The Role of Smart Contracts in Mergers and Acquisitions

Introduction

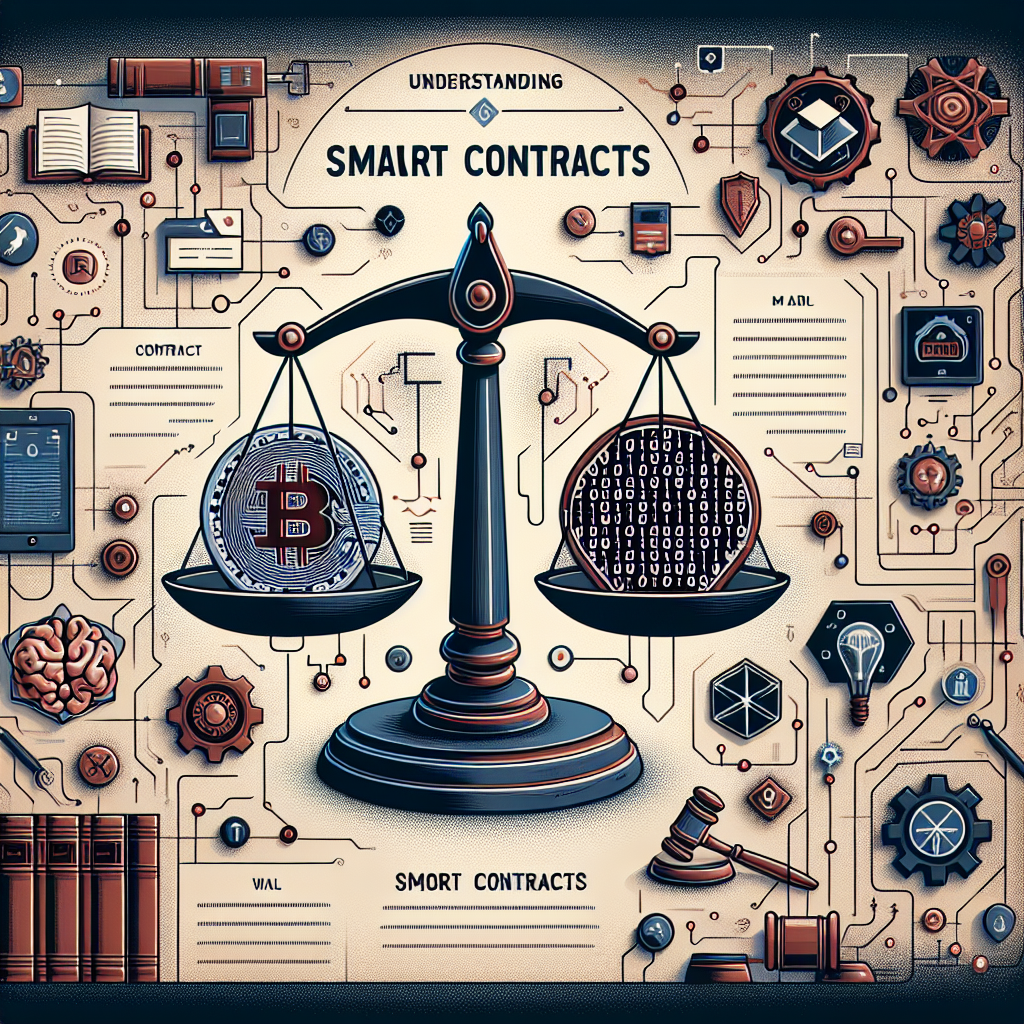

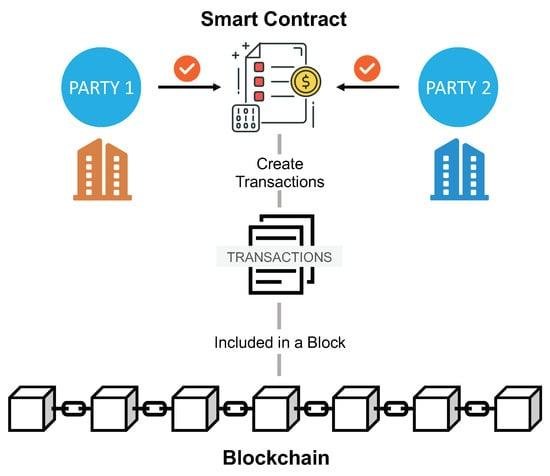

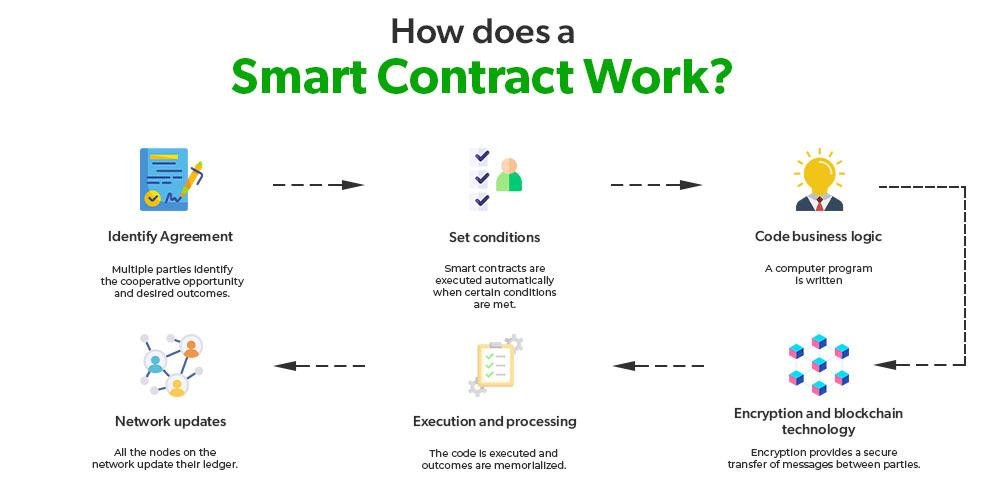

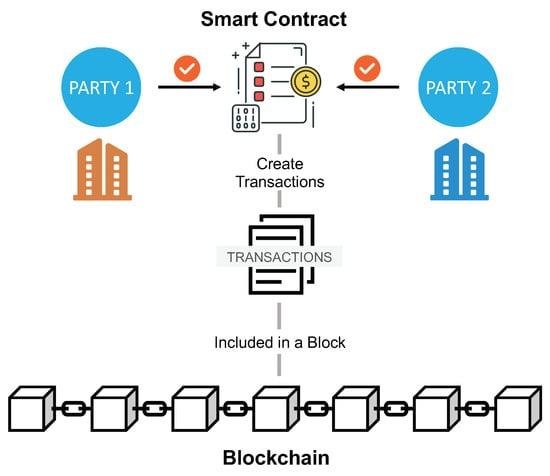

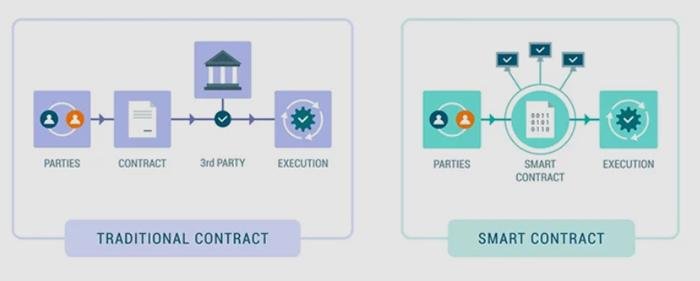

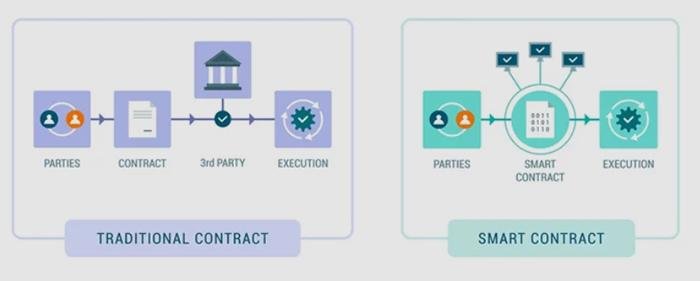

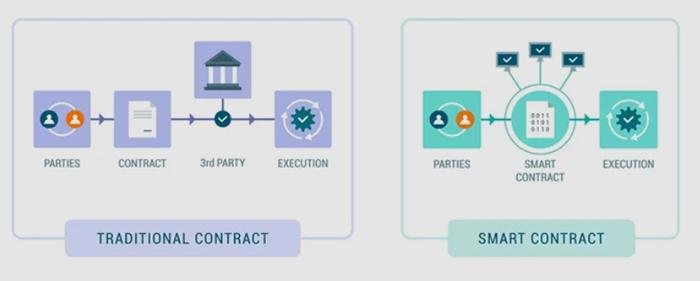

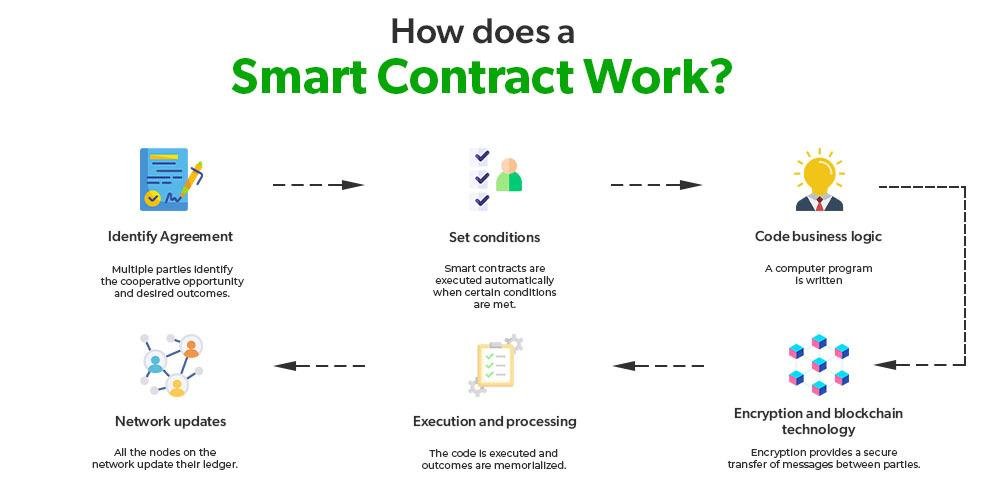

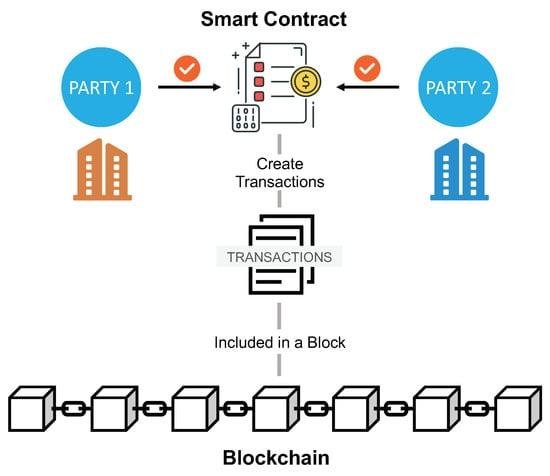

