The Future of Compliance in Legal Technology

Table of Contents

Introduction

The Future of Compliance in Legal Technology is poised to undergo significant transformation as advancements in technology reshape the legal landscape. With the increasing complexity of regulations and the growing demand for transparency, legal professionals are turning to innovative solutions such as artificial intelligence, blockchain, and data analytics to enhance compliance processes. These technologies not only streamline workflows but also improve accuracy and reduce the risk of non-compliance. As organizations prioritize regulatory adherence, the integration of legal tech will play a crucial role in ensuring that compliance measures are not only met but also proactively managed, paving the way for a more efficient and accountable legal environment.

Automation in Compliance Processes

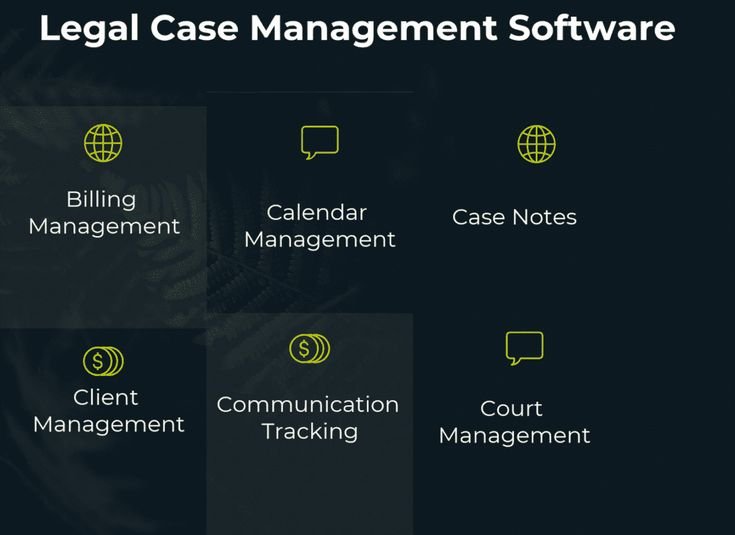

As the legal landscape continues to evolve, the integration of automation into compliance processes is becoming increasingly vital. The complexities of regulatory requirements demand a more efficient approach, and automation offers a promising solution. By leveraging advanced technologies, legal professionals can streamline compliance tasks, reduce human error, and enhance overall efficiency. This shift not only addresses the growing volume of regulations but also allows legal teams to focus on higher-value activities.

