Overcoming Regulatory Challenges for Blockchain Adoption in Law

Table of Contents

Introduction

The adoption of blockchain technology in the legal sector presents significant opportunities for enhancing transparency, efficiency, and security in legal processes. However, the integration of blockchain into existing legal frameworks faces numerous regulatory challenges. These challenges stem from the need to reconcile innovative decentralized systems with established legal principles, compliance requirements, and the evolving nature of digital assets. Addressing these regulatory hurdles is crucial for fostering an environment conducive to blockchain innovation in law, ensuring that legal practitioners can leverage its benefits while adhering to necessary legal standards and protecting stakeholders’ interests. This introduction explores the key regulatory challenges and potential pathways for overcoming them to facilitate the successful adoption of blockchain technology in the legal field.

Navigating Compliance: Key Regulations Impacting Blockchain in Law

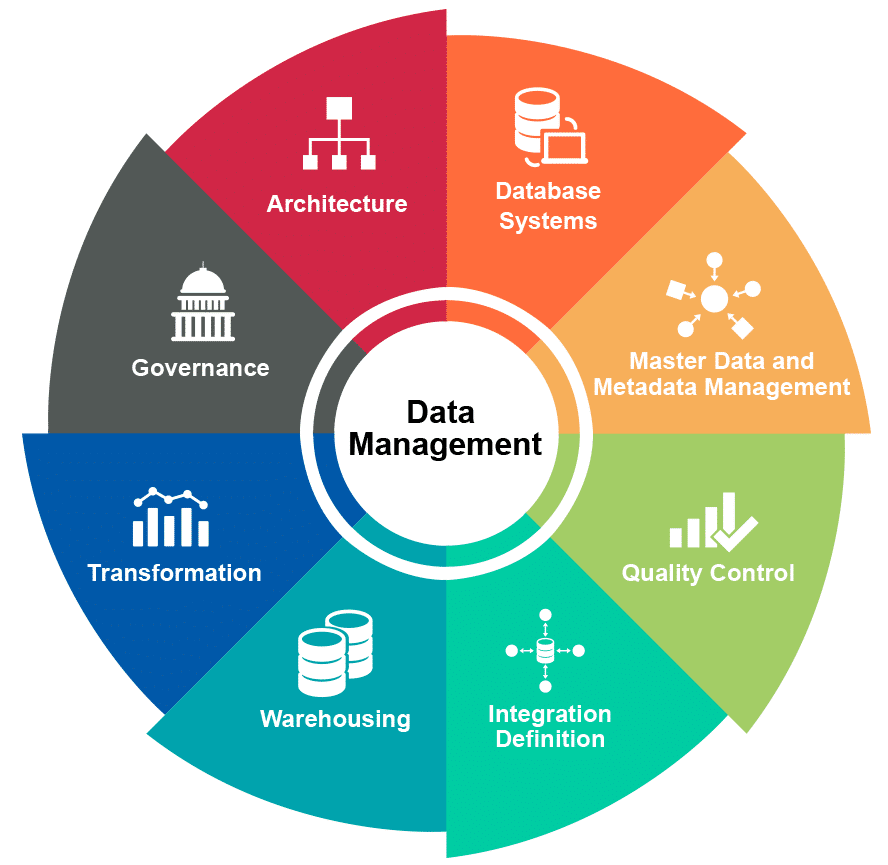

The integration of blockchain technology into the legal sector presents a myriad of opportunities, yet it is accompanied by significant regulatory challenges that must be navigated carefully. As legal professionals and organizations explore the potential of blockchain for enhancing transparency, efficiency, and security, they must also contend with a complex landscape of compliance requirements. Understanding the key regulations that impact blockchain adoption in law is essential for ensuring that these innovative solutions align with existing legal frameworks.

One of the foremost regulatory considerations is data protection and privacy laws, particularly the General Data Protection Regulation (GDPR) in the European Union. The immutable nature of blockchain poses unique challenges in this context, as the technology inherently conflicts with the GDPR’s right to erasure, also known as the “right to be forgotten.” Legal practitioners must devise strategies that allow for compliance with data protection mandates while leveraging the benefits of blockchain. This may involve implementing permissioned blockchains or utilizing cryptographic techniques to anonymize data, thereby balancing the need for transparency with individual privacy rights.

In addition to data protection regulations, anti-money laundering (AML) and know-your-customer (KYC) requirements are critical considerations for blockchain applications in law. Financial transactions recorded on a blockchain can be difficult to trace, raising concerns about the potential for illicit activities. Legal professionals must ensure that their blockchain solutions incorporate robust KYC processes to verify the identities of users and comply with AML regulations. This may necessitate collaboration with regulatory bodies to develop frameworks that facilitate compliance while fostering innovation in the use of blockchain technology.