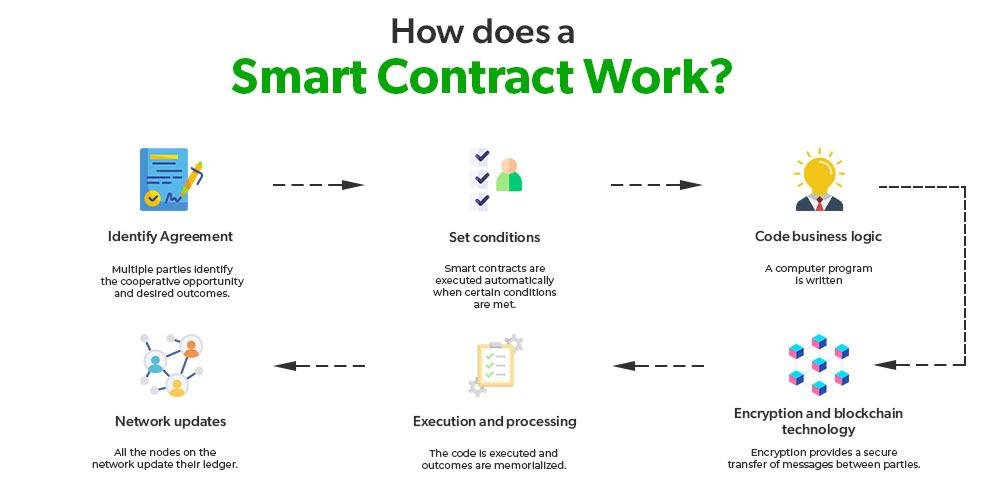

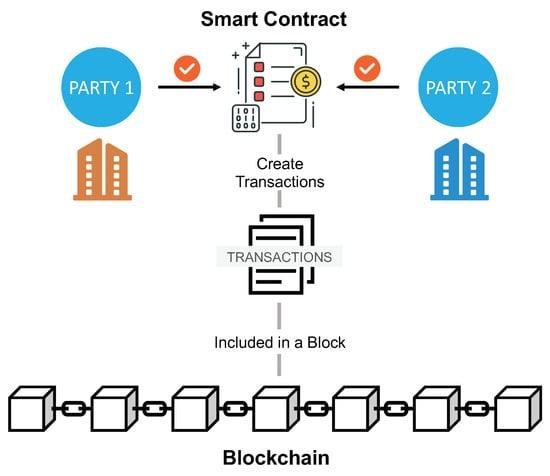

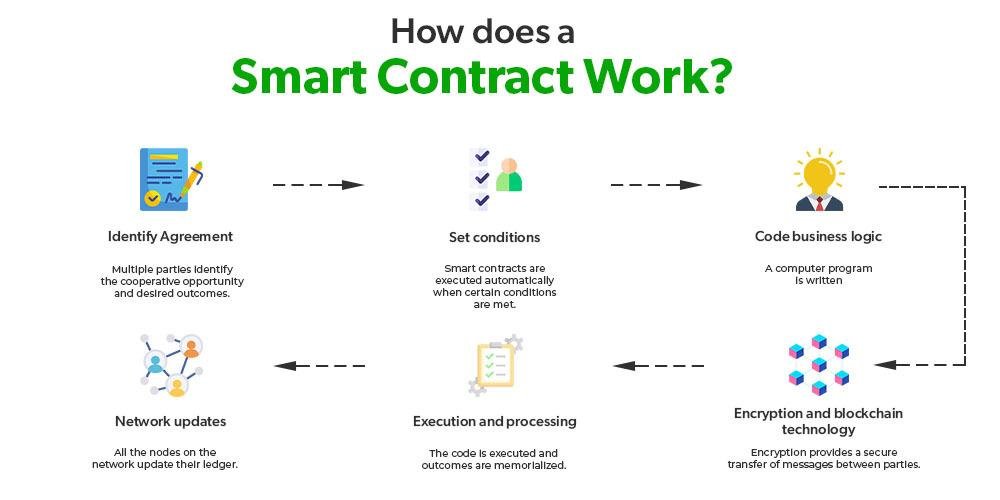

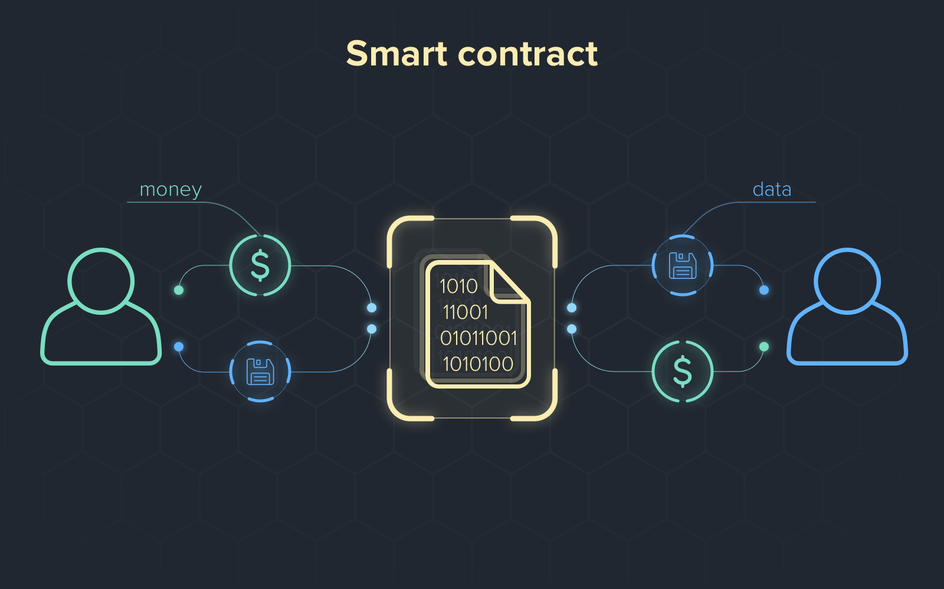

Mergers and acquisitions (M&A) are critical moments for companies, but they also come with many challenges. As businesses try to merge their operations, cultures, and technologies, they often face complex paperwork, negotiations, and risks. Smart