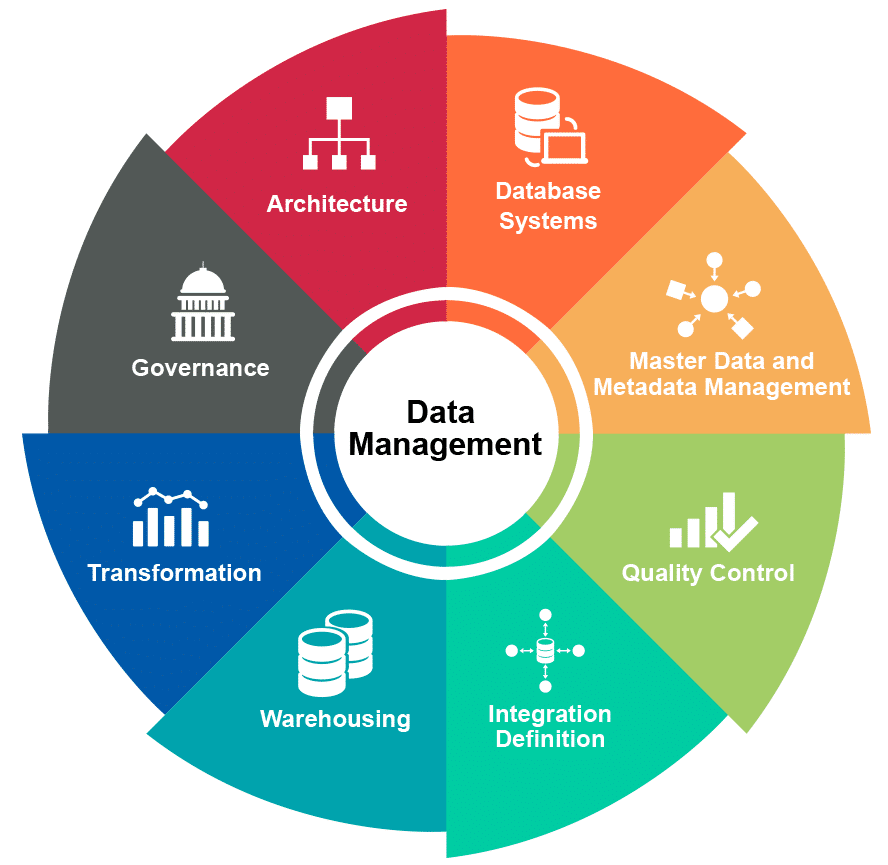

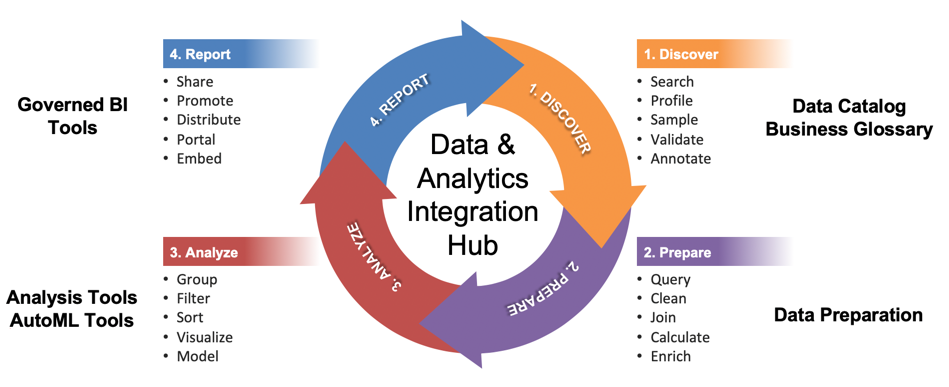

One of the primary benefits of automation in compliance processes is the ability to manage vast amounts of data with precision. Legal technology solutions equipped with artificial intelligence can analyze and interpret regulatory texts, identifying relevant provisions and obligations. This capability significantly reduces the time spent on manual reviews, enabling compliance officers to stay ahead of changing regulations. Furthermore, automated systems can continuously monitor updates in legislation, ensuring that organizations remain compliant without the need for constant manual oversight.

In addition to data management, automation enhances the accuracy of compliance reporting. Traditional reporting methods often involve extensive manual input, which can lead to inconsistencies and errors. By automating data collection and reporting processes, organizations can generate real-time compliance reports that are both accurate and comprehensive. This not only improves transparency but also facilitates better decision-making by providing stakeholders with timely insights into compliance status.

Moreover, automation fosters a proactive compliance culture within organizations. By implementing automated workflows, legal teams can establish clear protocols for compliance activities, ensuring that all employees understand their responsibilities. This clarity is essential in mitigating risks associated with non-compliance, as it empowers staff to adhere to established guidelines. Additionally, automated training modules can be deployed to educate employees about compliance requirements, further reinforcing a culture of accountability.

As organizations increasingly adopt automation, the role of compliance professionals is also evolving. Rather than being bogged down by repetitive tasks, compliance officers can now focus on strategic initiatives that drive organizational growth. For instance, they can analyze compliance data to identify trends and potential areas of risk, allowing for more informed decision-making. This shift not only enhances the value of compliance functions but also positions legal teams as strategic partners within the organization.

However, the transition to automated compliance processes is not without its challenges. Organizations must carefully consider the implementation of these technologies, ensuring that they align with existing systems and workflows. Additionally, there is a need for ongoing training and support to help compliance professionals adapt to new tools and processes. By addressing these challenges head-on, organizations can maximize the benefits of automation while minimizing potential disruptions.

Looking ahead, the future of compliance in legal technology will likely see further advancements in automation capabilities. As machine learning and artificial intelligence continue to evolve, compliance processes will become even more sophisticated. Predictive analytics, for example, could enable organizations to anticipate regulatory changes and adjust their compliance strategies accordingly. This proactive approach will not only enhance compliance but also foster a culture of innovation within legal teams.

In conclusion, the integration of automation into compliance processes represents a significant advancement in legal technology. By streamlining data management, improving reporting accuracy, and fostering a proactive compliance culture, automation empowers legal professionals to navigate the complexities of regulatory requirements more effectively. As organizations embrace these changes, the role of compliance will continue to evolve, positioning legal teams as essential contributors to organizational success in an increasingly regulated environment.

