Navigating Tomorrow: Compliance Innovations in Legal Technology

Introduction: The Intersection of Compliance and Legal Technology

The legal landscape is in dynamic flux, driven by an increasing complexity of regulatory requirements and the imperative need for organizations to remain compliant. Through the integration of sophisticated technologies, legal professionals can navigate this evolving environment more effectively. Legal technology solutions aimed at compliance not only help in understanding regulations but also streamline adherence processes, ensuring that firms operate within the bounds of the law. As compliance becomes a fundamental aspect of legal strategy, understanding the intersection of compliance and legal technology is crucial for law firms and corporate legal departments alike.

Technological innovations are no longer optional; they are essential components of compliance frameworks. Technologies like Artificial Intelligence (AI) and blockchain are enabling more efficient ways to monitor, assess, and report compliance. Moreover, with the regulatory landscape constantly shifting due to factors such as globalization and digital transformation, traditional compliance measures may fall short. Thus, embracing innovative legal technology is vital for maintaining compliance integrity while improving overall operational efficiency.

This article delves into key innovations in compliance technologies that are shaping the future of the legal industry. By examining the roles of AI, blockchain, automated compliance solutions, and Regulatory Technology (RegTech), we will explore how these innovations are not only enhancing compliance mechanisms but also mitigating risks. Examples from real-world applications will further illustrate how organizations are capitalizing on these trends to secure their operational frameworks against compliance failures.

The Role of Artificial Intelligence in Compliance

Artificial Intelligence (AI) is transforming compliance management from a cumbersome process into a streamlined operation. Machine learning algorithms are at the forefront, processing extensive datasets to detect compliance risks and irregularities. For example, some legal firms utilize AI systems that analyze thousands of transactions to highlight potential breaches of compliance, ensuring proactive risk management. The ability of AI to learn and adapt as new data emerges means that compliance strategies can remain robust even as regulations evolve.

Natural Language Processing (NLP) further enhances compliance measures by enabling legal professionals to sift through dense legal documents with remarkable efficiency. NLP applications can extract relevant compliance information from vast libraries of regulatory texts and case law, significantly reducing the manual workload. One practical application of this technology is found in due diligence processes, where AI tools can quickly summarize and highlight compliance risks associated with mergers and acquisitions.

Predictive analytics is another transformative aspect of AI in compliance. By analyzing historical compliance data, these tools forecast future compliance trends, allowing organizations to act preemptively and avoid potential pitfalls. Companies such as IBM have developed AI-driven compliance platforms that not only automate reporting but also provide actionable insights for compliance teams, optimizing their decision-making processes while minimizing human error.