contracts, which are self-executing agreements powered by blockchain technology, offer a solution to make these transactions faster, more transparent, and secure. In this article, we’ll explore how smart contracts can transform M&A deals, improving efficiency and trust while reducing risks.

Exploring the Efficiency Gains of Smart Contracts in Mergers and Acquisitions

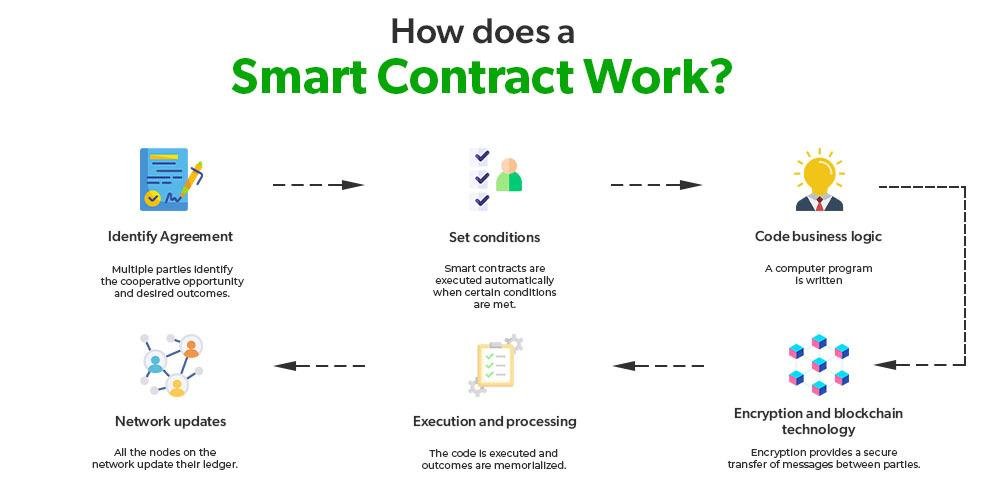

Smart contracts are changing how M&A deals are done by automating key processes, which can save time and reduce costs. Here are some of the ways they improve efficiency:

- Faster Transactions: With smart contracts, the execution of agreements happens automatically, eliminating delays from manual processes.

- Lower Costs: By cutting out intermediaries like lawyers and notaries, businesses can save money on transaction fees.

- Better Transparency: All parties can see the same immutable document on the blockchain, making the deal more transparent and building trust.

Smart contracts also allow businesses to set specific conditions in the contract that trigger actions automatically. For example, if certain performance metrics are met, the contract can automatically trigger payments or transfers of ownership. This eliminates delays and ensures terms are followed on time.