The Role of Artificial Intelligence in Legal Compliance

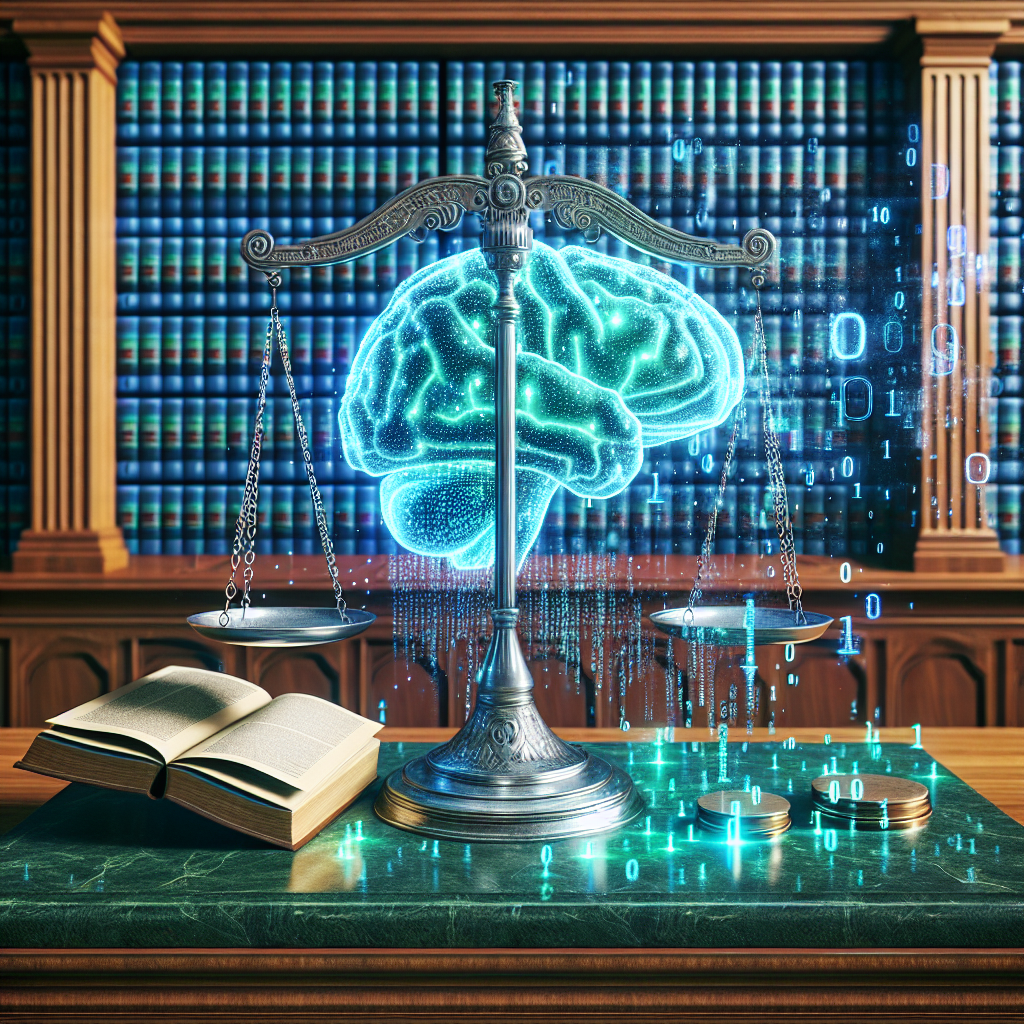

The integration of artificial intelligence (AI) into legal technology is transforming the landscape of compliance, offering unprecedented opportunities for efficiency, accuracy, and risk management. As regulatory environments become increasingly complex, organizations are compelled to adopt innovative solutions that not only streamline compliance processes but also enhance their ability to adapt to evolving legal requirements. AI stands at the forefront of this transformation, providing tools that can analyze vast amounts of data, identify patterns, and predict potential compliance issues before they escalate.

One of the most significant advantages of AI in legal compliance is its ability to process and analyze large datasets at speeds unattainable by human counterparts. Traditional compliance methods often involve manual reviews of documents, contracts, and regulatory updates, which can be time-consuming and prone to human error. In contrast, AI algorithms can quickly sift through extensive legal texts, extracting relevant information and flagging discrepancies or areas of concern. This capability not only accelerates the compliance review process but also enhances the accuracy of the findings, thereby reducing the risk of non-compliance.

Moreover, AI-driven tools can facilitate real-time monitoring of compliance obligations. By continuously scanning regulatory changes and updates, these systems can alert organizations to new requirements that may impact their operations. This proactive approach allows businesses to stay ahead of compliance challenges, ensuring that they can adapt their policies and procedures in a timely manner. As a result, organizations can mitigate risks associated with regulatory breaches, which can lead to significant financial penalties and reputational damage.

In addition to monitoring and analysis, AI can also play a crucial role in automating compliance workflows. By leveraging machine learning algorithms, organizations can develop systems that automatically generate compliance reports, track deadlines, and manage documentation. This automation not only reduces the administrative burden on compliance teams but also allows them to focus on more strategic initiatives, such as developing compliance training programs or conducting risk assessments. Consequently, the overall efficiency of compliance operations is significantly enhanced, leading to better resource allocation and improved organizational performance.

Furthermore, AI can assist in the identification of potential compliance risks through predictive analytics. By analyzing historical data and identifying trends, AI systems can forecast areas where compliance issues are likely to arise. This predictive capability enables organizations to implement preventive measures, thereby reducing the likelihood of violations. For instance, if an AI system identifies a pattern of non-compliance in a particular department or process, organizations can take corrective action before issues escalate, fostering a culture of compliance throughout the organization.