Moreover, intellectual property (IP) rights present another layer of complexity in the regulatory landscape. As blockchain enables the creation of digital assets and smart contracts, legal practitioners must navigate the implications for IP protection. The decentralized nature of blockchain can complicate the enforcement of IP rights, as ownership and authorship may become obscured. Legal professionals must stay abreast of evolving IP laws and consider how blockchain can be utilized to enhance the protection of creative works, such as through the use of non-fungible tokens (NFTs) that provide verifiable ownership records.

Furthermore, the regulatory environment surrounding cryptocurrencies and tokens is rapidly evolving, with various jurisdictions implementing their own frameworks. Legal professionals must be vigilant in understanding how these regulations impact blockchain applications, particularly in relation to securities laws. The classification of tokens as securities can impose stringent compliance obligations, including registration requirements and disclosure obligations. As such, legal practitioners must conduct thorough legal analyses to determine the regulatory status of tokens and ensure that their blockchain initiatives adhere to applicable securities regulations.

In light of these challenges, collaboration between legal professionals, technologists, and regulators is paramount. By fostering open dialogue and sharing insights, stakeholders can work together to develop regulatory frameworks that support innovation while safeguarding public interests. Additionally, ongoing education and training for legal professionals on blockchain technology and its regulatory implications will be crucial in equipping them to navigate this complex landscape effectively.

In conclusion, while the adoption of blockchain technology in law holds great promise, it is imperative for legal practitioners to remain cognizant of the regulatory challenges that accompany this innovation. By understanding key regulations related to data protection, AML/KYC compliance, IP rights, and securities laws, legal professionals can better position themselves to leverage blockchain’s potential while ensuring adherence to the evolving legal landscape. Through proactive engagement and collaboration, the legal sector can successfully navigate these challenges and unlock the transformative power of blockchain technology.

Strategies for Law Firms to Address Regulatory Uncertainty in Blockchain

As the legal landscape continues to evolve in response to technological advancements, law firms are increasingly confronted with the complexities of blockchain technology and its regulatory implications. To effectively navigate this uncertain terrain, law firms must adopt strategic approaches that not only address regulatory challenges but also position them as leaders in the integration of blockchain within legal practices. One of the foremost strategies involves fostering a deep understanding of the regulatory environment surrounding blockchain. This requires law firms to invest in continuous education and training for their attorneys, ensuring they are well-versed in the nuances of blockchain technology, its applications, and the regulatory frameworks that govern it. By cultivating expertise in this area, firms can better advise clients on compliance issues and potential legal risks associated with blockchain initiatives.

In addition to enhancing internal knowledge, law firms should actively engage with regulatory bodies and industry stakeholders. Building relationships with regulators can provide valuable insights into forthcoming regulations and help shape the dialogue around blockchain policy. By participating in public consultations, industry forums, and working groups, law firms can advocate for clear and balanced regulations that promote innovation while safeguarding public interest. This proactive engagement not only positions firms as thought leaders but also allows them to influence the regulatory landscape in a manner that benefits their clients.

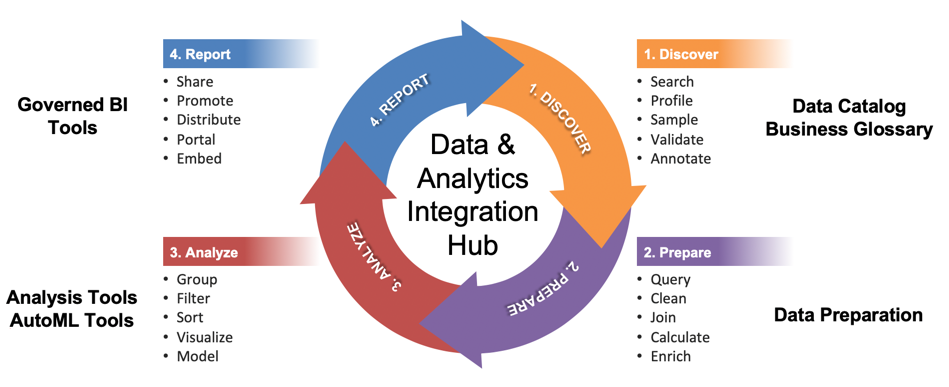

Moreover, law firms can leverage technology to streamline compliance processes and mitigate regulatory risks. Implementing blockchain-based solutions for internal operations, such as contract management and data storage, can enhance transparency and security while demonstrating the practical benefits of the technology. By adopting these tools, firms can showcase their commitment to innovation and compliance, thereby instilling confidence in clients who may be hesitant to embrace blockchain due to regulatory concerns. Furthermore, utilizing advanced analytics and compliance software can help firms monitor regulatory changes in real-time, enabling them to adapt swiftly to new requirements and provide timely advice to clients.