Here’s how smart contracts change traditional M&A processes:

| Factor | Before Smart Contracts | After Smart Contracts |

|---|---|---|

| Manual Reviews | Time-Consuming | Automated |

| Conflict Resolution | Prolonged Negotiations | Instant Execution of Terms |

| Audit Trails | Difficult to Track | Transparent and Immutable |

Read Also: Enhancing Legal Education and Access with Technology

Ensuring Trust and Transparency Through Automated Agreement Execution

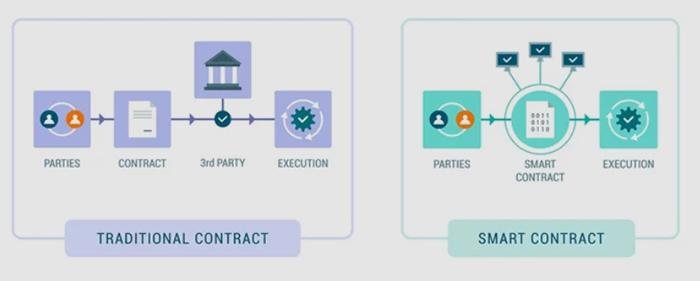

In M&A transactions, trust and transparency are critical. Smart contracts work on blockchain technology, which is decentralized and ensures that all parties have access to the same unchangeable data. This removes the need for intermediaries and reduces misunderstandings that can arise in traditional contracts.

Key benefits of using smart contracts in M&A include:

- Real-Time Data Access: All parties can see the progress of the deal and check whether conditions are being met.

- Reduced Overhead Costs: By minimizing the need for legal intermediaries, businesses save on costs.

- Streamlined Execution: Contract conditions are automatically triggered, reducing delays and disputes.

Because blockchain keeps an immutable record of every action, it’s easy to verify that the terms are being followed. This transparency increases trust and reduces risks in the deal. Here’s how traditional contract execution compares to smart contracts:

| Aspect | Traditional Execution | Smart Contract Execution |

|---|---|---|

| Transaction Time | Days or weeks | Instantaneous |

| Cost of Intermediaries | High | Low |

| Transparency | Limited | High |

| Dispute Resolution | Complex and lengthy | Automated and predefined |

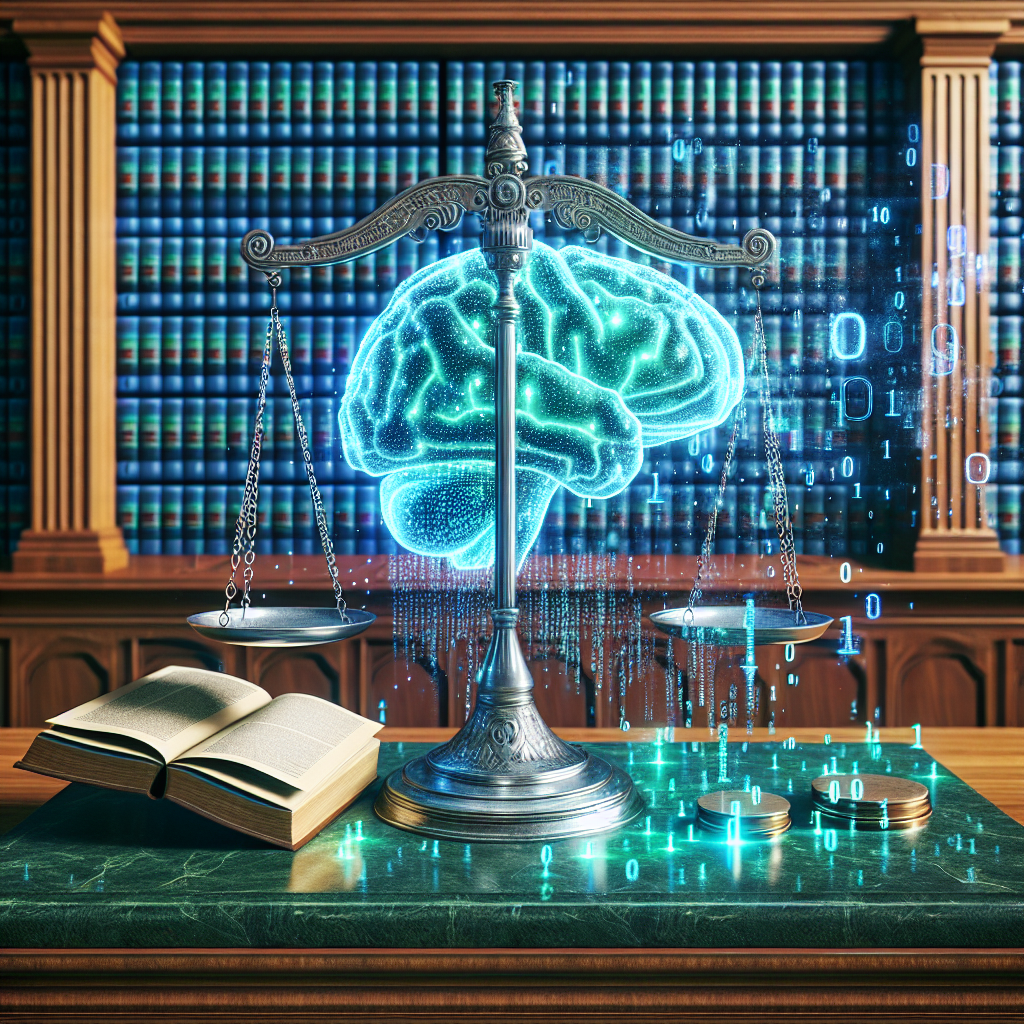

Navigating Regulatory Challenges: Smart Contracts in a Complex Legal Landscape

While smart contracts can improve efficiency, they also introduce new legal challenges. As smart contracts are a relatively new development, the legal frameworks governing their use are still in the process of evolving. This can cause confusion about whether smart contracts are legally enforceable and which laws apply, especially in cross-border transactions.

Some key challenges include:

- Unclear Regulations: Different countries may interpret the legality of smart contracts in different ways.

- Jurisdictional Issues: Blockchain’s decentralized nature makes it hard to determine which laws apply in international transactions.

- Consumer Protection: Ensuring that automated transactions follow consumer protection laws can be tricky.

Additionally, data privacy laws like GDPR (General Data Protection Regulation) or CCPA (California Consumer Privacy Act) could affect how personal data is stored and handled on the blockchain. Businesses need to be careful when including sensitive data in smart contracts.

Here are several recommended approaches to tackle these challenges:

| Best Practices for Compliance | Description |

|---|---|

| Clear Documentation | Ensure all smart contract terms are transparently documented and easily accessible. |

| Regular Audits | Conduct periodic assessments of the smart contract code to identify potential legal vulnerabilities. |

| Legal Consultation | Engage legal experts specializing in blockchain to navigate jurisdictional nuances. |

Best Practices for Implementing Smart Contracts in M&A Transactions

To get the most out of smart contracts in M&A, it’s essential to follow best practices. These practices help ensure that all parties understand the terms, avoid conflicts, and remain compliant with laws. Here are some key points:

- Clear Terms: Make sure everyone involved understands the contract’s terms, such as trigger events and payment milestones. This reduces the chance of misunderstandings.

- Verification Mechanisms: Include security features like multi-signature wallets, timelocks for important actions, and audit trails to ensure compliance.

- Legal and Tech Experts: Bring in both legal and technical experts to help create and deploy the smart contracts. Legal advisors ensure the contracts meet regulations, while IT professionals can handle the technology side.

Regular updates and reviews are necessary as laws and technology evolve. Setting up a team to oversee the process is also important.

| Team Role | Responsibilities |

|---|---|

| Legal Advisor | Ensure compliance and risk management |

| Blockchain Developer | Oversee contract functionality |

| Audit Specialist | Verify contract performance and security |

In Conclusion

Smart contracts are revolutionizing mergers and acquisitions by offering faster, more efficient, and more transparent transactions. These self-executing agreements can reduce costs, save time, and improve trust between parties. However, they also come with regulatory challenges that businesses must address, including ensuring compliance with legal requirements and data privacy laws.

As the use of smart contracts grows, they will continue to reshape how businesses approach M&A deals. By embracing these technologies and following best practices, companies can stay ahead in a competitive, tech-driven marketplace. While there are still hurdles to overcome, the integration of smart contracts has the potential to create a more agile and collaborative business environment.

The future of M&A is digital, and the combination of technology and strategy in smart contracts could unlock new opportunities and efficiencies. As businesses continue to evolve, staying adaptable and prepared for these changes will be key to navigating the new landscape of mergers and acquisitions.