However, the integration of AI into legal compliance is not without its challenges. Concerns regarding data privacy, algorithmic bias, and the need for transparency in AI decision-making processes must be addressed to ensure that these technologies are used ethically and responsibly. Organizations must also invest in training their compliance teams to effectively leverage AI tools, ensuring that they possess the necessary skills to interpret AI-generated insights and make informed decisions.

In conclusion, the role of artificial intelligence in legal compliance is poised to reshape the future of the legal industry. By enhancing data analysis, automating workflows, and providing predictive insights, AI offers organizations the tools they need to navigate the complexities of compliance in an increasingly regulated environment. As businesses continue to embrace these technologies, they will not only improve their compliance efforts but also position themselves for long-term success in a rapidly changing legal landscape.

Data Privacy Regulations and Legal Technology

As the landscape of legal technology continues to evolve, the intersection of data privacy regulations and compliance becomes increasingly critical. With the advent of stringent data protection laws such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States, legal technology providers are compelled to adapt their solutions to ensure compliance. This adaptation is not merely a matter of meeting regulatory requirements; it is also about fostering trust and transparency in an era where data breaches and privacy violations can have devastating consequences for organizations.

To begin with, the implementation of robust compliance frameworks within legal technology is essential for organizations to navigate the complexities of data privacy regulations. Legal technology solutions must incorporate features that facilitate data governance, enabling firms to manage and protect sensitive information effectively. This includes tools for data mapping, which help organizations understand what data they hold, where it is stored, and how it is processed. By providing a clear overview of data flows, legal technology can assist firms in identifying potential compliance risks and addressing them proactively.

Moreover, the integration of artificial intelligence (AI) and machine learning into legal technology platforms is transforming the way compliance is approached. These technologies can analyze vast amounts of data to identify patterns and anomalies that may indicate non-compliance. For instance, AI-driven tools can automate the monitoring of data access and usage, ensuring that only authorized personnel have access to sensitive information. This not only enhances security but also streamlines compliance processes, allowing legal teams to focus on more strategic tasks rather than manual oversight.

In addition to these technological advancements, the role of legal professionals in ensuring compliance cannot be overstated. As data privacy regulations become more complex, legal practitioners must be equipped with the knowledge and tools necessary to interpret and implement these laws effectively. Legal technology can play a pivotal role in this regard by providing training modules and resources that keep legal teams informed about the latest regulatory developments. By fostering a culture of compliance within organizations, legal technology can help mitigate risks associated with data privacy violations.

Furthermore, as organizations increasingly adopt cloud-based solutions, the importance of understanding the implications of data residency and cross-border data transfers becomes paramount. Legal technology must offer features that allow firms to manage data in accordance with the specific requirements of various jurisdictions. This includes ensuring that data is stored in compliant locations and that appropriate safeguards are in place when transferring data across borders. By addressing these challenges, legal technology can empower organizations to operate globally while remaining compliant with local regulations.

As we look to the future, it is clear that the relationship between data privacy regulations and legal technology will continue to deepen. The ongoing evolution of regulatory frameworks will necessitate that legal technology providers remain agile and responsive to changes in the legal landscape. This adaptability will not only enhance compliance but also drive innovation within the industry. Ultimately, the future of compliance in legal technology hinges on the ability of organizations to leverage advanced tools and strategies to navigate the complexities of data privacy regulations while maintaining the highest standards of ethical practice. In this dynamic environment, the synergy between legal expertise and technological innovation will be crucial in shaping a compliant and secure future for all stakeholders involved.