Collaboration with technology partners is another effective strategy for law firms seeking to address regulatory uncertainty. By forming alliances with blockchain developers and technology providers, firms can gain access to cutting-edge solutions that enhance their service offerings. These partnerships can facilitate the development of tailored legal solutions that address specific regulatory challenges, such as smart contracts and digital asset management. Additionally, collaborating with technology experts allows law firms to stay ahead of the curve in understanding emerging trends and potential regulatory shifts, ensuring they remain competitive in a rapidly changing environment.

Finally, law firms should prioritize client education and communication regarding blockchain and its regulatory implications. By providing clients with clear, concise information about the legal landscape surrounding blockchain, firms can empower them to make informed decisions about their own blockchain initiatives. Hosting workshops, webinars, and informational sessions can serve as valuable platforms for sharing insights and fostering dialogue about the intersection of law and technology. This not only enhances client relationships but also positions the firm as a trusted advisor in navigating the complexities of blockchain adoption.

In conclusion, overcoming regulatory challenges in blockchain adoption requires a multifaceted approach that combines education, engagement, technology, collaboration, and client communication. By implementing these strategies, law firms can effectively address regulatory uncertainty, positioning themselves as leaders in the evolving landscape of blockchain technology while providing invaluable support to their clients. As the legal profession continues to adapt to technological advancements, those firms that embrace these strategies will be well-equipped to thrive in an increasingly complex regulatory environment.

