive measures but also for nurturing trust and transparency with stakeholders. A rigorous compliance framework assures consumers, investors, and other interested parties that a business operates within the legal boundaries, which is a cornerstone for building a reputable brand. Moreover, as laws grow increasingly intricate, organizations must be vigilant and proactive, utilizing available resources to ensure compliance is maintained consistently.

The following section elucidates the importance of legal compliance and its fundamental components which underscore the need for thorough understanding and attention to be paid by organizations within various sectors.

Importance of Legal Compliance

- Risk Mitigation: Legal compliance is fundamentally about mitigating risks. When organizations fail to comply with relevant laws or regulations, they expose themselves to potential penalties, including fines and sanctions. By adopting robust compliance measures, businesses can minimize these risks significantly. Failure to adhere to regulations like the General Data Protection Regulation (GDPR) can lead to fines of up to €20 million or 4% of annual global turnover, highlighting the substantial financial repercussions of non-compliance.

- Reputation Management: Strong legal compliance not only protects a business from legal penalties but also serves as a critical factor in maintaining the trust of stakeholders. An organization known for its ethical practices fosters confidence among customers and partners, thereby enhancing its market reputation. In a digital age where information spreads rapidly, any breach of compliance can lead to adverse media coverage, causing lasting damage to a business’s image.

- Operational Continuity: Maintaining legal compliance is essential for ensuring smooth business operations. Organizations that fail to comply with regulations may face operational interruptions, forced shutdowns, or legal disputes that can hinder their ability to conduct business effectively. By embedding compliance into their operational framework, companies can enhance their resilience against regulatory challenges and ensure continuity in their core activities.

Compliance Components

- Regulatory Frameworks: Understanding the legal frameworks that apply to various aspects of business operations is a foundational compliance component. Regulations such as the Health Insurance Portability and Accountability Act (HIPAA) in the healthcare sector or GDPR in the realm of data protection serve as vital structures that organizations must navigate. Awareness of specific obligations under these frameworks enables businesses to prioritize compliance efforts accordingly.

- Internal Policies: Developing clear internal policies that align with legal requirements is critical. These policies should outline the procedures and guidelines for compliance within the organization. Training employees on these policies ensures that everyone understands their roles and responsibilities in maintaining legal compliance, thus fostering a culture of accountability.

- Training and Awareness: Regular training and awareness programs are essential to keep staff updated on compliance practices and changes in legislation. An informed employee base can effectively mitigate risks associated with non-compliance. Organizations can leverage technology to implement online training modules that can be easily updated to reflect the latest regulatory changes.

You May Also Like: Designing a Compliance-Driven Tech Stack for Law Firms

Key Challenges in Legal Compliance

Legal compliance presents several challenges that can vary significantly based on the business type and the regulatory environment they operate in. Addressing these hurdles is crucial for effective compliance management.

1. Complexity of Regulations

The complexity of regulations often poses a formidable challenge for businesses. With a labyrinth of local, national, and international laws, organizations can struggle to keep track of their compliance obligations. For example, financial institutions must navigate Federal and state banking laws, anti-money laundering regulations, and various data protection laws simultaneously, each with different reporting and compliance standards. This complexity can lead to unintentional violations due to misinterpretation or oversight of specific requirements.

Additionally, the varied interpretations of compliance can further compound difficulties. Each regulatory body may have a distinct take on how to interpret and enforce the laws, leading businesses to face challenges in harmonizing their compliance strategies. Organizations operating in multiple jurisdictions may need tailored compliance strategies that account for these differences, which can strain resources.

2. Resource Allocation

Another prominent challenge in legal compliance is the resource allocation it demands. Compliance requires significant investments in terms of both human and financial resources. Many organizations may find it necessary to employ specialized compliance officers or legal consultants to stay abreast of changing regulations, which can be a costly endeavor. For smaller businesses, these financial burdens can be particularly strenuous, diverting limited resources away from core business operations.

Furthermore, regular training and upskilling of employees are vital to maintaining compliance, yet they require ongoing investment in time and finances. Companies must develop training programs that align with compliance needs without disrupting daily operations. Balancing these efforts with other crucial business functions can prove to be a challenging exercise in resource management.

3. Rapidly Changing Legal Landscapes

Regulatory environments evolve quickly, particularly given the influence of globalization and technological advancement. Organizations must stay updated on changes that may arise from legislative updates, court rulings, or shifts in political priorities. For instance, new environmental regulations introduced due to climate change concerns can significantly affect industries such as manufacturing and energy.