The Impact of Blockchain on Compliance Practices

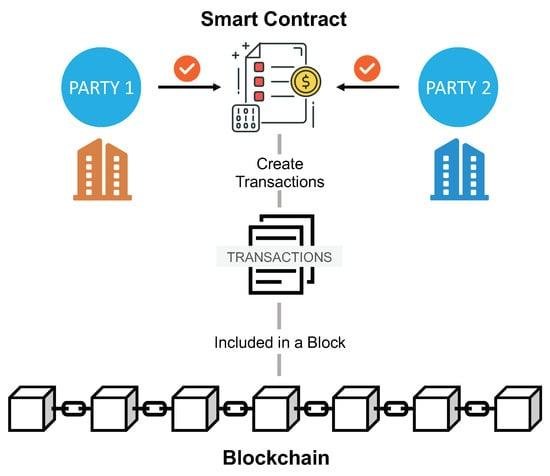

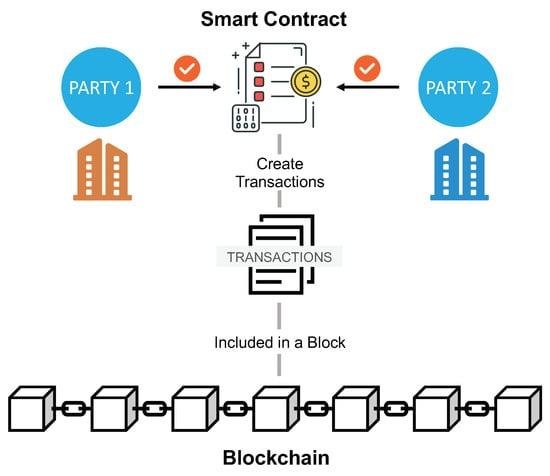

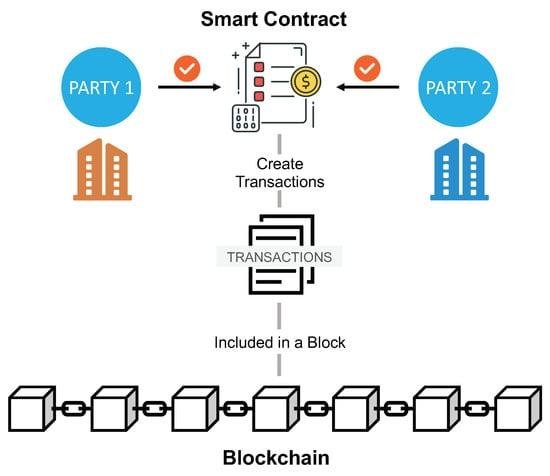

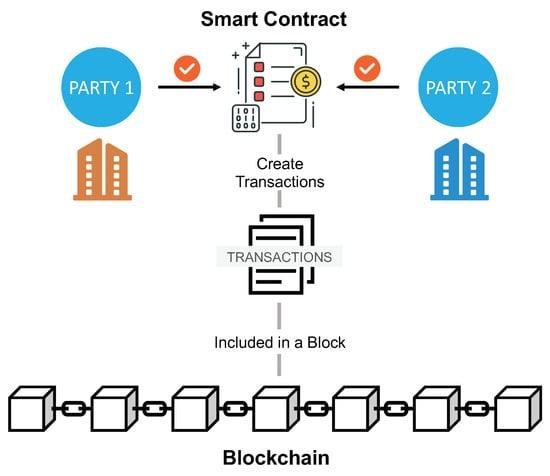

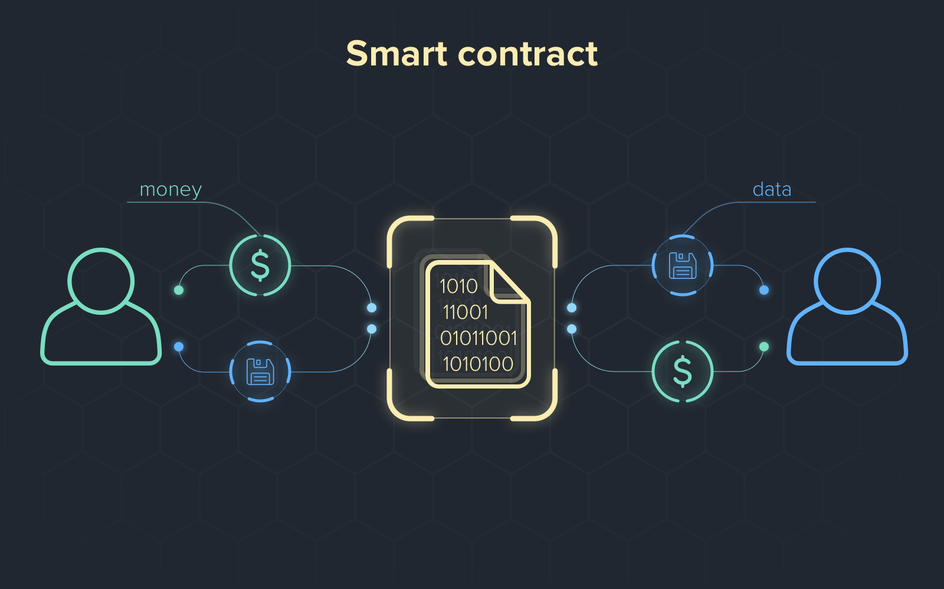

The advent of blockchain technology is poised to revolutionize compliance practices across various sectors, particularly within the legal domain. As organizations increasingly grapple with the complexities of regulatory requirements, the immutable and transparent nature of blockchain offers a compelling solution to enhance compliance frameworks. By providing a decentralized ledger that records transactions in a secure and verifiable manner, blockchain can significantly reduce the risks associated with data manipulation and fraud, thereby fostering greater trust among stakeholders.