The Role of Legal Frameworks in Facilitating Blockchain Adoption

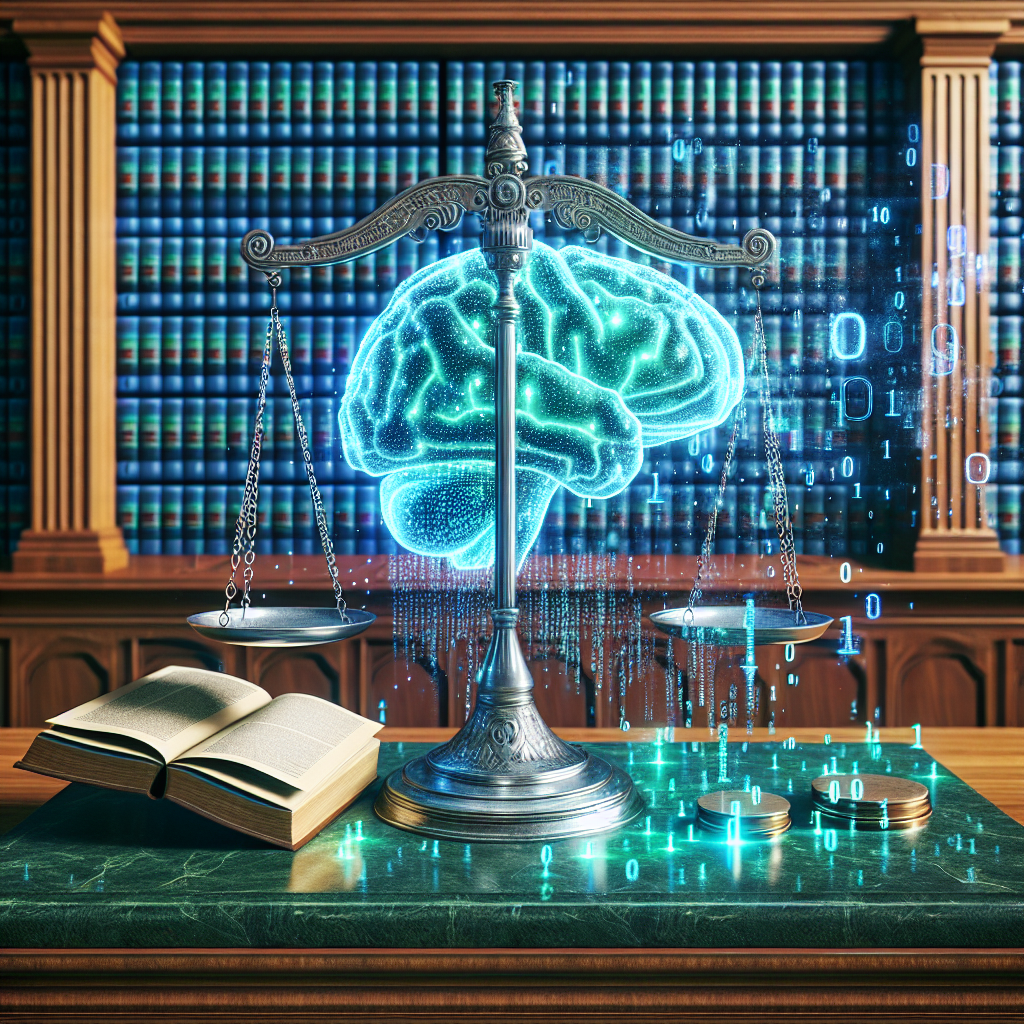

The integration of blockchain technology into the legal sector presents a myriad of opportunities, yet it is accompanied by significant regulatory challenges that must be addressed to facilitate its widespread adoption. Legal frameworks play a crucial role in shaping the environment in which blockchain can thrive, as they provide the necessary guidelines and structures that govern its use. By establishing clear regulations, legal frameworks can mitigate risks associated with blockchain technology, such as fraud, data breaches, and compliance issues, thereby fostering a more secure and trustworthy ecosystem.