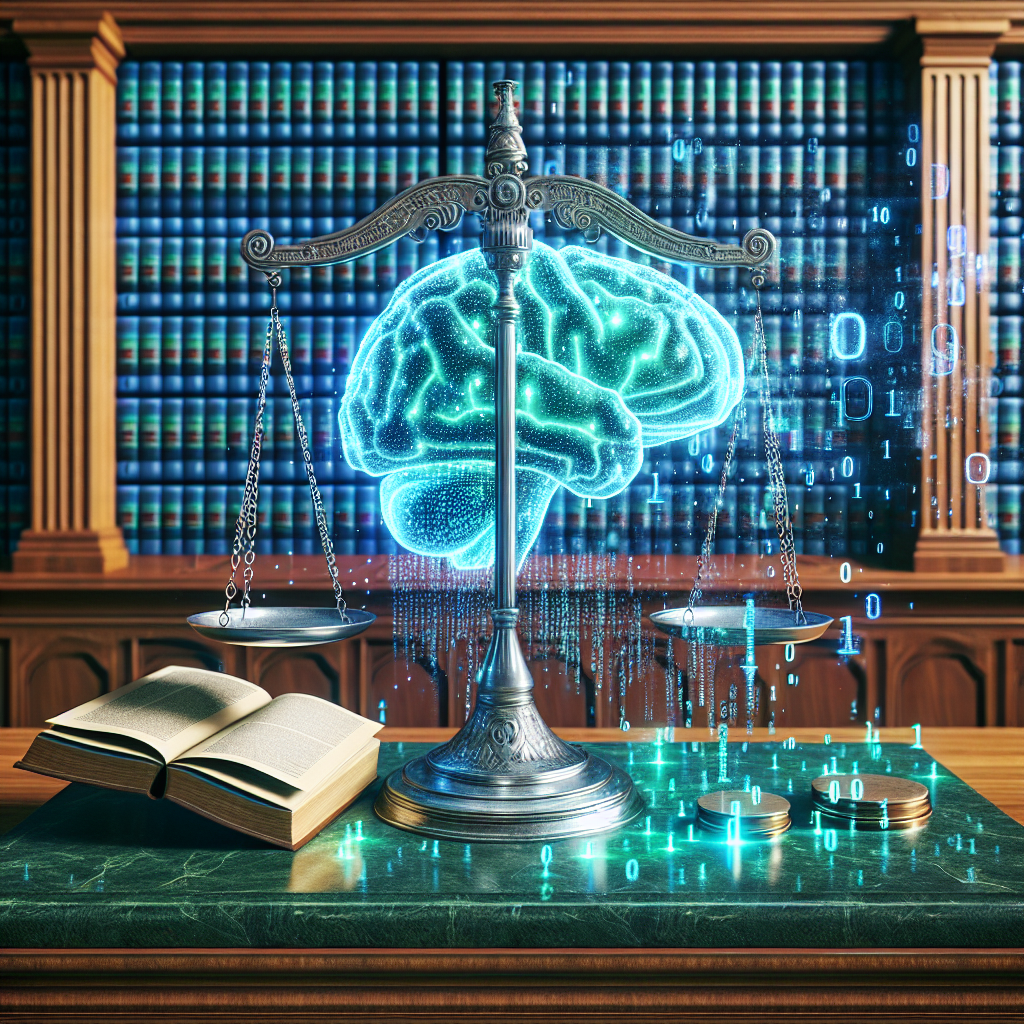

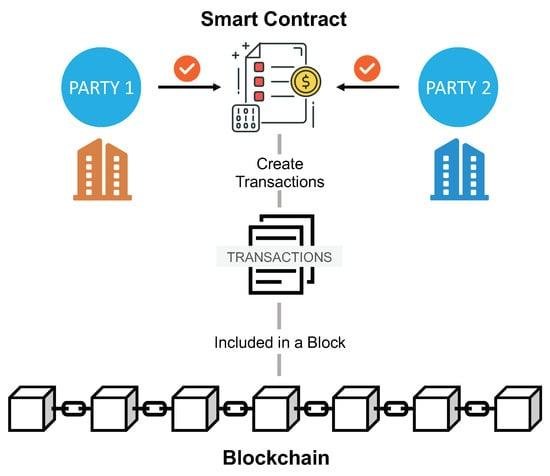

Blockchain Technology and Compliance Tracking

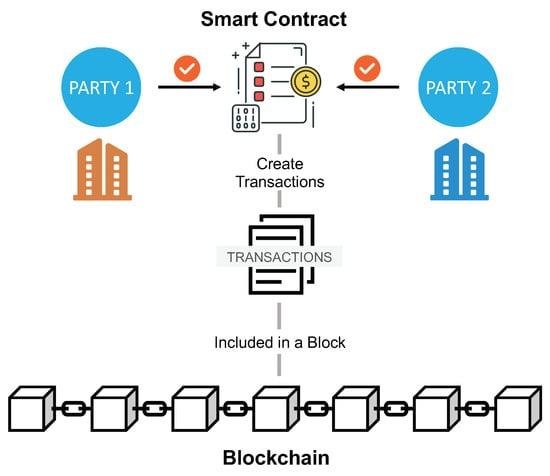

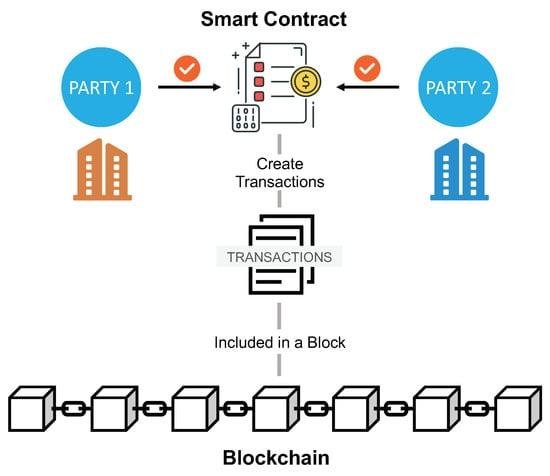

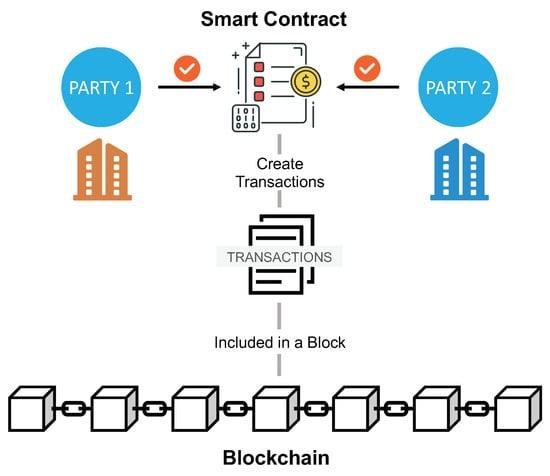

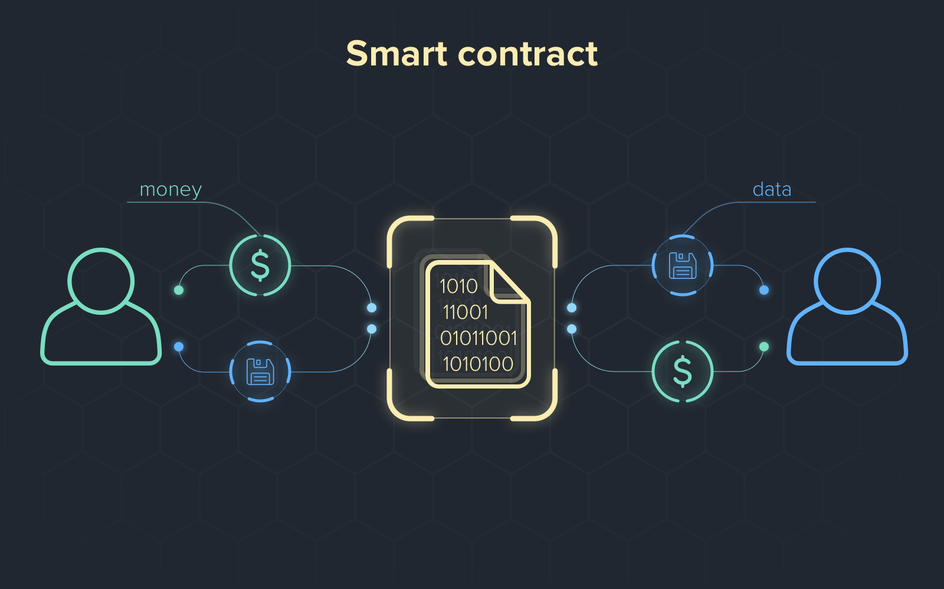

Blockchain technology is revolutionizing compliance tracking by offering an efficient, transparent, and secure method for managing regulatory obligations. Decentralized ledgers provide immutable records of all transactions and regulatory updates, fostering enhanced accountability across organizations. For instance, firms in the financial services sector are adopting blockchain solutions to track customer transactions, ensuring compliance with anti-money laundering (AML) regulations. The transparency of blockchain enables real-time oversight, making it easier for regulators to monitor compliance efforts.