One of the most significant impacts of blockchain on compliance practices is its ability to streamline the auditing process. Traditional auditing methods often involve extensive manual checks and reconciliations, which can be time-consuming and prone to human error. In contrast, blockchain enables real-time access to transaction data, allowing auditors to verify compliance with regulations more efficiently. This shift not only reduces the time and resources required for audits but also enhances the accuracy of compliance assessments. As a result, organizations can respond more swiftly to regulatory changes, ensuring that they remain compliant in an ever-evolving legal landscape.

Moreover, the transparency inherent in blockchain technology facilitates enhanced traceability of transactions. Each entry on a blockchain is time-stamped and linked to previous entries, creating a comprehensive audit trail that is easily accessible to authorized parties. This feature is particularly beneficial for industries that are heavily regulated, such as finance and healthcare, where maintaining accurate records is crucial for compliance. By leveraging blockchain, organizations can demonstrate their adherence to regulatory requirements more effectively, thereby mitigating the risk of penalties and reputational damage.

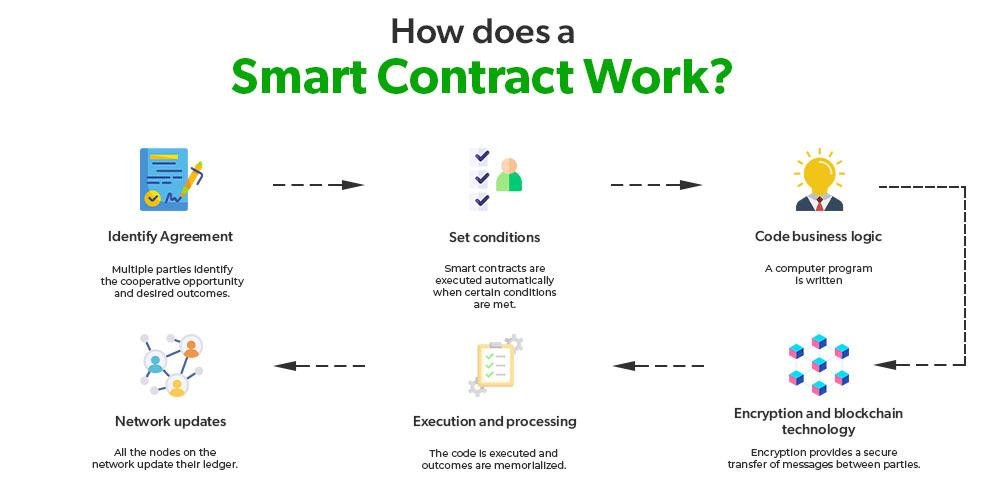

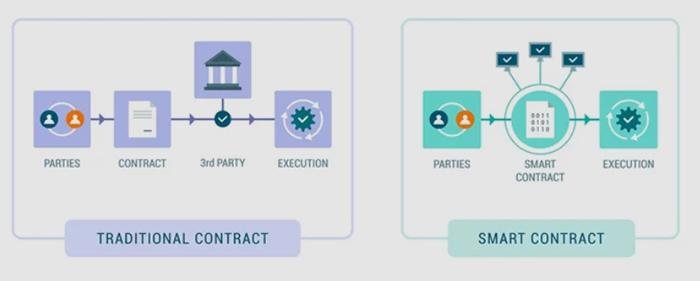

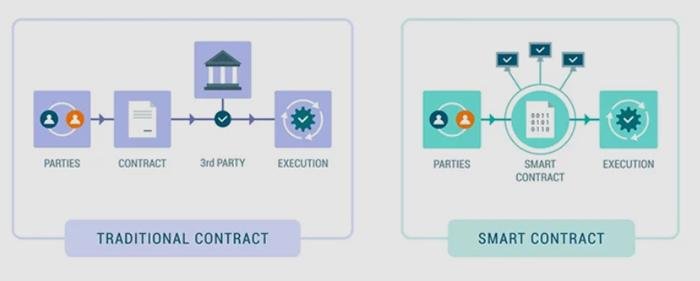

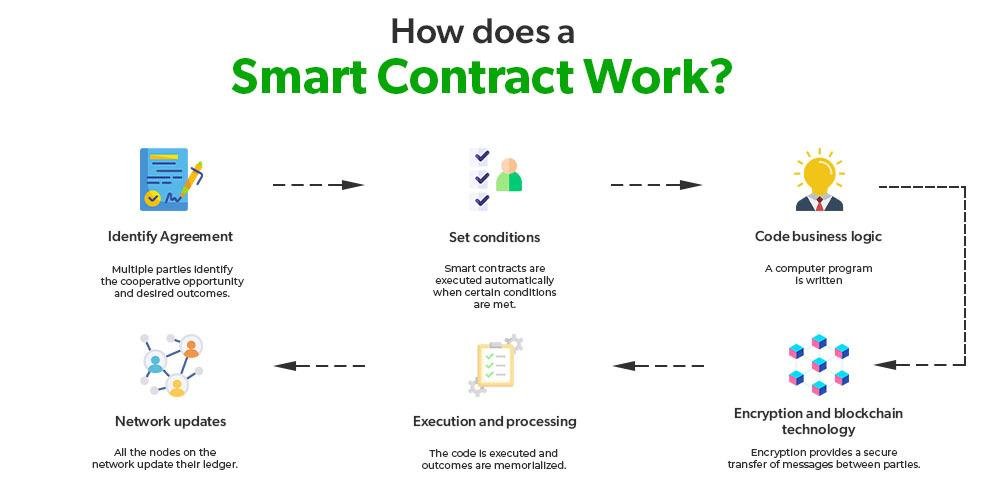

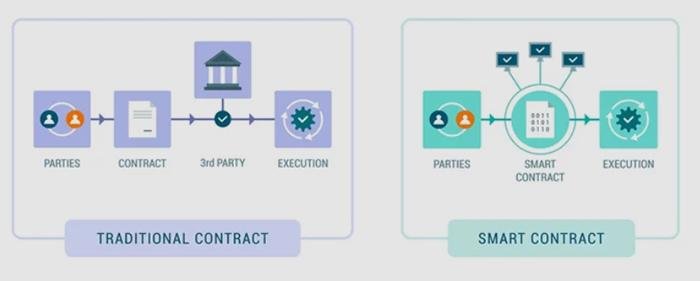

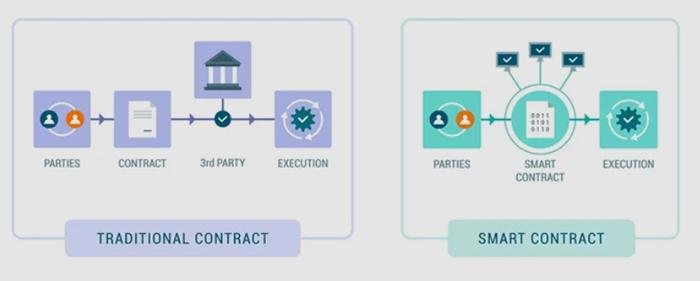

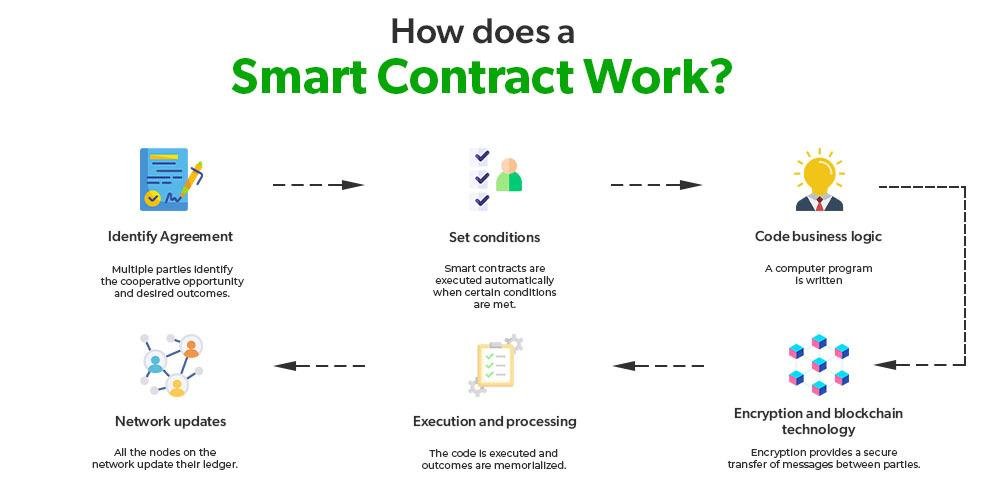

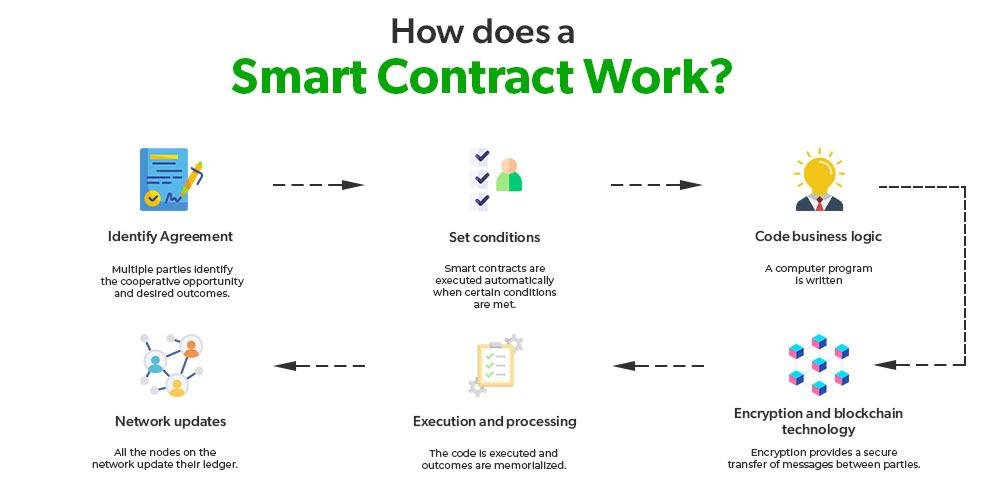