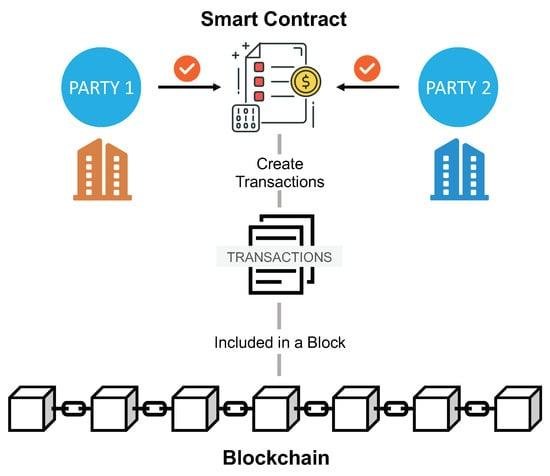

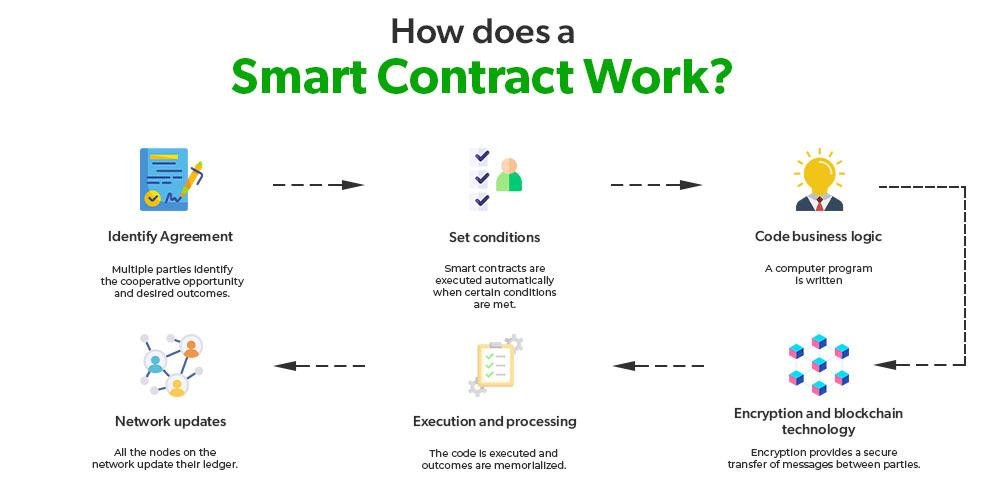

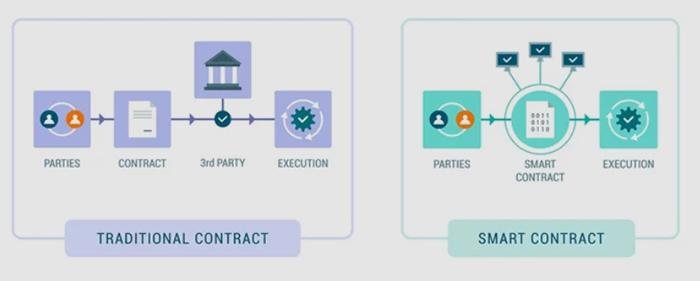

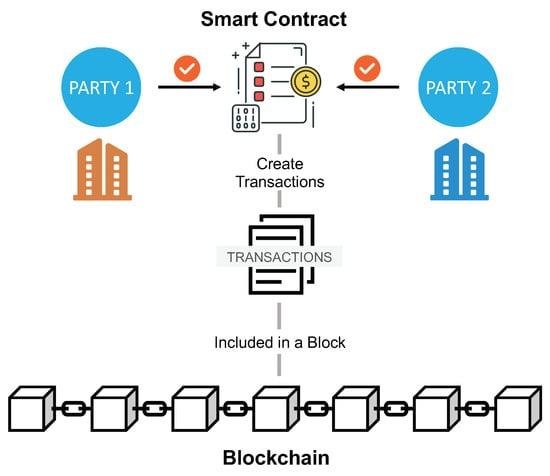

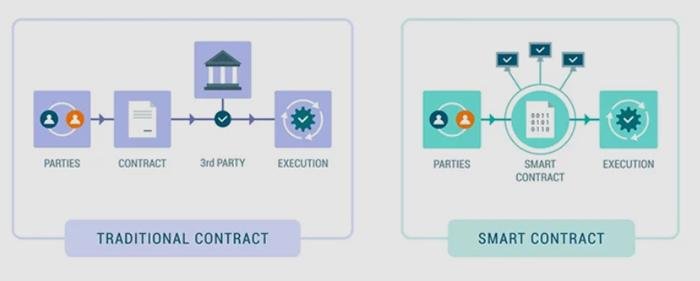

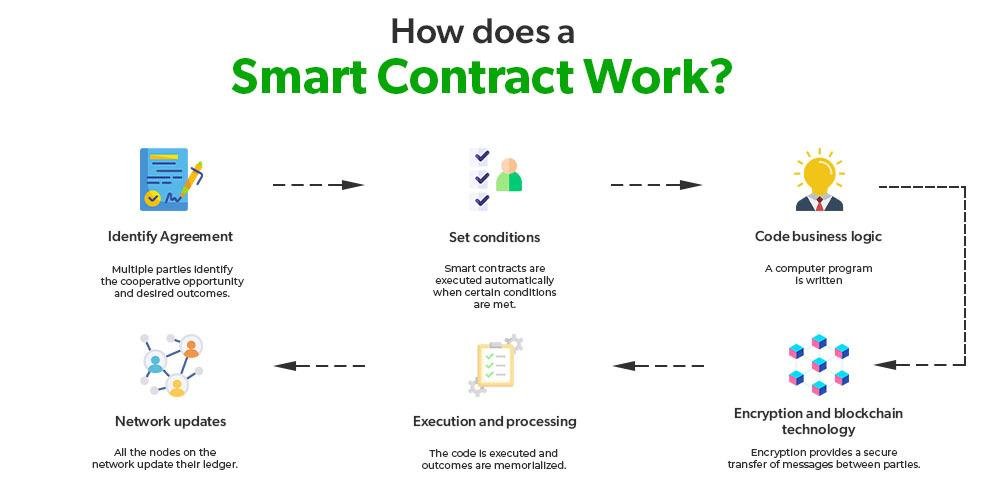

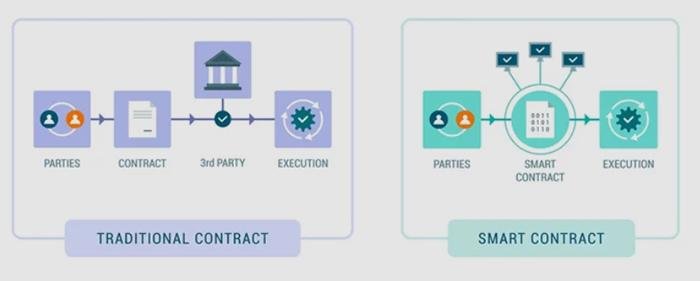

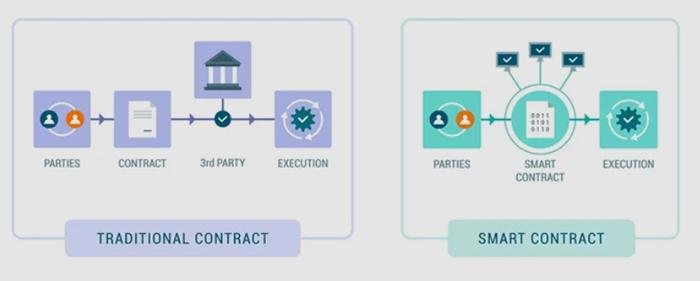

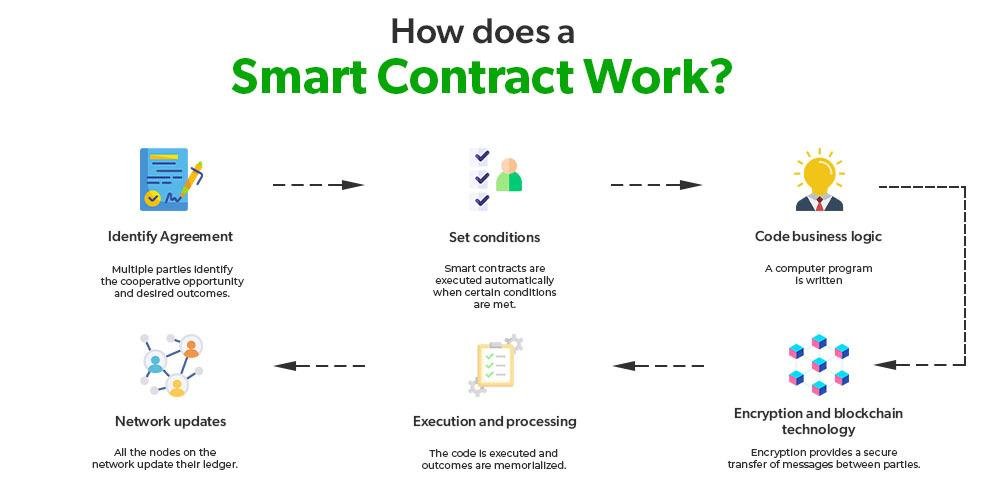

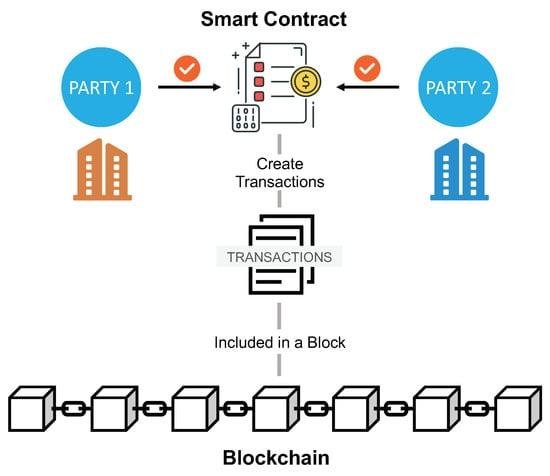

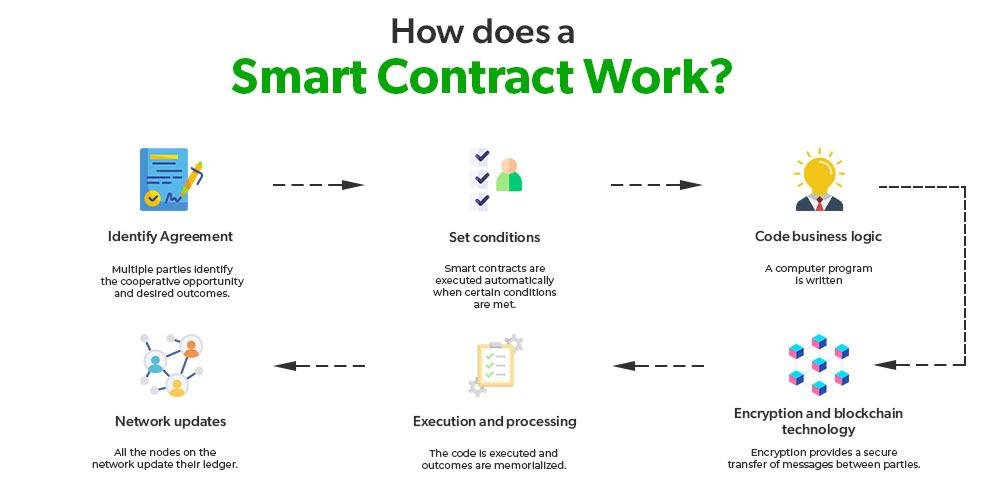

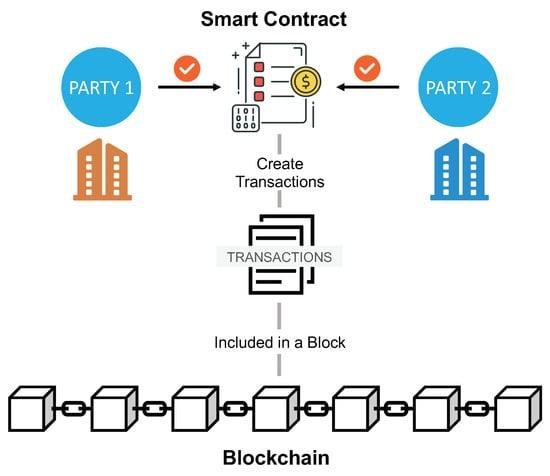

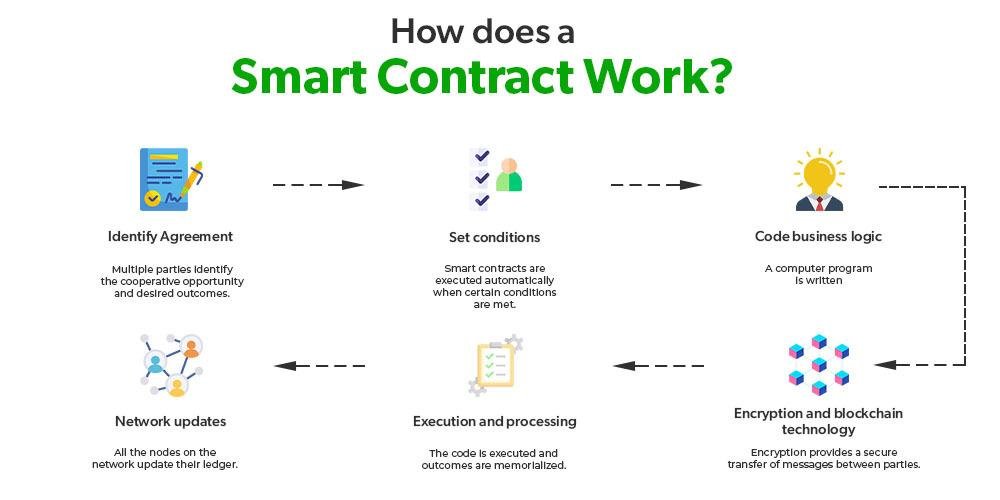

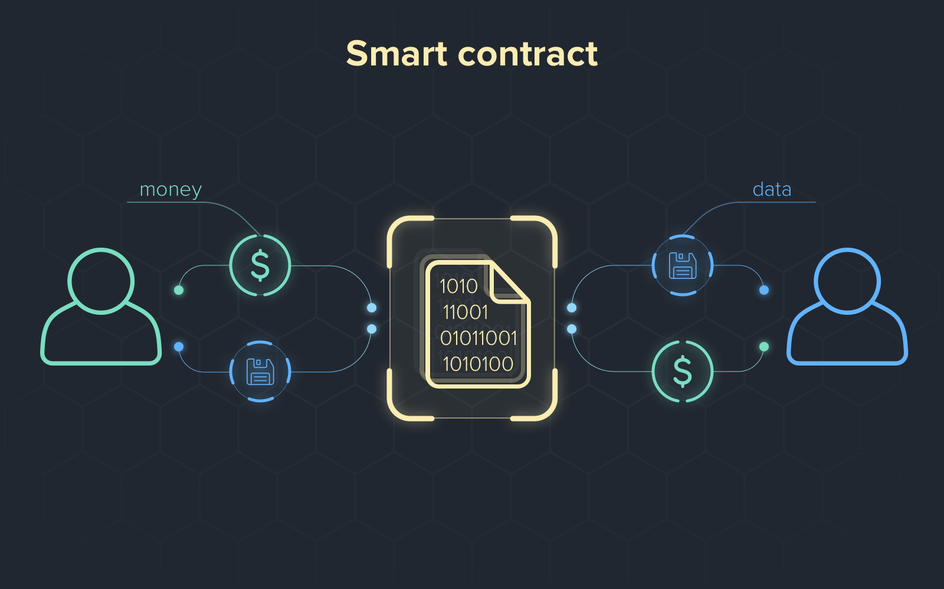

To begin with, the development of comprehensive legal frameworks is essential for clarifying the status of blockchain transactions and smart contracts. Currently, many jurisdictions lack specific regulations that define how these digital agreements are treated under existing law. This ambiguity can lead to uncertainty for legal practitioners and businesses alike, as they navigate the complexities of enforcing contracts that exist outside traditional legal paradigms. By creating laws that explicitly recognize and validate smart contracts, regulators can provide the clarity needed for stakeholders to confidently engage with blockchain technology.

Moreover, the role of legal frameworks extends to addressing issues of data privacy and security. As blockchain systems often involve the storage and transfer of sensitive information, it is imperative that regulations align with data protection laws, such as the General Data Protection Regulation (GDPR) in Europe. This alignment ensures that blockchain applications can operate within the confines of existing privacy laws while still leveraging the benefits of decentralization and transparency. By establishing guidelines that govern data handling practices on blockchain networks, regulators can help organizations implement solutions that are both innovative and compliant.

In addition to privacy concerns, legal frameworks must also tackle the challenges posed by jurisdictional issues inherent in blockchain technology. Given that blockchain operates on a global scale, transactions can easily cross borders, complicating the enforcement of local laws. This necessitates the creation of international agreements and harmonized regulations that can accommodate the decentralized nature of blockchain. By fostering collaboration among nations, regulators can work towards establishing a cohesive legal landscape that supports cross-border blockchain transactions, thereby enhancing the technology’s viability in the global market.