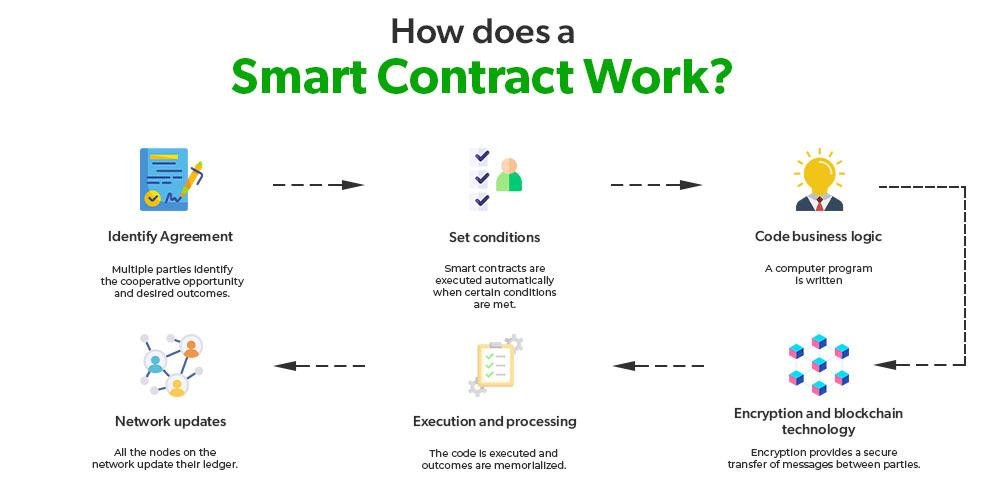

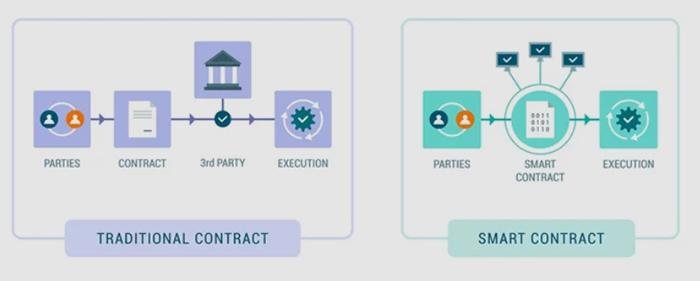

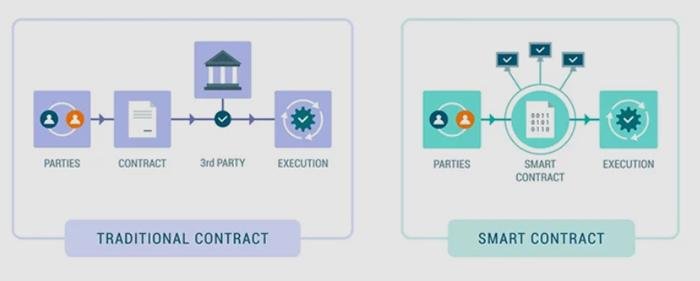

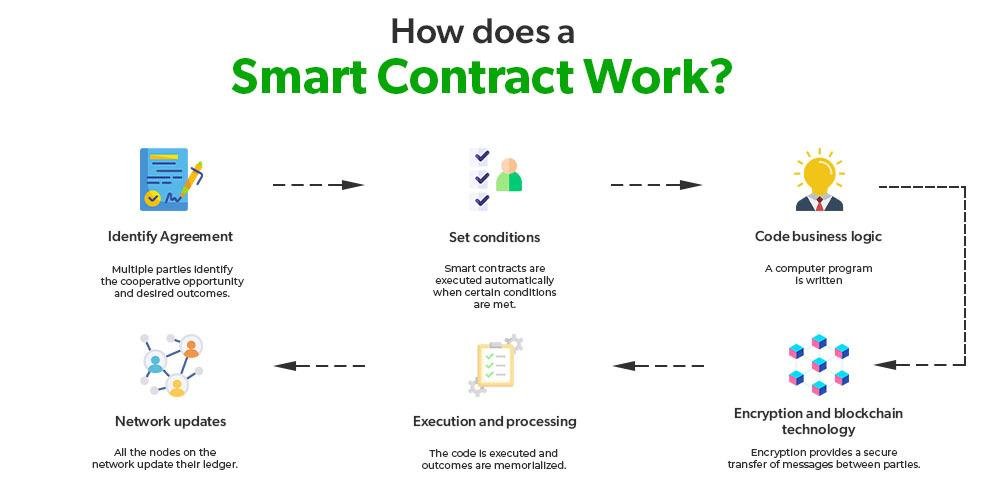

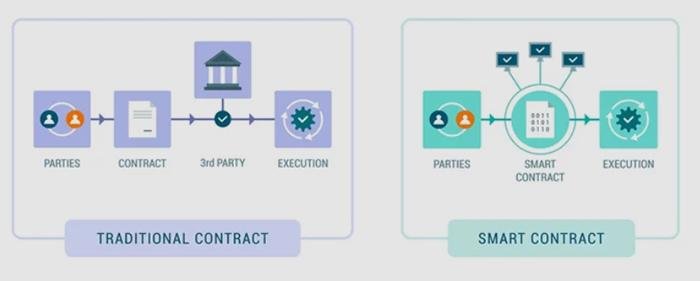

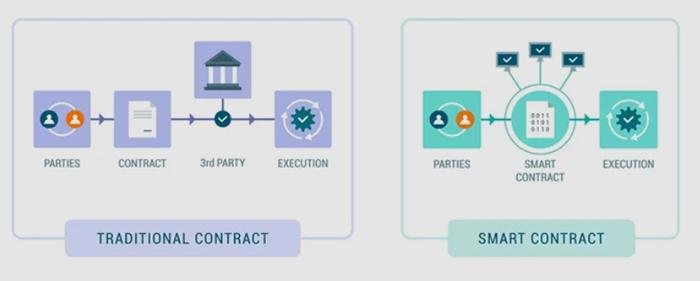

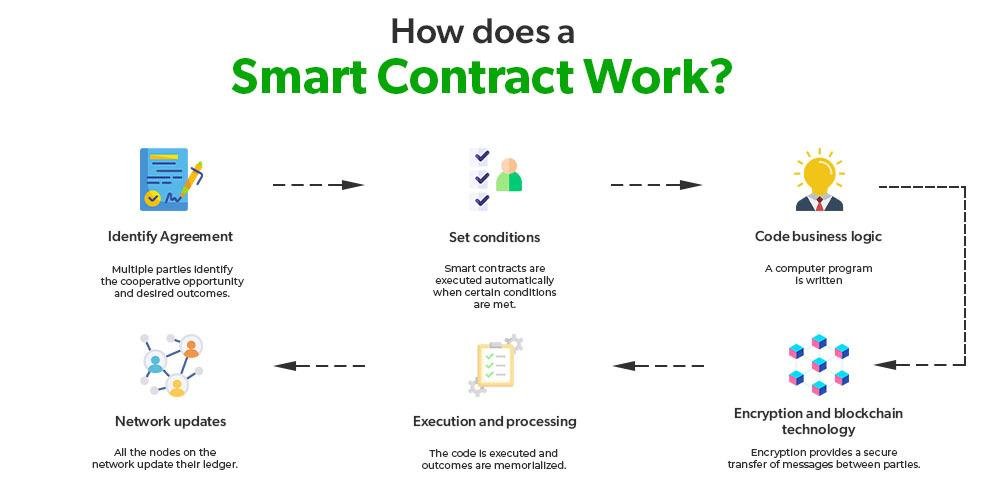

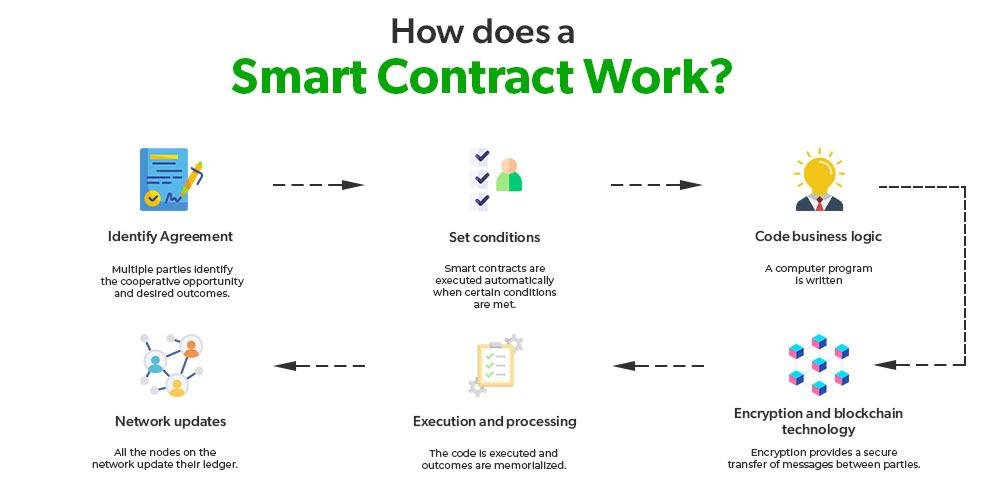

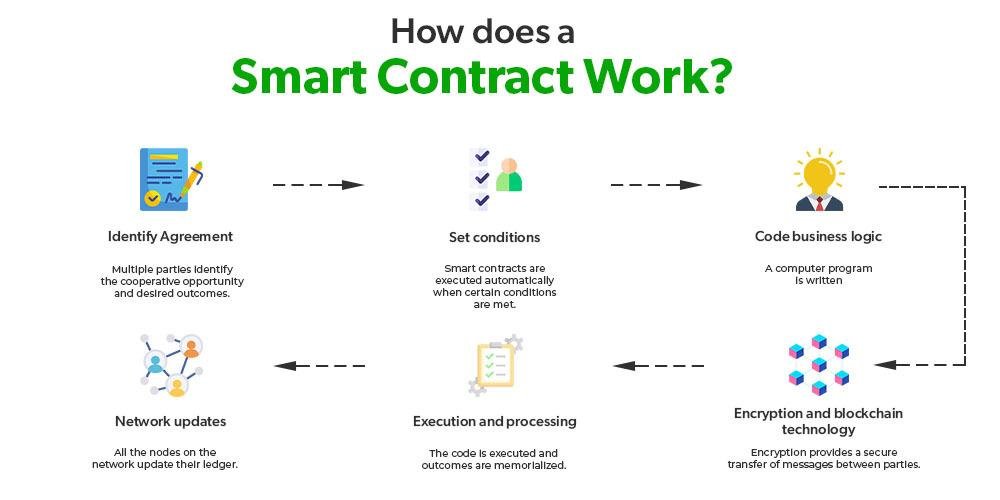

Smart contracts built on blockchain technology automate compliance processes by executing agreements when predefined criteria are met. This capability significantly reduces the administrative burden on legal teams and mitigates the risk of human error. A notable example is the use of smart contracts in supply chain management, where compliance with import and export regulations can be automatically verified, thereby streamlining operations while ensuring adherence to legal requirements.

Furthermore, blockchain technology provides real-time, tamper-proof audit trails, which are essential for compliance verification. Companies can utilize blockchain to maintain a comprehensive record of compliance activities, making audits quicker and more efficient, as seen in organizations that have implemented blockchain for their compliance frameworks. By minimizing the risk of compliance failures and enhancing verification processes, blockchain emerges as a vital tool in the legal technology landscape.