The challenge lies in tracking these rapid changes effectively. Businesses may struggle to implement necessary adjustments to comply with new laws, risking potential violations. As an example, the rapid implementation of the California Consumer Privacy Act (CCPA) presented a substantial compliance challenge for organizations, which were required to overhaul their data handling policies promptly to meet the new standards.

4. Data Privacy and Security

As organizations increasingly rely on data to drive their business strategies, compliance with data protection laws has become paramount. With data breaches on the rise and regulations such as GDPR and CCPA imposing stringent requirements, the importance of securing sensitive information has never been more critical. Organizations face ongoing challenges in protecting customer data while ensuring compliance with evolving legal requirements.

Moreover, the need for constant audits and assessments complicates matters, as businesses often find it challenging to keep up with the requisite security measures and documentation processes. A breach not only leads to penalties but can also have catastrophic implications for consumer trust and brand loyalty, as evidenced by high-profile data breaches involving companies like Equifax and Facebook.

5. Lack of Standardization

The lack of standardization in compliance requirements across different industries can complicate an organization’s approach to achieving legal compliance. Each sector may possess unique compliance obligations, leading to disparate practices and frameworks. For instance, healthcare organizations must adhere to HIPAA regulations, while financial institutions must comply with the Dodd-Frank Act. This presents significant challenges for businesses engaged in multiple sectors, making it difficult to implement a uniform compliance strategy.

Furthermore, the absence of a universal benchmarking system can hinder organizations’ efforts to measure their compliance standing against competitors. Organizations may invest time and resources in ensuring compliance with existing regulations but find themselves ill-equipped to navigate potential changes or recognize the evolving standards within their industry. The development and adoption of best practices and standards can help reduce this confusion and drive consistency in compliance strategies.

Technology Solutions for Legal Compliance

Advancements in technology provide significant opportunities for businesses to enhance their legal compliance strategies. By leveraging innovative tools and solutions, organizations can streamline their compliance efforts and mitigate the risks associated with non-compliance.

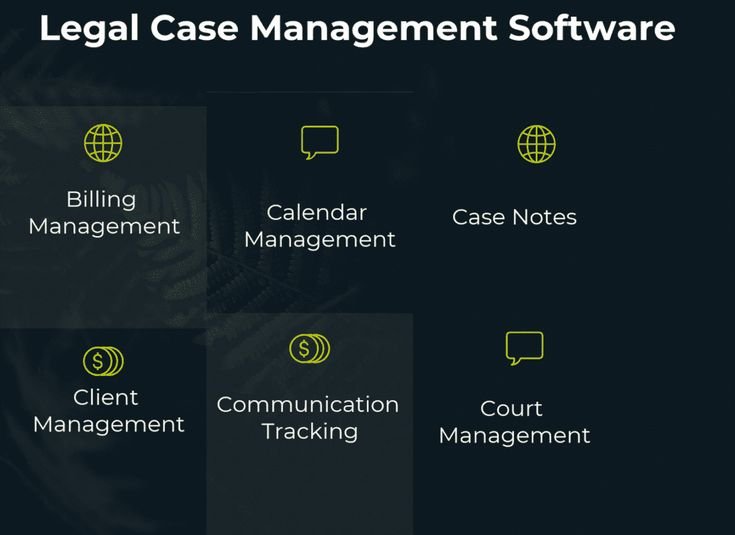

Integrated Compliance Management Systems

Integrated compliance management systems (CMS) offer a comprehensive approach to managing regulatory obligations. These systems centralize all compliance-related documentation, processes, and reporting, enabling businesses to maintain accurate and up-to-date records. For instance, software platforms like LogicManager and ComplyAdvantage facilitate the monitoring of regulatory changes, fostering proactive responses. By leveraging these systems, organizations can improve efficiency and accountability in their compliance processes.

Moreover, these integrated systems can often automate tasks related to compliance management, such as schedule regular audits, conduct risk assessments, and manage policy updates. Automating these functions lessens the burden on compliance teams and minimizes the chances of human error in compliance documentation.