Furthermore, the role of legal frameworks in promoting innovation cannot be overstated. By providing a stable regulatory environment, lawmakers can encourage investment in blockchain technology and its applications within the legal sector. This stability is particularly important for startups and established firms looking to develop blockchain solutions, as it reduces the uncertainty that often accompanies emerging technologies. When businesses are assured that they can operate within a clear legal framework, they are more likely to invest resources into research and development, ultimately driving innovation and growth in the industry.

In conclusion, the establishment of robust legal frameworks is vital for overcoming the regulatory challenges that hinder blockchain adoption in the legal sector. By clarifying the status of smart contracts, addressing data privacy and security concerns, resolving jurisdictional issues, and promoting innovation, these frameworks can create an environment conducive to the successful integration of blockchain technology. As stakeholders continue to explore the potential of blockchain, it is imperative that regulators take proactive steps to develop and implement comprehensive legal structures that not only protect consumers and businesses but also foster the growth of this transformative technology. In doing so, they will pave the way for a more efficient, transparent, and secure legal landscape that harnesses the full potential of blockchain.

Case Studies: Successful Blockchain Implementation Amid Regulatory Hurdles

The integration of blockchain technology into the legal sector has been met with a myriad of regulatory challenges, yet several case studies illustrate how innovative approaches can lead to successful implementation despite these hurdles. One notable example is the use of blockchain for property title management in countries like Georgia. In 2016, the Georgian government partnered with the Bitfury Group to create a blockchain-based land registry system. This initiative aimed to enhance transparency and reduce corruption in property transactions. By digitizing land titles and recording them on a blockchain, the government not only streamlined the process but also provided a secure and immutable record of ownership. The success of this project demonstrated that, with the right partnerships and a clear regulatory framework, blockchain can significantly improve efficiency in legal processes.

Similarly, in the United States, the state of Wyoming has emerged as a pioneer in creating a conducive regulatory environment for blockchain technology. By enacting a series of laws aimed at clarifying the legal status of digital assets and smart contracts, Wyoming has attracted numerous blockchain startups and projects. One such initiative is the creation of a blockchain-based voting system for shareholder meetings. This system allows shareholders to cast votes securely and transparently, ensuring that their voices are heard without the risk of fraud. The regulatory clarity provided by Wyoming’s legislation has enabled companies to innovate while maintaining compliance, showcasing how proactive regulatory measures can facilitate blockchain adoption in the legal domain.

In another instance, the European Union has been exploring the use of blockchain for cross-border legal agreements through its European Blockchain Services Infrastructure (EBSI). This initiative aims to create a secure and efficient framework for digital identities and notarization services across member states. By addressing regulatory concerns related to data privacy and cross-border transactions, the EBSI project exemplifies how collaborative efforts among governments can lead to successful blockchain implementations. The pilot projects under EBSI have demonstrated the potential for blockchain to enhance trust and efficiency in legal processes, paving the way for broader adoption across Europe.

Moreover, the financial sector has also seen successful blockchain implementations that have implications for legal practices. The Australian Securities Exchange (ASX) has been working on replacing its clearing and settlement system with a blockchain-based solution. This transition, while fraught with regulatory scrutiny, has been guided by a commitment to transparency and stakeholder engagement. By involving regulators early in the process and addressing their concerns, the ASX has been able to navigate the complex regulatory landscape while advancing its blockchain initiative. This case highlights the importance of collaboration between industry players and regulators in overcoming challenges and fostering innovation.

As these case studies illustrate, successful blockchain implementation in the legal sector is not only possible but can also lead to significant improvements in efficiency, transparency, and security. The key lies in understanding the regulatory landscape and engaging with stakeholders to create frameworks that support innovation while ensuring compliance. By learning from these examples, other jurisdictions can develop strategies to overcome their own regulatory challenges, ultimately paving the way for broader adoption of blockchain technology in law. The journey may be complex, but the potential benefits of blockchain in enhancing legal processes are undeniable, making it a worthwhile endeavor for governments and legal practitioners alike.

Conclusion

Overcoming regulatory challenges for blockchain adoption in law requires a collaborative approach among stakeholders, including lawmakers, legal professionals, and technology developers. By fostering dialogue and creating adaptable regulatory frameworks, the legal industry can harness the benefits of blockchain technology while ensuring compliance and protecting public interests. Continuous education and awareness are essential to bridge the knowledge gap and promote innovation within a secure legal environment. Ultimately, a proactive stance towards regulation can facilitate the integration of blockchain, enhancing transparency, efficiency, and trust in legal processes.