Read Also: Streamlining Compliance Audits: Innovations in Legal Technology

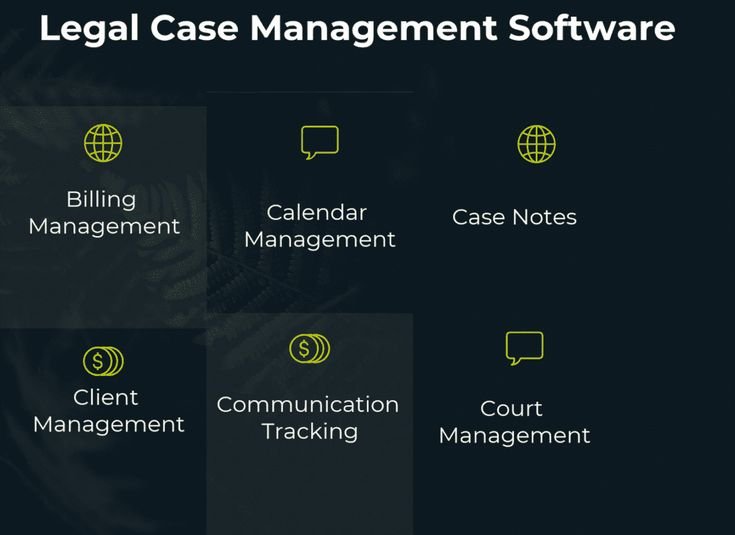

Automated Compliance Solutions: Streamlining Processes

Automation has emerged as a cornerstone for advancing compliance frameworks in the legal sector. Automated compliance solutions are increasingly sophisticated, incorporating features like regulatory change management systems designed to track and manage changes in regulations in real time. Firms leveraging such systems can ensure compliance teams stay up-to-date with the latest requirements, reducing the risk of non-compliance. For example, compliance management platforms like ComplyAdvantage offer automated tracking of global regulatory changes, allowing firms to align their policies and practices promptly.

Compliance training programs are another critical feature of automated solutions. Providing staff with up-to-date training on compliance matters is essential for any organization. Companies are investing in automated training modules that adapt to the latest regulatory requirements. These platforms not only track employee progress but also curate custom training programs based on individual roles, as seen in organizations using compliance e-learning tools such as SAI Global.

Document management systems are also evolving through automation, facilitating streamlined processes for generating, storing, and retrieving documents while maintaining compliance standards. Such systems ensure that legal documents undergo compliance checks before approval, thereby minimizing the chances of errors. Real-world applications, like those implemented by legal firms utilizing systems such as iManage, demonstrate reduced workload for legal teams, allowing them to focus on more strategic compliance issues while adhering to regulatory standards.

The Impact of Regulatory Technology (RegTech)

Regulatory Technology, or RegTech, is a burgeoning subset of legal technology that specifically addresses the challenges organizations face in maintaining compliance. RegTech encompasses tools and systems designed to assist organizations in managing regulatory compliance more effectively and efficiently. Firms that incorporate RegTech solutions report streamlined processes for monitoring compliance, which can significantly reduce operational costs. A clear example can be seen with companies utilizing RegTech platforms like RiskScreen, which automate compliance checks and significantly speed up the KYC (Know Your Customer) processes in financial institutions.