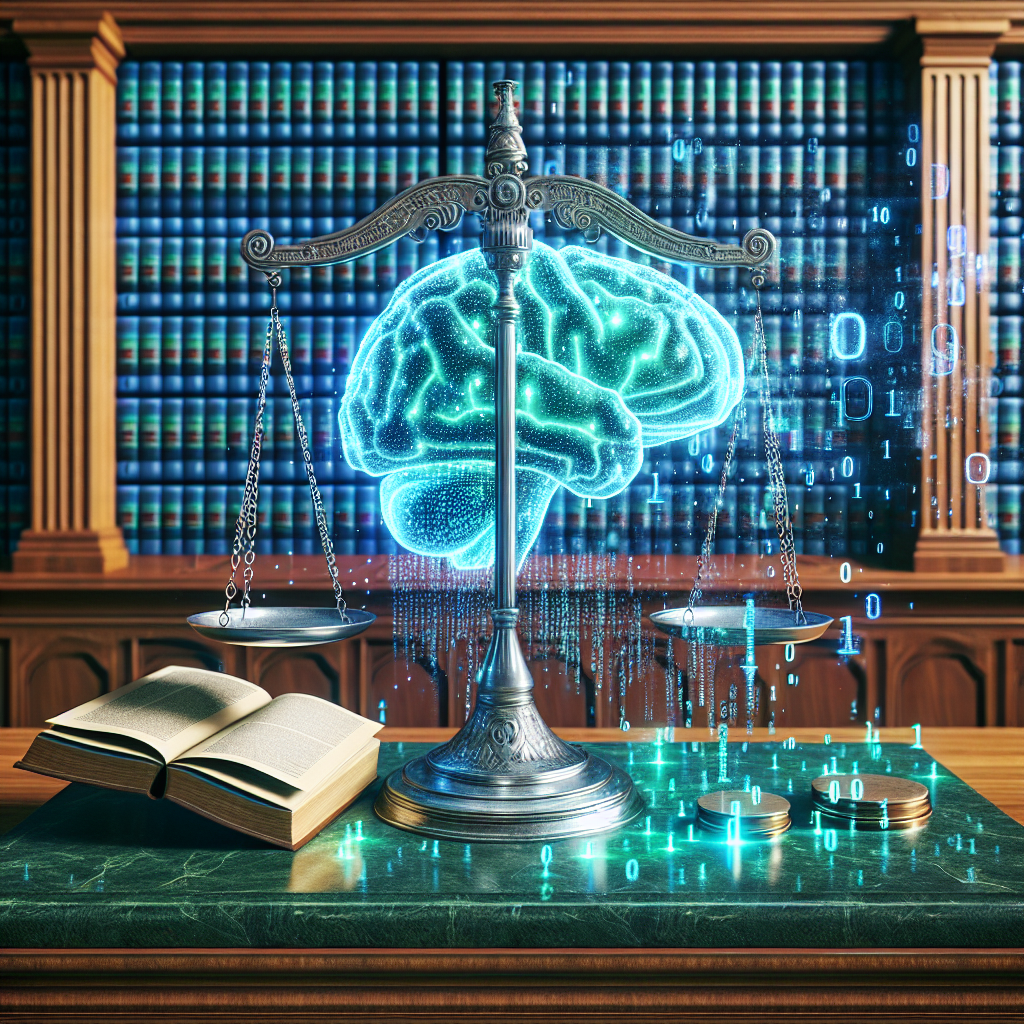

AI and Machine Learning Applications

Artificial intelligence (AI) and machine learning are transforming compliance management by offering predictive insights and risk assessments. AI-powered tools can identify patterns and anomalies in data to detect potential non-compliance risks. For instance, financial institutions can utilize machine learning to spot unusual transactions that may indicate fraudulent activity or regulatory breaches.

These technologies can also assist businesses in staying abreast of evolving legal requirements. Natural language processing (NLP) applications can analyze legal documents and provide insights into changes in regulations that are relevant to the organization’s operations. By implementing AI-driven solutions, businesses can enhance their compliance tracking capabilities and respond faster to emerging risks.