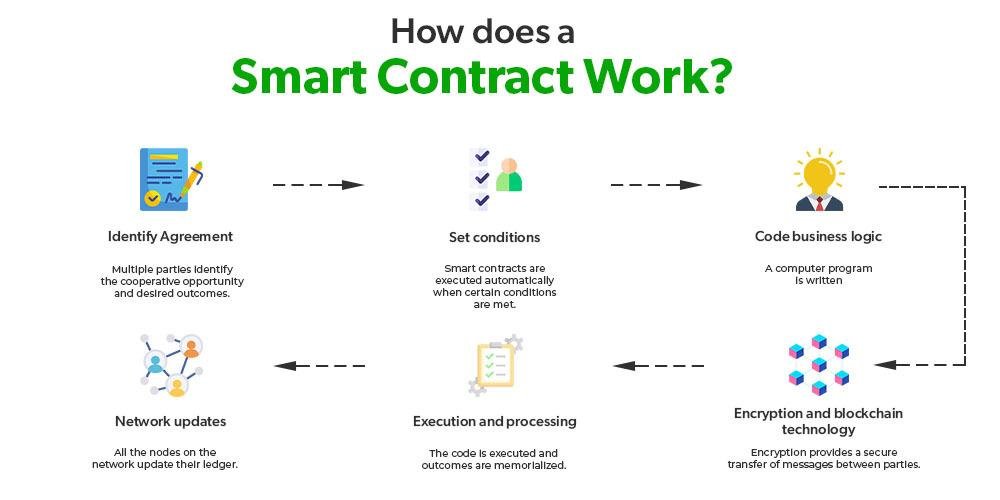

In addition to improving audit processes and traceability, blockchain can also automate compliance through the use of smart contracts. These self-executing contracts are programmed to automatically enforce the terms of an agreement when predefined conditions are met. For instance, in the context of regulatory compliance, smart contracts can be designed to trigger specific actions, such as reporting transactions to regulatory bodies or executing penalties for non-compliance. This automation not only reduces the administrative burden on compliance teams but also minimizes the potential for human error, ensuring that organizations remain compliant with minimal oversight.

Furthermore, the integration of blockchain with other emerging technologies, such as artificial intelligence and machine learning, can further enhance compliance practices. By analyzing data stored on the blockchain, AI algorithms can identify patterns and anomalies that may indicate compliance risks. This proactive approach allows organizations to address potential issues before they escalate, thereby fostering a culture of compliance that is both responsive and adaptive. As regulatory environments continue to evolve, the ability to leverage advanced technologies in conjunction with blockchain will be critical for organizations seeking to maintain compliance.

However, while the potential benefits of blockchain for compliance are substantial, it is essential to recognize the challenges that may arise during implementation. Issues such as interoperability with existing systems, regulatory acceptance, and the need for industry-wide standards must be addressed to fully realize the advantages of blockchain technology. As organizations navigate these challenges, collaboration among stakeholders, including regulators, technology providers, and industry participants, will be vital to developing effective compliance solutions.

In conclusion, the impact of blockchain on compliance practices is profound and multifaceted. By enhancing transparency, streamlining audits, automating processes, and integrating with advanced technologies, blockchain has the potential to transform how organizations approach compliance in the legal sector. As the technology matures and regulatory frameworks adapt, organizations that embrace blockchain will likely find themselves at the forefront of compliance innovation, positioning themselves for success in an increasingly complex regulatory environment.

Conclusion

The future of compliance in legal technology is poised for significant transformation, driven by advancements in artificial intelligence, automation, and data analytics. As regulatory landscapes become increasingly complex, legal technology will play a crucial role in ensuring organizations can efficiently navigate compliance requirements. Enhanced tools for risk assessment, real-time monitoring, and streamlined reporting will empower legal teams to proactively manage compliance obligations. Additionally, the integration of blockchain technology may provide greater transparency and security in compliance processes. Ultimately, the evolution of legal technology will lead to more agile, responsive, and effective compliance strategies, enabling organizations to mitigate risks and adapt to changing regulations with greater ease.