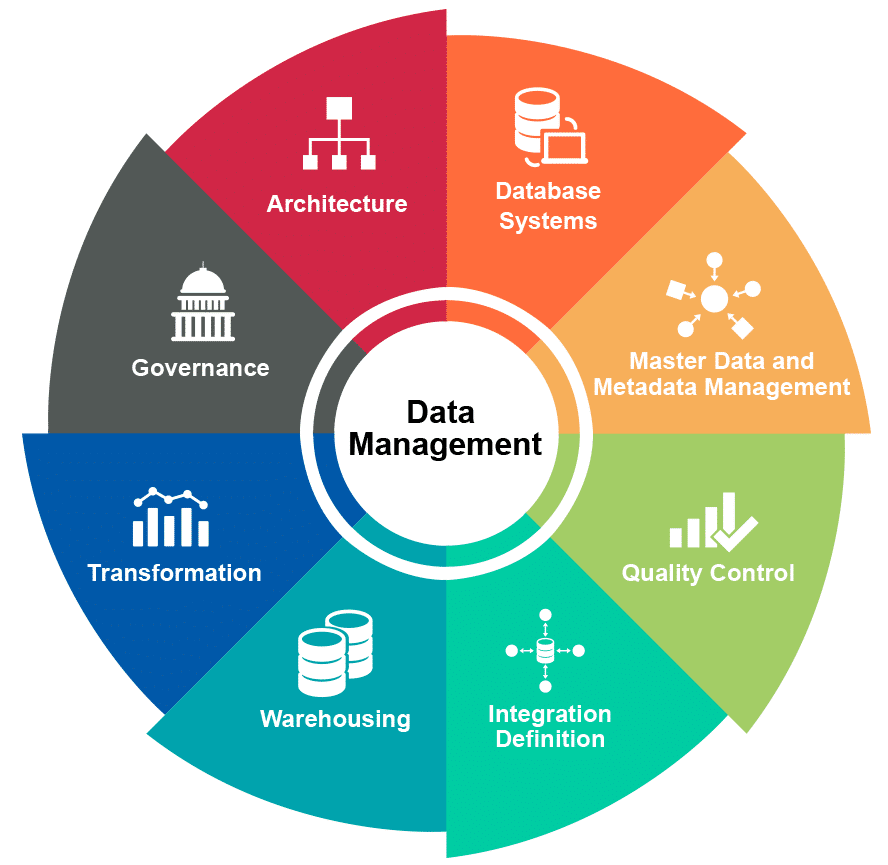

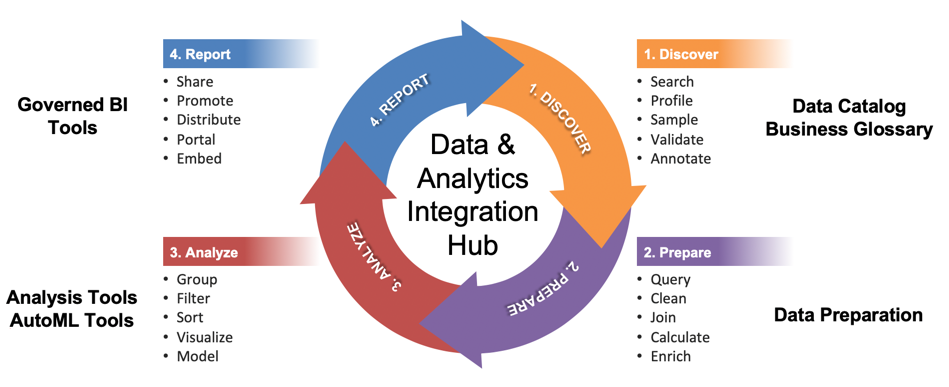

Moreover, RegTech is increasingly being seen as a critical enabler of regulatory reporting. By automating data collection and reporting procedures, organizations can ensure that their submissions are timely and accurate. For example, automated reporting tools can be designed to pull real-time data from various systems, allowing firms to respond quickly to regulatory inquiries and eliminate the risk of penalties due to delayed reporting. Solutions from companies like AxiomSL highlight the value of RegTech in simplifying complex regulatory reporting requirements.

The impact of RegTech also extends to enhancing collaboration between compliance teams and other business units. With centralized compliance platforms, teams can easily work together and share insights on compliance issues, creating a more cohesive strategy across the organization. Organizations adopting RegTech not only increase their compliance posture but also gain a competitive advantage by becoming more agile in responding to regulatory changes, as demonstrated by firms that have successfully integrated these technologies into their operations.

Conclusion: Navigating the Future of Compliance through Innovation

As we stand on the brink of a technological revolution in the legal industry, innovations in compliance processes are surfacing as indispensable tools. The seamless integration of AI, blockchain, automation, and RegTech represents a future where compliance management is not only efficient but also adaptive to ever-changing regulatory landscapes. Legal professionals willing to embrace these innovations can future-proof their operations, reduce risk exposure, and enhance their overall compliance capabilities.

The adoption of these technologies illustrates the notion that compliance is not a burdensome responsibility, but rather an opportunity for organizations to develop stronger credibility and operational efficiency. By understanding and leveraging these compliance innovations, legal entities can thrive in an increasingly complex regulatory environment, ultimately navigating tomorrow with confidence.

FAQs about Compliance Innovations in Legal Technology

1. What are the key technologies shaping compliance in the legal industry?

Key technologies include Artificial Intelligence (AI), blockchain, automation tools, and Regulatory Technology (RegTech). Each offers unique capabilities that enhance compliance management and streamline processes.

2. How does Artificial Intelligence improve compliance management?

AI improves compliance management by automating routine tasks, identifying compliance risks using machine learning algorithms, and enhancing data analysis through Natural Language Processing (NLP).

3. What advantages does blockchain offer for compliance tracking?

Blockchain offers decentralized ledgers for secure and transparent compliance tracking, smart contracts to automate compliance processes, and audit trails that enhance accountability.

4. What is Regulatory Technology (RegTech)?

Regulatory Technology, or RegTech, refers to tools designed to help organizations manage compliance challenges efficiently. RegTech automates regulatory reporting, monitoring, and data management processes.

5. Why is automation important in compliance solutions?

Automation minimizes manual intervention, reduces the risk of human error, and enhances the efficiency of compliance workflows. It allows organizations to better keep pace with evolving regulatory requirements.