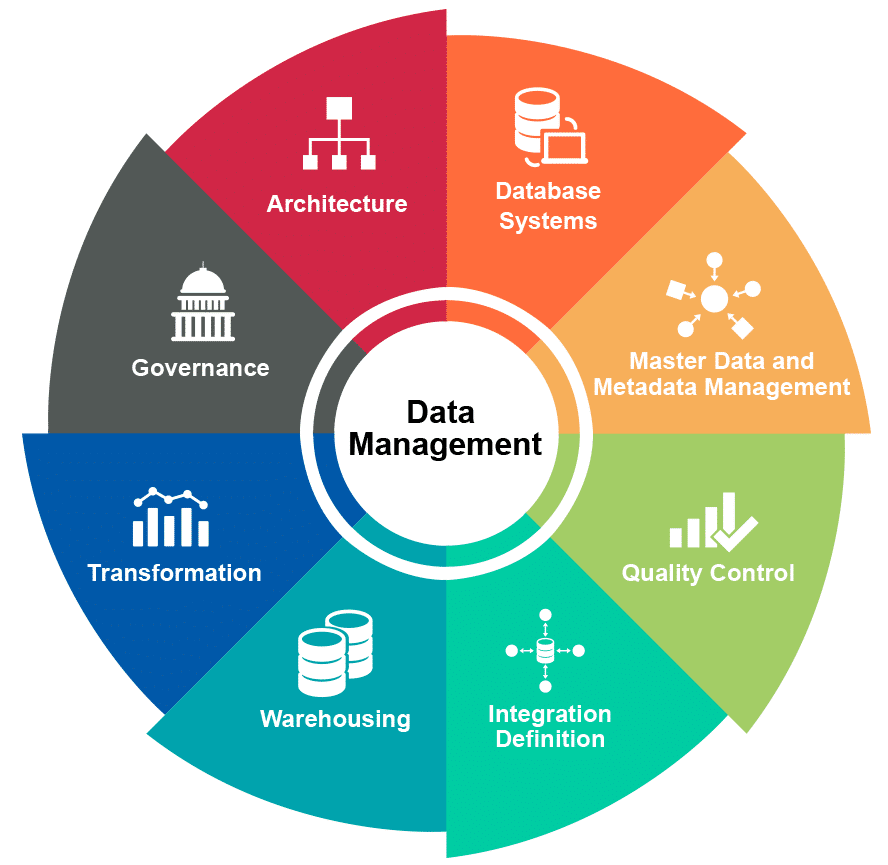

Data Privacy Tools and Solutions

Given the heightened focus on data privacy, organizations have access to various tools specifically designed to ensure compliance with data protection laws. Technologies like encryption, data masking, and identity access management systems help organizations safeguard sensitive information against unauthorized access and breaches.

Moreover, businesses can utilize solutions that perform regular audits and assessments of their data management practices, assessing compliance with existing regulations. For example, tools such as OneTrust and TrustArc provide organizations with resources to manage their privacy compliance programs effectively. By leveraging such technologies, organizations can build robust data protection frameworks, thereby mitigating the risks associated with non-compliance.

Conclusion

In conclusion, navigating the challenges of legal compliance is an ongoing endeavor that requires vigilance, resources, and innovative solutions. Organizations must recognize the importance of compliance in mitigating risks, protecting their reputations, and ensuring operational continuity. By embracing technology solutions, such as integrated compliance systems, AI applications, and data privacy tools, businesses can enhance their compliance efforts and navigate the complex legal landscape more effectively.

As the regulatory environment continues to evolve, organizations that prioritize legal compliance will not only safeguard themselves against legal repercussions but can also foster trust and transparency with their stakeholders, ultimately gaining a competitive advantage in their respective markets.

FAQs

1. What is legal compliance?

Legal compliance refers to the processes and measures organizations implement to adhere to laws, regulations, and standards applicable to their industry. It involves understanding relevant legal frameworks, developing internal policies, and educating employees about compliance practices.

2. Why is legal compliance important for businesses?

Legal compliance is vital for businesses as it helps mitigate risks, maintain trust and reputation with stakeholders, ensure operational continuity, and potentially provide a competitive advantage. Non-compliance can lead to severe penalties, financial losses, and reputational damage.

3. What are the common challenges businesses face in legal compliance?

Common challenges include the complexity of regulations, resource allocation, rapidly changing legal landscapes, data privacy and security concerns, and lack of standardization across different industries. Each of these hurdles can complicate compliance efforts and expose organizations to risks.

4. How can technology assist in legal compliance?

Technology can assist in legal compliance through integrated compliance management systems, AI and machine learning applications, and specialized data privacy tools. These technologies streamline compliance processes, enhance tracking of regulatory changes, and help safeguard sensitive information.

5. What are some examples of compliance regulations organizations must follow?

Organizations may need to comply with various regulations depending on their industry, such as GDPR (data protection), HIPAA (healthcare), Dodd-Frank Act (finance), and industry-specific environmental regulations. Understanding these obligations is crucial for effective compliance management.